Oil is sometimes referred to as ‘black gold' while cotton is often called ‘white gold'. Now, with the global fight against climate change taking off, a similar interest is growing for specific natural resources that are crucial for eco-friendly technologies such as EVs. Lithium and cobalt, which are essential for the production of batteries, have seen a particularly spectacular rise in demand. Counterintuitively, however, the production costs of these metals dropped by almost 30 percent in 2019. This could be a watershed moment for the widespread adaptation of EVs which are increasingly becoming price competitive with internal combustion vehicles.

Rising demand

Environmentalists have, for decades, been warning of the effects of climate change, which has had little impact on the adaptation of specific technologies. In recent years, however, sales of hybrid and fully electric vehicles have taken off significantly due to the rapid improvement of technologies, increased government subsidies, and lower production costs. In some instances, countries are struggling to install sufficient recharging installations such as Norway which has the highest per capita concentration of EVs in the world.

China, on the other hand, is the biggest market for auto producers. In 2018, more hybrids and EVs were sold in the Asian country than the rest of the world combined. Chinese companies have a firm grip on the global supply chain of crucial battery components. To strengthen its global position, Beijing has made it a top priority to have a dominant role in the technologies of the future. EVs are among the ten key areas identified under the ‘Made in China 2025’ industrial strategy, which has given yet another boost to demand. Related: Will China Cutoff Rare Earth Exports?

Mining activities, however, are having a devastating environmental and social impact in some areas where lithium and cobalt can be found. The extraction of cobalt is particularly problematic, with most of it concentrated in a single region in the south of DR Congo where over half of the world's supply is produced. Due to political instability and weak institutions, illegal mines are common in the area where 35,000 children participate in activities. Unfortunately, the electrification of societies and rising demand for batteries do not bode well for the future of mining in DR Congo.

Rising demand but dropping prices

Counterintuitively, soaring sales of EVs in China, Europe, and the U.S. haven’t had the expected effect on commodity prices. According to some analysts, the market is in oversupply because producers have reacted to predictions of insufficient lithium and cobalt production. It is expected that the current situation will continue into 2020 and maybe even further.

Francesco Venturini, CEO at Enel X, predicts a watershed moment for EVs as overall production costs are also decreasing. He compared the recent developments with the experience of the PV industry in 2010 when prices had come down 84 percent due to a steep decline of the commodity polysilicon, used in photovoltaic cells, from $450/kg to $70/kg in a single year.

Uncertainty ahead

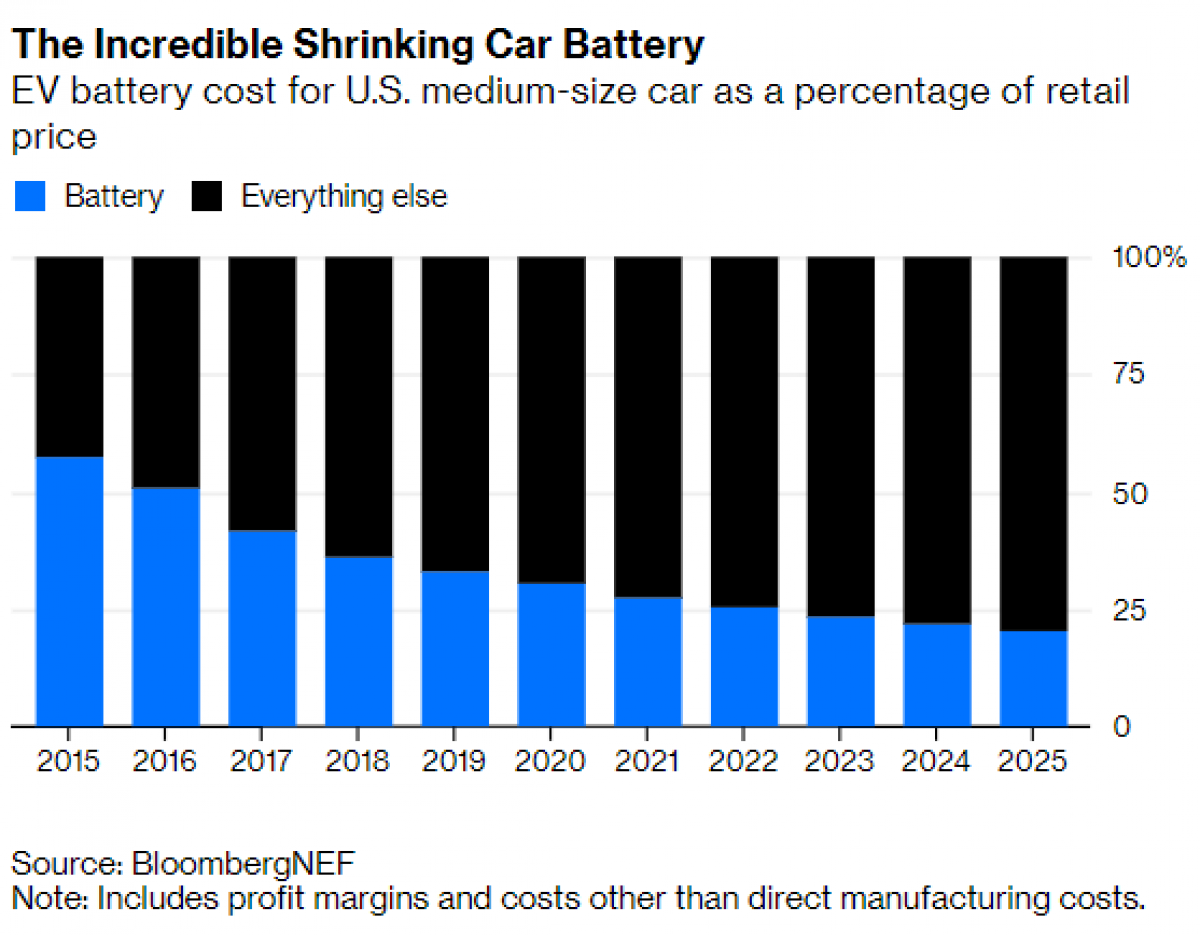

From an economic point of view, the dropping prices of certain commodities are a godsend for EV producers. In 2015, the battery made up around 57 percent of the total costs of vehicles. Lower prices mean that the share of batteries in the overall expenses has dropped to 33 percent this year, and by 2025 it could have reached 20 percent. This prediction does not include a sustained reduction in lithium and cobalt prices, which could lower costs even further and improve the competitiveness of EVs vis-à-vis the internal combustion engine. Related: How Clean Is “Freedom Gas”?

However, it is more likely that market forces will keep supply and demand in balance and prices in check. Lower prices will lead to increased demand for EVs, which will affect commodity prices. Furthermore, producers are looking for alternative methods and metals to produce batteries with in order to prevent overdependence on lithium and cobalt. This would influence demand in the long term and therefore, suppress prices. For the time being, the world is dependent on a limited number of metals to power the shift away from fossil fuels, and the dropping prices could not have come at a better time.

By Vanand Meliksetian for Oilprice.com

More Top Reads From Oilprice.com:

- Saudis Raise Oil Prices To Asia As Demand Spikes

- Shale Drillers Keep On Falling Into The Same Trap

- Floods Threaten America’s Largest Oil Hub

Replacing lithium is probably impossible due to its electron shell structure. That would be like trying to replace carbon in millions of different molecules. It can't be done. Other types of batteries may never match the energy storage potential of lithium batteries. Thousands of scientists are working on battery technology.