Oilfield service (OFS) companies have lost their luster, given the malaise that hangs over the oilfield service space at the present. Quite simply, the OFS space needs a catalyst to give investors confidence in its ability to generate profits.

There is no question that these companies are oversold at current levels. But it's hard to get excited about the OFS space when they tell us (as they do) that no increases in business are expected before the second half of the year. That said, I think there are several drivers emerging for Baker Hughes General Electric, NYSE: BHGE, to post increased profits and cash flow.

It is worth noting that we are well on the way to the second half of the year, so we should begin to see some improvement when Q-2 numbers are announced. So, let's take a look at several long term theses that might change the trajectory of Baker Hughes stock.

- LNG plant construction

- Growth in the subsea tree market

- Digitalization of oilfield data management

- Electrification of frac pumps in the Permian

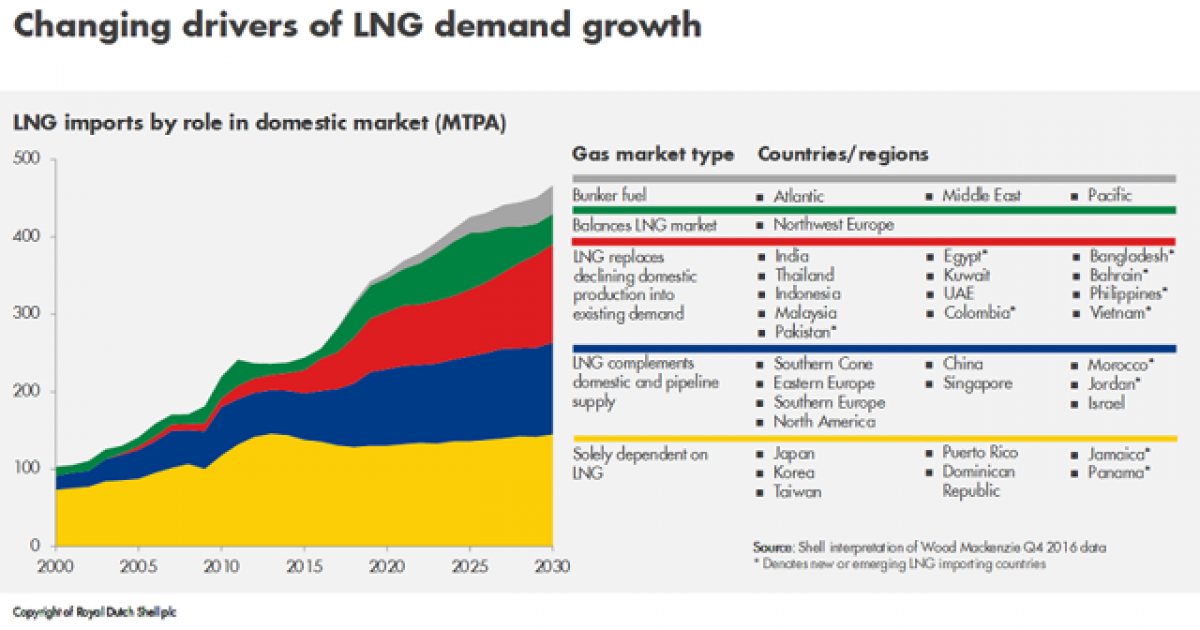

The Growth Thesis for LNG

This is the strongest short term hydrocarbon thesis out there; in part, because it is the one form of hydrocarbon energy the “Greens” will haltingly accept in their view of the future's energy mix.

The great truth that drives this market is some of our planet's most populous nations lack the energy resources to meet the demands of their economies. These countries all have mandates to clean up their air, while at the same time see a growing middle class. This means that electricity use will go up dramatically in these countries.

The future of these countries contains cleaner fuels like natural gas to generate electricity. They will have to import these energy supplies, to a great extent. The U.S., thanks to shale gas, has boundless stores of this resource. It only needs to be shrunk about 500 X in volume cryogenically, and we're have plenty to send to them. Therein lies the opportunity for Baker.

Baker has seen demand for cryo plants and equipment increase at a rapid clip throughout 2018, and has seen acceleration in the announcements for new plants continue in 2019. So far in 2019, Baker expects about 100 million tons per annum-MPTA, in new FIDs for the year. This amounts to about 10-12 of these multi-billion dollar plants for the year, at average sizes.

