Friday, November 15, 2019

1. China’s economic slowdown

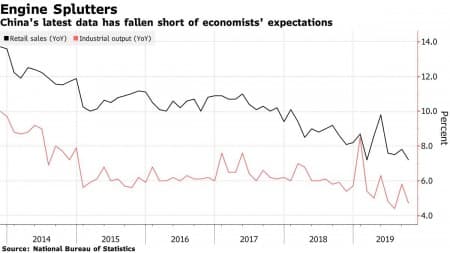

- China’s retail and industrial activity continues to decelerate, with a particular dip notable in 2019 as the trade war takes its toll.

- But Germany and Japan also just reported dismal numbers. Germany narrowly avoided a recession with third quarter GDP growth at 0.3 percent, and that anemic growth rate was actually an improvement over the second quarter. Japan’s GDP figure stood at 0.2 percent, a sharp slowdown from 1.8 percent previously.

- “We are in a manufacturing recession,” Saker Nusseibeh, chief executive officer of Hermes Fund Managers, said on Bloomberg TV. “Even in the U.S., there’s contraction in manufacturing".

- China reported that fixed asset investment grew by only 5.2 percent in the first 10 months of this year, the lowest growth rate since 1998.

2. Shale drillers balance well length, costs and production

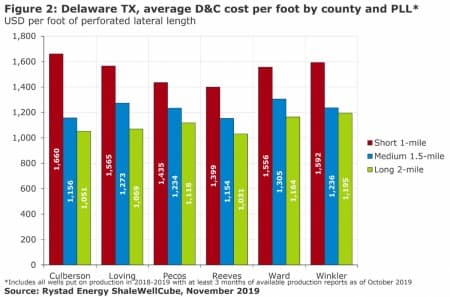

- Shale drillers have generally increased the length of their wells over time, but there is a balancing act at play.

- After a certain length, well productivity declines. On the flip side, longer laterals can be cheaper because there are fixed costs (well construction, land acquisition, gathering lines, etc.) that can be spread out. So, even if a longer well produces less oil per foot, sometimes it makes sense in order to spread out those fixed costs.

- “A simple linear relationship suggests that for every 1,000 feet of additional lateral…

Friday, November 15, 2019

1. China’s economic slowdown

- China’s retail and industrial activity continues to decelerate, with a particular dip notable in 2019 as the trade war takes its toll.

- But Germany and Japan also just reported dismal numbers. Germany narrowly avoided a recession with third quarter GDP growth at 0.3 percent, and that anemic growth rate was actually an improvement over the second quarter. Japan’s GDP figure stood at 0.2 percent, a sharp slowdown from 1.8 percent previously.

- “We are in a manufacturing recession,” Saker Nusseibeh, chief executive officer of Hermes Fund Managers, said on Bloomberg TV. “Even in the U.S., there’s contraction in manufacturing".

- China reported that fixed asset investment grew by only 5.2 percent in the first 10 months of this year, the lowest growth rate since 1998.

2. Shale drillers balance well length, costs and production

- Shale drillers have generally increased the length of their wells over time, but there is a balancing act at play.

- After a certain length, well productivity declines. On the flip side, longer laterals can be cheaper because there are fixed costs (well construction, land acquisition, gathering lines, etc.) that can be spread out. So, even if a longer well produces less oil per foot, sometimes it makes sense in order to spread out those fixed costs.

- “A simple linear relationship suggests that for every 1,000 feet of additional lateral length, operators are able to save $74 in drilling and completion cost per foot on average. Hence, on average, operators are able to allow a 5% degradation in productivity per foot for every additional 1,000 feet of additional lateral length,” Rystad Energy said in a report.

- “It is logical to expect lower drilling and completion cost per foot for long laterals compared to shorter laterals,” Rystad added.

3. China’s record oil imports

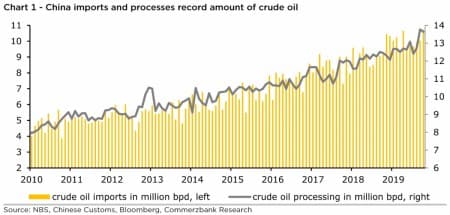

- China’s oil imports stood at 13.62 mb/d in October, just shy of the record high reached in September.

- But China’s economy is slowing, raising questions about the nature of the demand surge. “It is not clear where any significant additional impetus for demand should come from,” Commerzbank said.

- New refineries coming online and attractive refining margins could mean that import surge is related to processing. That provides a bit of demand on the crude market, but the oil will be processed into refined fuels. If that isn’t met with strong growth in fuel consumption, China may be exporting more products.

- Meanwhile, Chinese oil demand – and much of the global economy – hinges on the outcome of the trade war. The latest news suggests the U.S.-China negotiations hit a snag over differences on agricultural purchases.

