The Hottest Investment Sector Of The Decade: Billionaire investors are already piling in, and now the smart money is set to follow.

Learn more here

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

- Natural gas inventories rose to 3,519 billion cubic feet for the week ending on October 11. That marked the first week that inventories exceeded the five-year average since September 22, 2017.

- According to the EIA, weekly injections into inventory in three of the past four weeks surpassed 100 billion cubic feet, or about 27 percent more than is typical for this time of year.

- Natural gas prices have fallen this year, and the strong build in inventories creates very little room for price gains.

Market Movers

- Schlumberger (NYSE: SLB) announced a $12.7 billion write-down, due in part to the weak oil market in North America.

- Royal Dutch Shell (NYSE: RDS.A) plans to sell its onshore upstream assets in Egypt’s Western Desert, shifting its focus to Egypt offshore gas exploration.

- Dominion (NYSE: D) signed a 420-MW renewable energy deal with the state of Virginia, the largest-ever state procurement of renewable energy. It will cover 30 percent of the state government’s energy needs by 2022.

Tuesday, October 22, 2019

Oil prices edged up on Tuesday on reduced concerns surrounding both Brexit and the U.S.-China trade war. As with both issues, sentiment seems to shift by the hour, but at the start of the week, there were some small signs of progress on both.

Halliburton and Schlumberger earnings hit by shale. Earnings reports from Schlumberger (NYSE: SLB) and Halliburton (NYSE: HAL) show a hit to profits by the slowdown in U.S. shale drilling. Both oilfield services giants reported downbeat figures on the contraction in drilling in North America, while striking a more optimistic note on international activity. Related: Two Dead Following ISIS Attack On Iraqi Oil Field

Shell exits two projects in Kazakhstan. Royal Dutch Shell (NYSE: RDS.A) decided to abandon two oil projects in Kazakhstan after determining that they were unprofitable. The move is a testament to the struggles of high-cost areas in the Caspian as well as the increased scrutiny by the oil majors on project economics due to investor pressure.

Trudeau to form minority government. Canadian Prime Minister Justin Trudeau won reelection, emerging with the largest vote share, but with a diminished block and short of a majority. That means he will likely form a minority government with another party, with the NDP the obvious partner. NDP Leader Jagmeet Singh has said that long distance pipelines should not be built through provinces that don’t want them, which may mean that the Trans Mountain Expansion faces new hurdles. “It’s pretty negative outcome from an energy-sector perspective,“ Tim Pickering, founder and chief investment officer of Auspice Capital Advisors in Calgary, told Bloomberg. “This is a very, very bad outcome for Alberta.”

Trade deal hopes seesaw. U.S. Commerce Secretary Wilbur Ross said on Monday that a trade deal with China does not need to be finalized in November, as was suggested by the “partial deal” agreed to earlier this month. The comment cut into hopes of a deal, dragging down oil prices on Monday. But President Trump contradicted that, saying the talks were on track for a November signing. Markets seesawed on the news.

Investment banks cut energy teams. As U.S. deal making dries up, investment banks are cutting jobs on their energy teams, according to Reuters.

California to investigate high gasoline prices. Citing gasoline prices that are 30 cents per gallon higher than other states, California Governor Gavin Newsome asked the state’s attorney general to investigate oil and gas suppliers for price-fixing.

IEA: Renewables to grow by 50 percent in 5 years. Global renewable energy capacity could grow by 50 percent over the next five years, according to a new report from the International Energy Agency. However, while significant, the pace of growth is still too slow to meet global climate targets. “Renewables are already the world’s second largest source of electricity,” said Fatih Birol, the IEA’s executive director. “But their deployment still needs to accelerate if we are to achieve long-term climate, air quality and energy access goals.”

Kuwait-Saudi Neutral Zone could reopen. Kuwait and Saudi Arabia could sign a deal to reopen the neutral zone oil fields within 45 days, according to Bloomberg. The fields have been idled for several years, and have 500,000 bpd in capacity. Even if the deal is made, production wouldn’t necessarily come online since output levels from the two countries are subjected to the OPEC+ agreement.

Bullish bets on oil hit 9-month low. The net-length on WTI dropped to a nine-month low for the week ending on October 15, a testament to the pessimism from investors and traders. “Demand is the major obstacle here,” said Greg Sharenow, portfolio manager at Pimco, according to the Wall Street Journal.

“Shale bonds” the latest trick to raise funds. The Wall Street Journal reported on the latest novel approach from the shale industry to find capital. So-called “shale bonds,” a type of asset-backed security, transfers ownership in wells to financial vehicles, which then issue bonds to be paid out over the wells’ lifetime. The main problem? The production profile of shale wells remain a moving target, and as the WSJ has previously reported, the long-term production potential in the aggregate has disappointed relative to what has been promised.

ExxonMobil goes on trial. ExxonMobil (NYSE: XOM) goes on trial this week, sued by the New York Attorney General over securities fraud. It’s the culmination of several years of investigation. The NY Attorney General alleges that Exxon defrauded its shareholders when it essentially kept two versions of its books, downplaying its risk to climate change and climate regulation. The lawsuit argues that Exxon undercounted billions of dollars of costs. Litigation risks have exploded for the oil industry, but this will be the first suit that goes to trial.

Carlyle Group quits oil export project. Carlyle Group (NASDAQ: CG) said on Friday that it was exiting a $1 billion proposed crude oil export terminal near Corpus Christi, Texas. The company did not reveal why it withdrew. The proposed project is one of about nine proposed export terminals along the Gulf Coast. Related: Oilfield Services Face Crisis As Shale Slowdown Worsens

U.S. extends Chevron waiver in Venezuela. The U.S. government decided to grant Chevron (NYSE: CVX) another three-month waiver, allowing the company to continue to operate in Venezuela.

Brazil auction could raise $50 billion. An offshore oil auction in Brazil could raise as much as $50 billion in November, according to Bloomberg. The November 6 auction could yield $25 billion in winning bids, plus payments to Petrobras that the company has already made in the area.

Trump to keep troops in Syria to protect oil fields. After scathing blowback in Washington over his decision to greenlight a Turkish invasion of Northern Syria, President Trump said that the U.S. would leave behind troops to protect some oil fields.

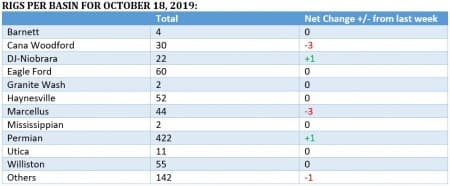

Rig count collapse continues. The U.S. oil and gas rig count fell again last week, this time led by gas rigs.

By Josh Owens for Oilprice.com

More Top Reads From Oilprice.com:

- Is Eating Meat Worse Than Burning Oil?

- Dreams Of An Aramco IPO Are Fading Fast

- Russia Predicts The Death Of U.S. Shale