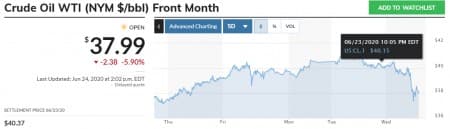

The oilfield was served up a harsh reminder that all is not “sunshine” and “strawberries” in the oilfield today. The EIA Weekly Petroleum Status Report’s confirmation of the API’s notice of an inventory build last week sent prices into a slump, knocking out significant recent gains at one fell swoop.

There had been a bit of a party atmosphere in the weeks leading up to today’s issuance, as general improvements in the economy, and signs the Chinese Covid-19 pandemic might not have the long lasting effects initially feared in the dark days of March. Oil had rallied impressively for eight straight weeks, topping $40/bbl for WTI as recently as Monday.

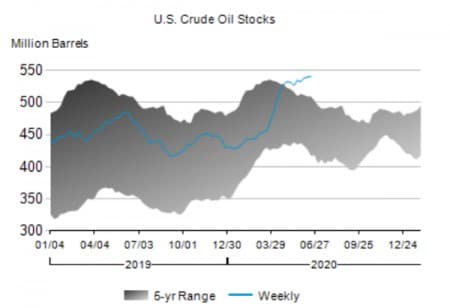

Concerns about the 500+ mm barrel inventory overhang, as per this edition of the WPSR, had abated somewhat as well, as the decline in drilling has led to a commensurate decline in U.S. daily production, as I noted in a recent linked article.

These two inventory reports, coming on the heels of two weeks of increasing inventories that the oil market “bulls” had looked past in their gaiety, brought “rain-to-the-picnic.”

The latest from the Dallas Fed

Bad news seems to travel in packs, and a second helping of sobriety was served up to the oilfield by the Dallas Fed’s quarterly missive.

The Dallas branch of the Federal Reserve, colloquially known as the “Dallas Fed,” publishes a quarterly energy survey of executives that operate in its area of remit. If you have questions about how the Fed operates, I would recommend you go back and read my earlier article where I showcased this government agency.

Some key takeaways from this report.

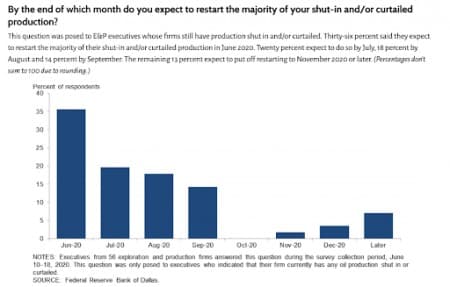

This survey to no one’s great surprise, put a damper on any early signs of life emerging out of the collapse of the oilfield activity in the Permian basin, the key area covered by the Dallas Fed. What was surprising was just how dour these energy execs seemed to be late in the second quarter. Particularly when paired with the general enthusiasm as expressed by the rising oil price, leading some to expect that production restarts might happen faster than originally thought by the market.

Related: Iraq Considers A String Of Massive Oil Deals With China

This expectation was largely borne out in the survey with about 75% of the energy companies with shut-in production expecting to start it up again by the end of the third quarter. This is mildly bearish for WTI and could have been a contributor to the morning’s sell off.

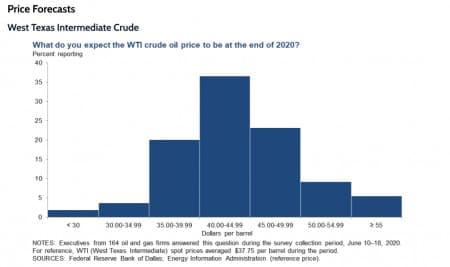

The next key indicator lay their expectation for price realizations for WTI through the end of the year. About half do not expect a price beyond $45 a barrel until 2021. That is significant because many of them are not cash flow positive at these levels, rising from the fact their acreage is Tier-II, or III and carries higher development costs than Tier-I

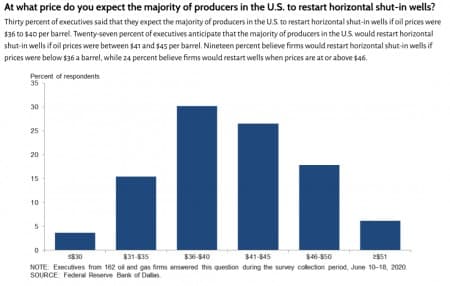

The next question in the survey discussed their requirements for restarting wells that had been shut-in. The majority of respondents replied that pricing above $35, which has only just recently been attained would be needed for them to restart wells.

This is bullish for ultimate pricing as it shows that these cash starved companies are willing to show some restraint at present, in hopes of seeing better pricing down the road.

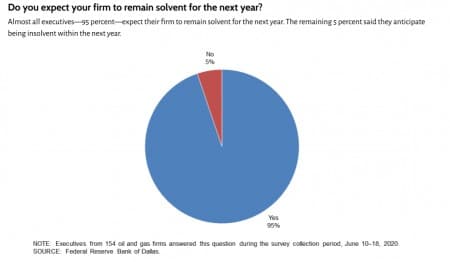

What was quite surprising was the number of execs who thought their firm could weather the current storm and survive to better days. Given the recent bankruptcies coming out of the shale patch, the most recent of which being this week’s filing by Chisholm Oil and Gas, my expectations would have been for a larger fraction of insolvencies.

Your takeaway

In spite of oil’s current tendency to go higher on good news, or no news, prices will not be able to stabilize until the barrels in storage begin to come down. This has not happened yet as evidenced by these recent inventory builds.

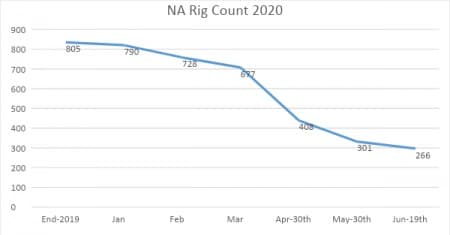

The long term thesis for oil moving higher from increased demand, versus tightening supply remains intact from the depth of the decline in drilling.

The current rig count implies a monthly new production rate of only ~213 BOPM of new production, against a monthly legacy well decline rate several times this amount.

The bulls win in the end at this rate.

By David Messler for Oilprice.com

More Top Reads From Oilprice.com:

- Oilfield Services May Not Recover Until 2023

- How Saudi Arabia Caused The Worst Oil Price Crash In History

- Pirates Threaten Oil Operations In Gulf Of Mexico