Particularly with its jet-based gas engines, Baker has had a number of key wins in recent times.

KBR to use Baker Hughes Turbines for medium sized LNG projects

Venture Global to double the size of its export capacity to 60 MPTA

Baker wins gas turbines in Shell Kitimat LNG project

Baker Hughes wins turbo-machinery deal for Golden Pass LNG project

McDermott, Baker selected to develop Equus gas project in Australia

Baker Hughes wins Cheniere's Corpus Christie LNG contract

Baker is also primary on BP's (NYSE:BP) Greater Tortue Ahmeyim FLNG project offshore Senegal and Mauritania, in a joint venture with McDermott (NYSE: MDR).

What drives these awards is the breadth of Baker's offering in this space, and in particular their proprietary gas powered engines that help compress the feed gas.

Baker Hughes Nova LT gas turbine Currently being used on the Istrana gas pipeline project in Italy.

Baker has a number of iterations of this gas turbine equipment that address the type and amount of feed gas to be processed in a given plant. It sees a growing market globally for this equipment, and expressed optimism in the recent Q-1 conference call about the LNG business going forward. Baker’s CEO, Lorenzo Simonelli commented on this business in the Q-1 call.

“In 2018, we have made significant progress on the priorities we laid out for TPS. We continue to be at the forefront of technology and solutions for the LNG market.”

I think that TPS (Turbo-machinery and Process Solutions) will drive significant profits over the next several years as these LNG plants proliferate around the world to meet the burgeoning energy demand we have discussed. Baker is clearly in a leadership position with these key components of the LNG compression train and should continue to receive project awards that will boost sales and profits. I do not think the current stock price is reflective of the value in this market.

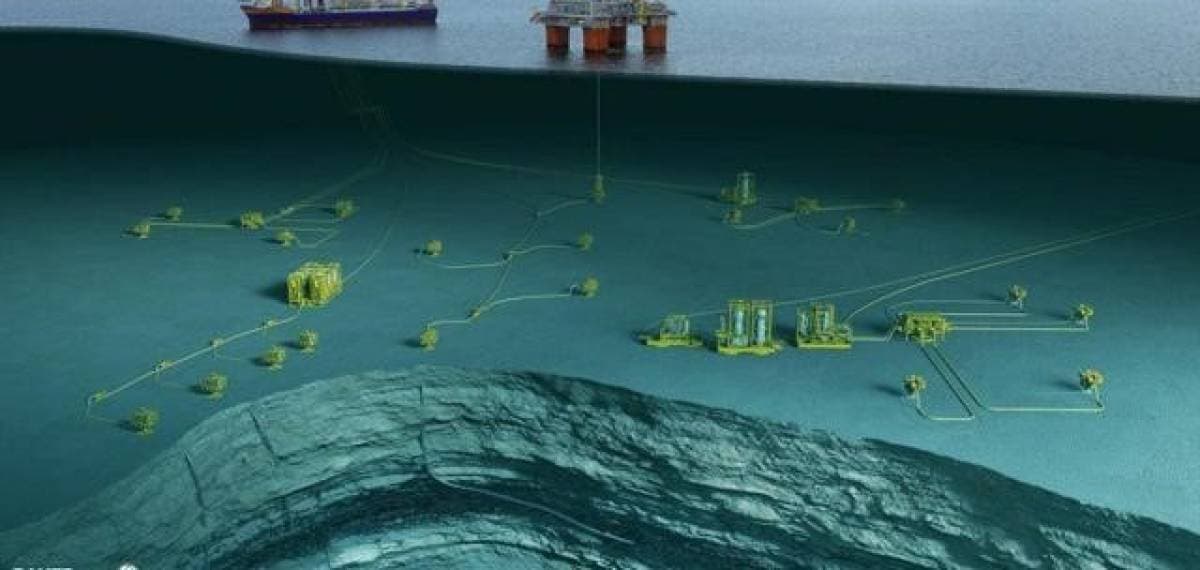

Subsea Connect

WoodMac, an energy consultancy, forecasts about a 20% rise in deepwater FIDs for 2019, and a similar increase for 2020. There are a number of hotspots that are yielding strong exploration results that will result in key project developments over the next few years. Guyana, Mexico, Brazil, The GoM, Cyprus, South Africa, West Africa, East Africa, Australia, Malaysia, and the Barents Sea offshore Norway all have deepwater Final Investment Decisions-FIDs, under review for sanction.