4. ExxonMobil struggling in shale

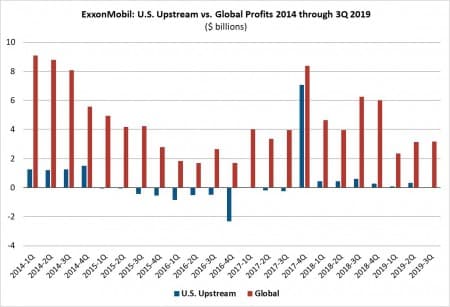

- ExxonMobil’s (NYSE: XOM) subsidiary, XTO Energy, said that it was shifting from a short-cycle focus on cash flow to long-term, value-creation in the Permian.

- But critics see cracks in the oil major’s operations. “The short-cycle investment strategy was abandoned because ExxonMobil’s unconventional Permian investments did not produce quick cash,” the Institute for Energy Economics and Financial Analysis wrote in a commentary. “Massive capital expenditures have produced only meager earnings. Like its smaller counterparts, ExxonMobil is courting financial failure by following the siren call of fracking.”

- IEEFA noted that Exxon only earned $37 million from its upstream unit in the third quarter of 2019, down more than $500 million from a year earlier, which itself was a disappointment.

- In fact, Exxon has years of disappointing returns from its U.S. upstream assets. The only good quarter it had was at the end of 2017, which was a one-off benefit from a federal tax cut.

- “[I]t appears that ExxonMobil is content to burn through assets, plowing more capex into the Permian Basin with no sign of a payday anytime soon,” IEEFA said.

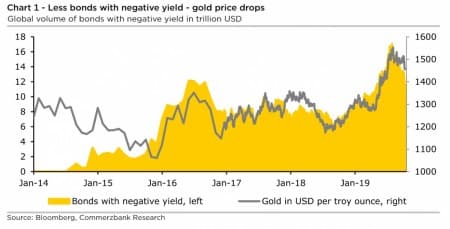

5. Gold losing its appeal

- Gold moved up a bit on Thursday but is only rising off of three-month lows near $1,450.

- “We believe that one of the factors that has been weighing on its price in the meantime is the fact that the latest rise in interest rates means significantly more bonds are showing a positive yield again, which makes gold less attractive as a non-interest-bearing investment,” Commerzbank said in a note.

- Outflows from gold ETFs have not helped either.

- The recent slide in prices was also partly attributed to the seeming thaw in the U.S.-China trade war. The snag reported mid-week may have contributed to the slight rebound in prices.

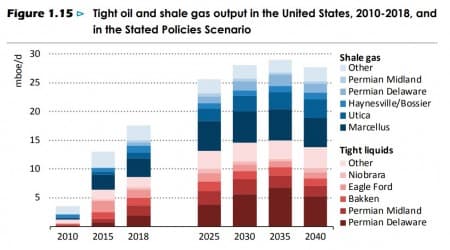

6. IEA: U.S. shale to almost double again

- Despite the dramatic slowdown underway in U.S. shale, the IEA said that growth would continue over the next decade.

- Roughly $900 billion has poured into the upstream shale sector over the past decade. “This has not, for the moment, been a profitable business for many of the companies involved,” the IEA said. But the “shale race is not yet run; many of the most profound impacts of the shale revolution still lie ahead,” the agency said.

- The IEA says that before 2025, U.S. shale will alone surpass all oil and gas output from Russia.

- Even in the IEA’s “Sustainable Development Scenario,” the agency sees U.S. shale oil rising above 10 mb/d in the 2030s before tailing off.

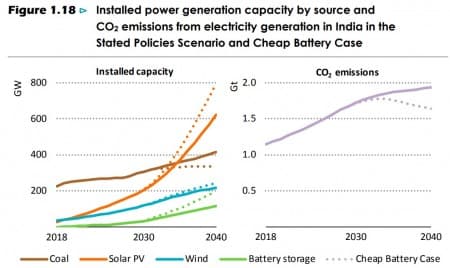

7. Renewables soar, but emissions don’t peak

- In the IEA’s outlook to 2040, it says that solar PV dominates the story. By 2040, wind and solar PV provide more than half of the world’s electricity, even in the baseline scenario.

- Solar alone becomes the largest source of installed capacity by 2040. The speed of growth depends quite a bit on battery costs.

- However, despite the rapid deployment of renewables going forward, CO2 emissions may not peak before 2040, the agency said. Absent a more dramatic policy overhaul, growing populations and economies offset the rise in renewables.

- The IEA made more urgent calls to tackle emissions than it has in the past. “Without new policies in place, the world will miss its climate goals by a very large margin,” said Fatih Birol, the agency’s executive director.