Crude oil prices trended up slightly in the second half of this week on a surprise crude oil inventory draw, but disappointments over U.S.-China trade talks mean there’s not much to move this needle. Any excitement over a prospective deal has been quashed by another conflict over China’s apparent agreement to buy $50 billion in American agricultural products annually. More than anything, this is what oil prices are responding to these days.

‘Latin Spring’ Starts in Bolivia … Where Will It Stop?

After the military ordered long-time Bolivian leader Evo Morales to step down, prompting him to flee to Mexico for asylum, violent protests and clashes with police have now been renewed as Bolivian Senate leader Jeanine Anez assumes the interim presidency, with the apparent backing of the police and the military. And those protests are being staged by Morales’ supporters, keeping in mind that, whether he’s in Mexico or not, Morales’ party controls a majority in both houses of Congress.

Morales lost his footing after mass protests broke out following the October 20th presidential elections in which he was controversially seeking a fourth term in office. At stake are some major projects that are now hostage to the chaotic whims of a caretaker government that has to usher in new elections quickly.

It would be a mistake to think that it was that easy to get rid of Morales, whose claim to fame was indigenous rule in Bolivia, as well as fairly strong economic growth…

Crude oil prices trended up slightly in the second half of this week on a surprise crude oil inventory draw, but disappointments over U.S.-China trade talks mean there’s not much to move this needle. Any excitement over a prospective deal has been quashed by another conflict over China’s apparent agreement to buy $50 billion in American agricultural products annually. More than anything, this is what oil prices are responding to these days.

‘Latin Spring’ Starts in Bolivia … Where Will It Stop?

After the military ordered long-time Bolivian leader Evo Morales to step down, prompting him to flee to Mexico for asylum, violent protests and clashes with police have now been renewed as Bolivian Senate leader Jeanine Anez assumes the interim presidency, with the apparent backing of the police and the military. And those protests are being staged by Morales’ supporters, keeping in mind that, whether he’s in Mexico or not, Morales’ party controls a majority in both houses of Congress.

Morales lost his footing after mass protests broke out following the October 20th presidential elections in which he was controversially seeking a fourth term in office. At stake are some major projects that are now hostage to the chaotic whims of a caretaker government that has to usher in new elections quickly.

It would be a mistake to think that it was that easy to get rid of Morales, whose claim to fame was indigenous rule in Bolivia, as well as fairly strong economic growth on the back of commodities. Anez’s temporary hold on power is certainly not stable.

That means major oil and gas and lithium projects are effectively on hold as foreign companies await clarification on the political scene. What some of the country’s most powerful oligarchic forces would like to see is a partition of the country, cutting off the oil and gas areas from indigenous populations so it can be more directly controlled. Conspiracy theories suggest that Morales’ ouster was orchestrated by these same forces and that he assisted them unwittingly by controversially seeking another term in office.

The lion’s share of Bolivia’s oil and gas wealth is in the eastern region.

Now, oil and gas companies are facing force majeure. Bolivia’s state-owned YPFB has already warned Argentina it may not meet its export commitments. Morales supporters attacked gas installations, and YPFB says that unidentified groups have taken over the Carrasco field and nearby installations. Carrasco does not have any foreign ownership, and foreign majors have not yet been targeted for attack or takeover.

At stake are major projects by Spanish Repsol, the top private producer in Bolivia, along with Shell, which is working on the Jaguar exploration well. Major lithium projects are also threatened, but were already being stalled under Morales. Unconfirmed statements from analysts and former Bolivian officials claim that Shell, Total SA and Repsol have all stopped drilling or have limited drilling while waiting for clarification; however, none of the companies have confirmed this.

There will likely be much deeper regional reverberations here, which is exactly why Argentina’s new president-elect, Alberto Fernandez, takes issue with Trump’s statement on Morales’ resignation at the orders of the Bolivian military. Trump suggested that what happened to Morales was a signal to other Latin American countries that “democracy and the will of the people will always prevail”. That’s why Mexico granted Morales asylum and welcomed him with open arms in some heartwarmingly staged photo ops. None of Bolivia’s neighbors can afford to make it seem this easy to depose a leader. Fernandez has to clean up an economic disaster in Argentina and he needs everyone on board. Venezuela’s Maduro is hoping this won’t further embolden the opposition and those in the military who haven’t deserted him, and so on. Their stance absolutely must be that Morales was illegally deposed because what’s happening in the region right has some noticeable parallels to the ‘Arab Spring’. If it works once, it may well work again.

The Next Tesla Gigafactory Goes To...

Tesla announced the location of its next gigafactory in Europe this week, with the lucky winner being the Eastern German state of Brandenburg - the residents of which, according to German media, are very much looking forward to what they expect will be thousands of new jobs. The gigafactory will be in Gruenheide, about an hour’s drive east of Berlin. One of the reasons Musk chose Germany for Tesla’s European gigafactory was… Brexit, which made the UK far too risky.

At the same time, Tesla has also obtained its manufacturing license to start production at its Gigafactory 3 in Shanghai, so that likely means production launch is right around the corner.

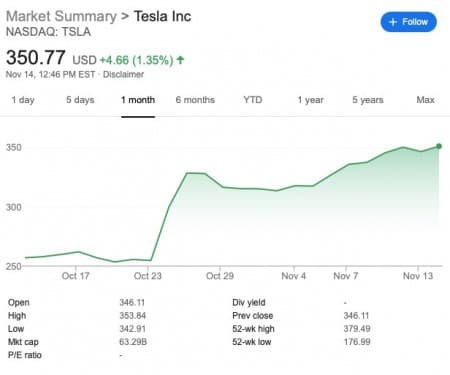

It’s probably time to stop shorting Tesla.

Credit Suisse is calling a 40% stock dive for Tesla, putting a $200 price target on shares, because it thinks that while the EV maker has the clear competitive lead, it risks not capitalizing on the opportunity. Credit Suisse analysts suggest that the Model 3 will face a serious challenge from Ford next year. Ford is expected to announce its new Mach-E this weekend, which is an electric SUV nod to the Mustang.

But the skeptics are, in general, being sidelined now because Tesla has reported a profit for the first time, and this year’s stabilization suggests a potential return to growth in revenue and earnings in 2020. Wall Street is losing whatever bearish mojo it might have had.