Source Shown in this graphic is a subsea gathering and export system with various types of equipment supplied by Baker as part of Subsea Connect.

Here again, Baker has a broad offering that it wraps under the Subsea Connect label and should be well positioned to reap the rewards of this type of technology. Recently, they have landed a number of key awards from major accounts globally.

Baker wins KG 98/2 subsea tree award from ONGC

McDermott and Baker win SHWE subsea contract offshore Myanmar

Baker wins Greater Tortue subsea award

Baker’s Subsea Connect offering was clearly a factor in this award. The early-engagement and collaboration - some of the key components of Subsea Connect - as well as bringing its expertise in deepwater, long-offset gas projects, helped to edge out other competitors. The company will provide five large-bore deepwater horizontal xmas trees (DHXTs), a 6-slot dual bore manifold, a pipeline end manifold, subsea distribution units (SDUs), three subsea isolation valves (SSIVs), diverless connections and subsea production control systems. This all adds up to hundreds of millions worth of revenue for Baker over the life of the project.

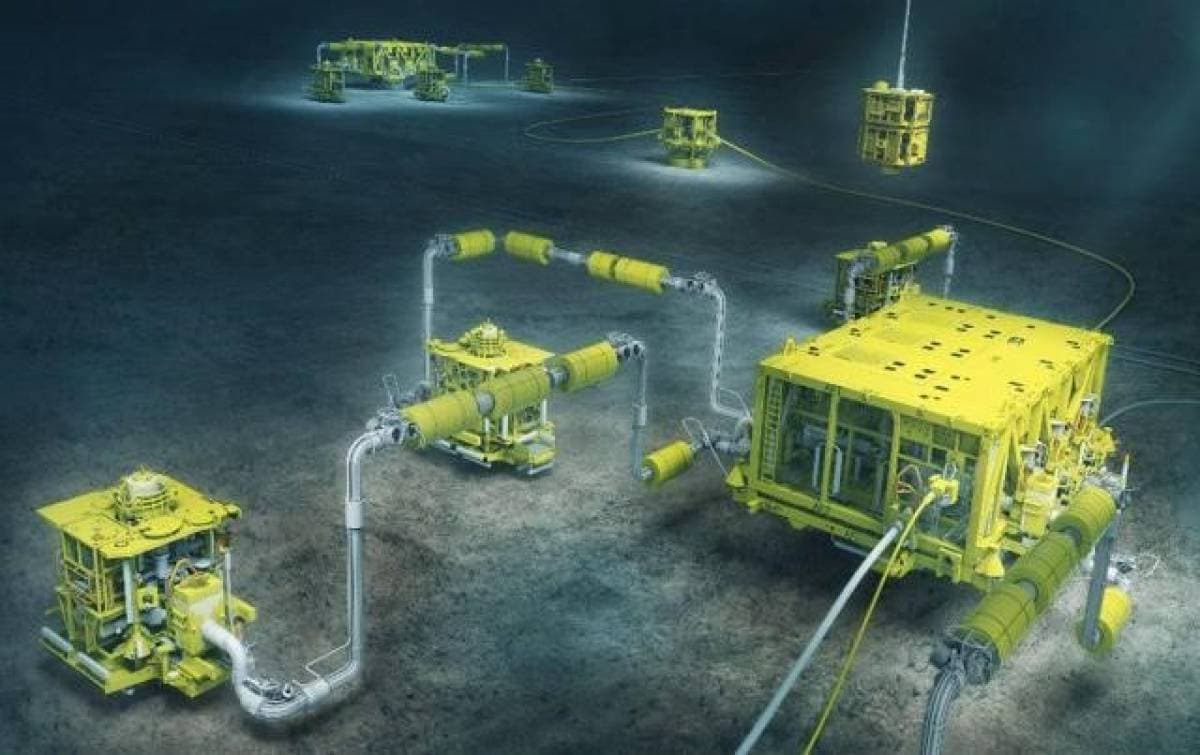

Source A key element of Subsea Connect is the Aptara™ TOTEX-lite subsea system, pictured above.

