Building on last week’s rally, which was spurred by fears of an impending supply crunch, oil prices are quickly approaching a two-month high with $80 Brent well within reach.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

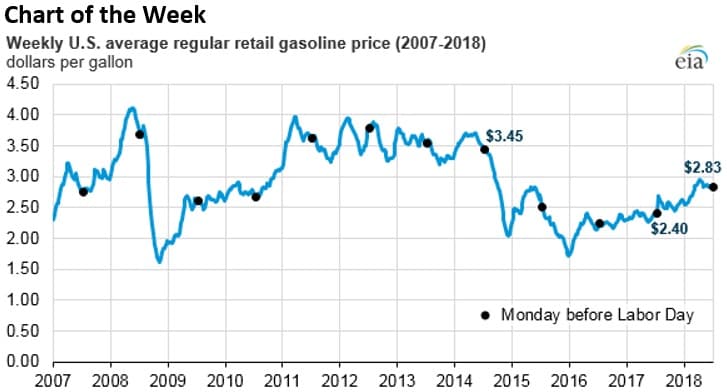

- U.S. retail gasoline prices for Labor Day weekend were the highest in four years at $2.83 per gallon nationally. That is also 43 cents per gallon higher than at this time last year.

- Regionally, retail gasoline prices vary quite a bit, due to proximity to refining and pipelines as well as state and local taxes.

- The West Coast has seen prices at the pump exceed $3/gallon consistently since the beginning of 2018. The Gulf Coast tends to have the cheapest gasoline, due to its location near so many refineries. Gulf Coast gasoline prices are averaging a little over $2.50 per gallon.

Market Movers

• The U.S. DOE sold 11 million barrels from its strategic petroleum reserve, a move intended to ease the blow of dwindling supply from Iran due to sanctions. ExxonMobil (NYSE: XOM) bought 3.3 million barrels from the sale, Marathon Petroleum (NYSE: MPC) purchased 1.4 million barrels, Saudi Arabia’s Motiva Enterprises bought 2.4 million barrels, among others.

• Petrobras (NYSE: PBR) and Total SA (NYSE: TOT) were awarded supply contracts from the Brazilian government for pre-salt production in the Santos basin.

• A blockade by former employees is threatening crude production at ExxonMobil's (NYSE:XOM) Qua Iboe oil terminal in southern Nigeria, a facility that exports over 300,000 bpd. The blockade could “impact the company's ability to safely continue production operations.”

Tuesday September 4, 2018

Oil prices rose a bit on Monday, with stronger gains in early trading on Tuesday, building on last week’s rally. Expectations of significant supply losses from Iran helped lift prices. “Exports from OPEC’s third-biggest producer are falling faster than expected and worse is to come ahead of a looming second wave of U.S. sanctions,” said Stephen Brennock, analyst at London brokerage PVM Oil Associates. “Fears of an impending supply crunch are gaining traction.”

Tropical Storm Gordon could form into hurricane. A tropical storm heading for the Louisiana coast could form into a hurricane before it makes landfall on late Tuesday or early Wednesday. “It is possible that Gordon could peak as a Category 1 hurricane after 36 hours, just before landfall occurs,” Senior Hurricane Specialist Stacy Stewart wrote in his forecast on Monday. As of now, there could be life-threatening storm surge for the coast, but little effect on oil and gas infrastructure is expected. A couple oil companies, including Anadarko Petroleum (NYSE: APC), announced temporary closures at oil fields in the Gulf, but the interruptions are expected to be temporary. The region produces about 17 percent of the nation’s oil and 5 percent of its natural gas.

Related: Houthis Claim Successful Attack On Aramco Oil Facility

U.S. oil production jumped in June. Despite reports last week that suggested that U.S. oil production fell in June, the EIA said that output rose by 231,000 bpd in June compared to a month earlier. Production stood at 10.674 million barrels per day, dispelling fears that U.S. shale output was grinding to a halt because of pipeline problems. Midstream bottlenecks are an obstacle to the Permian, but so far there is inconclusive evidence that the industry is suffering from a slowdown.

Iran seeks to evade U.S. sanctions. Iran’s oil minister alluded to the fact that his nation could try to work around U.S. sanctions to ensure oil exports continue. Offering discounts, bartering and even smuggling are just a few of the tactics on hand. Estimates obviously run the gamut, but FGE, a consultancy, says that Iran could keep oil exports at around 800,000 bpd using some of these strategies.

Trump considers $200 billion in Chinese tariffs. Bloomberg reported last week that the Trump administration is considering moving forward with the proposed $200 billion in tariffs on China when the public comment period ends on September 6. The move would be a significant escalation of the trade war and present a serious downside risk to the global economy and to China’s oil demand. Retaliatory tariffs would be expected, with U.S. exports of crude oil and LNG likely on the target list.

China’s oil demand slowdown a concern for Middle East. The U.S.-China trade war could slow China’s oil demand this year, a concern for oil-producing nations in the Middle East. “I think there is a risk on the demand side,” Bahrain's Oil Minister Sheikh Mohammed bin Khalifa Al Khalifa told CNBC. "Is demand going to continue as strongly as it did?” Separately, Oman’s oil minister echoes those concerns to CNBC. “There is a danger that the demand will be impacted as well. People often focus on the supply side — what happens if Iran stops supplying — but what happens if China reduces its consumption? So we are looking at both sides of this discussion,” Mohammed bin Hamad Al Rumhy told CNBC.

Barclays says medium-term oil market looks much tighter. Barclays revised up its medium-term oil price forecast for 2020 from $55 to $75 per barrel, and for 2025 from $70 to $80. The investment bank noted several major changes since last year’s forecast, including ongoing capital discipline in the oil industry, cohesive market management from OPEC+, more aggressive sanctions from the U.S., and the catastrophic production declines in several OPEC countries.

Related: Is This The World’s Most Beautiful Electric Car?

Elections in Nigeria and Libya add layer of uncertainty. Libya and Nigeria have seen their oil production levels seesaw back and forth depending on the security environment, a reality that is not going away anytime soon. But both countries face elections over the next few months, which raise additional risks to supply. Libya’s output plunged dramatically earlier this summer, which helped push up global oil prices. But output is back up to 1 million barrels per day. Nigeria has kept production between 1.7 and 2 mb/d this year, but a flare up of violence in the Niger Delta could put that at risk.

Carmakers work towards advanced batteries. The FT looked at the efforts by automakers and battery producers to develop advanced batteries. The cost of lithium-ion batteries has declined by 75 percent over the last eight years, and every time battery production capacity doubles, costs fall by an additional 5 to 8 percent, according to the FT and Wood Mackenzie. But supply shortages for metals such as cobalt and lithium are a concern as battery demand continues to skyrocket. Now automakers and battery producers are looking to switch to different materials that are more abundant, such as using relatively more nickel. Wood Mackenzie says that by 2025, low cobalt batteries will make up a majority of the electric car market. “Not only does this battery chemistry ease the supply constraints and ethical concerns arising from high cobalt use, but it also provides far superior energy density over the traditional chemistry, thereby reducing overall materials costs,” the consultancy says.

EU ends tariffs on Chinese solar. The European Union ended restrictions on solar panels from China this week, about five years after they first went into effect. The EU had set a floor price on solar panels from China, putting duties on any panels that Chinese manufacturers tried to sell for less, an anti-dumping measure intended to protect European manufacturers.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Is China’s $26 Trillion New Silk Road A Debt Trap?

- Saudi Oil Income Could Reach $161B This Year

- The EV War Is About To Heat Up