Baker won a total of 77 new trees in 2018 and expects that total to grow about 10% in 2019. The awards mentioned above give the company a clear path to land 85-90 new tree awards this year. Subsea is again a growing business, and Baker appears to have a sound strategy to grow its market share in this segment of the offshore market.

The energy industry is going digital

This is an area that is growing rapidly with a significant legacy market that lacks this sort of infrastructure. The thesis for digitalization is fairly straight-forward, and most of the major companies that participate in the offshore space have sophisticated plans to install or upgrade infrastructure in this area. Here is an example of this type of retro-installation.

BP deploys cloud based Baker Hughes analytics on GoM platforms.

The goal here is to reduce opex and improve performance in field management. This is an area that traditionally been a reactive-based approach, where a piece of equipment goes down, and a crisis ensues. It also encompasses big data gathering that here-to-fore has not been easily captured.

As we know, cost control and analytics are buzz words in every board room these days. Companies are seeing the benefit of installing the equipment and subscribing to service-based monitoring, and Baker should benefit from this initiative.

Changing frac pumps from diesel to electric

This is an area where Baker has stepped into a technology gap between legacy old diesel-powered frac pumps and the desire to reduce the carbon impact of oilfield operations. By some estimates, there are ~500 hydraulic frac fleets across the nation.

Each one of these frac fleets consumes about 7 mm gallons of diesel annually, somewhat dependent on usage. That equates to 700K met tons of Co2 emissions and requires about 700K tanker truck deliveries. Not very carbon footprint-friendly, and not where Baker wants to go, as their goal is zero carbon emissions by 2050.

So, what's the solution here?

Baker proposes utilizing its turbine gas pumps with produced gas to generate electricity on site, to conduct fracturing operations. There are a number of big carrots here that should appeal broadly to the industry.

First, flaring of produced gas. This is a massively wasteful result driven by the inability to contain produced gas that comes along with the light oil produced from shale. When there are no pipeline connections, flaring or simply shutting in the well is the only answer. So, reducing flaring by using this gas to power fracking operations just makes sense. BHGE already has some of this equipment operating in the Permian.

Second, many Permian operators are conscious of Co2 reduction, and some like Occidental (NYSE:OXY) even have direct carbon sequestration and injection businesses. The elimination of a Co2 source by using gas that would be flared otherwise looks very good on permit applications.

Bottom line, I think Baker will be very successful in converting a significant percentage of this market, and that creates an entire new market for its turbine equipment.

A review of the first quarter

New orders for the quarter were $5.7 billion, up 9% year over year and down 17% sequentially. The year over year growth was driven by Oilfield Equipment, which was up 54%, and Oilfield Services, which was up 14% partially offset by lower order intake in Turbomachinery due to order timing. Baker delivered solid orders growth across both equipment and services. Equipment orders were up 17%, and service orders were up 4%. Sequentially, the decline was driven by typical seasonality across all segments following a strong fourth quarter.

This was not a knock the ball out of the park quarter by any measure, which likely put a drag on the stock. The decline in EPS QoQ reflects margin pressure as equipment sat idle. Forecasts for the Digital Solutions segment to be down slightly YoY in Q-2 are also worrisome, as this is a key differentiator for the company. LNG orders for their gas engines were a bright spot, but couldn't overcome declines in other channels of the TPS segment.

Risks

I think the stock is largely de-risked to the downside at current levels, +/- 10% due to the instability in the market currently. The key upside risk lies in the current market aversion to the OFS sector. While I don't see a big downside, given the declines so far, your investment could be dead money until market sentiment shifts regarding the OFS space in general.

Your takeaway

Baker is evolving as an oilfield supplier. The benefits of the merger with GE are obvious as they attack the new and developing digital oilfield market. Currently, they are selling for about 4X EBITDA. By contrast, Halliburton (HAL) and Schlumberger (NYSE:SLB) sell for 6 X and 8.3 X EBITDA, respectively, indicating that Baker is 20-50% underpriced compared with its peers.

The justification for an investment in Baker lies in the belief that as the key initiatives we have discussed in this article will provide long-term drivers for growth that will propel the stock back above the $30 level. I think those drivers are in place, and that would equate to about 30% growth from present levels over the next year.

By David Messler for Oilprice.com