Friday November 22, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

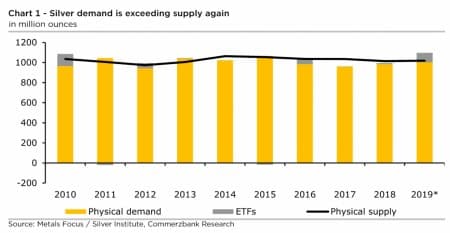

1. Silver supply gap

• The silver supply surplus is set to narrow this year, as physical demand is expected to rise by 1 percent and supply is expected to contract by 0.5 percent.

• “If silver ETFs, which have already seen strong inflows of nearly 3,000 tons this year, are factored into the equation, the silver market actually shows a clear deficit for the first time in six years,” Commerzbank said in a note.

• Silver’s largest use is for industrial demand (51 percent of the share), and industrial demand is set to stagnate. But silver demand in the auto industry is on the rise.

• “What is more, the photovoltaic industry is also likely to demand more silver because of numerous renewable energy projects,” Commerzbank said.

• Overall, the price for silver is “too low and is undervalued,” the bank concluded.

2. Refining margins plunge

• Refining margins have plunged in the last two months, falling from close to $20 per barrel down to near $12 per barrel, according to BP.

• In Northwest Europe, refining margins fell into negative territory this week, falling to -$0.49 per barrel, according to Reuters, their lowest level since…

Friday November 22, 2019

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy and metals sectors. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Silver supply gap

• The silver supply surplus is set to narrow this year, as physical demand is expected to rise by 1 percent and supply is expected to contract by 0.5 percent.

• “If silver ETFs, which have already seen strong inflows of nearly 3,000 tons this year, are factored into the equation, the silver market actually shows a clear deficit for the first time in six years,” Commerzbank said in a note.

• Silver’s largest use is for industrial demand (51 percent of the share), and industrial demand is set to stagnate. But silver demand in the auto industry is on the rise.

• “What is more, the photovoltaic industry is also likely to demand more silver because of numerous renewable energy projects,” Commerzbank said.

• Overall, the price for silver is “too low and is undervalued,” the bank concluded.

2. Refining margins plunge

• Refining margins have plunged in the last two months, falling from close to $20 per barrel down to near $12 per barrel, according to BP.

• In Northwest Europe, refining margins fell into negative territory this week, falling to -$0.49 per barrel, according to Reuters, their lowest level since 2013.

• “The return of refineries from maintenance has seriously reduced refinery economics, and this is not a sign of strong global oil product demand,” Petromatrix said in a note. Plenty of supply, not enough demand.

• In the U.S., refining runs have been down sharply this year relative to 2018. Year-to-date, refiners have averaged 16.6 mb/d in processing, compared to 16.9 mb/d for the same period in 2018.

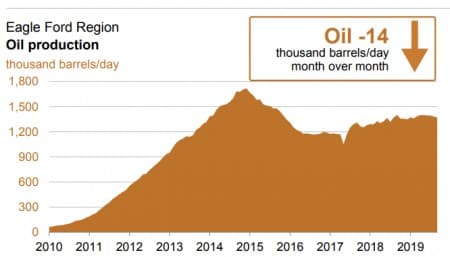

3. Eagle Ford in decline

• U.S. oil production continues to rise, but growth is now almost entirely concentrated in the Permian basin.

• The Eagle Ford is expected to lose another 14,000 bpd in December compared to a month earlier.

• At 1.36 mb/d, the Eagle Ford has now passed its second peak, reached earlier this year at 1.39 mb/d. The Eagle Ford hit its first peak at 1.71 mb/d in 2015.

• It isn’t clear if the Eagle Ford can come back from its most recent peak. The best locations have been picked over and Wall Street has lost interest in financing unprofitable drilling.

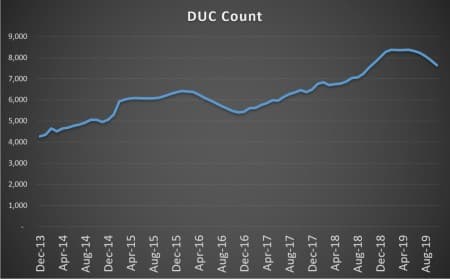

4. Shale drillers dip into DUC backlog

• The backlog of drilled but uncompleted wells (DUCs) rose steadily over the last few years, as shale companies drilled wells at a faster rate than they completed them.

• This occurs for various reasons, such as waiting for oil prices to rise, or waiting for completion crews, or due to a shortage of pipelines available to takeaway new supply.

• However, after uninterrupted increases for two and a half years, the DUC backlog peaked at 8,374 in March 2019.

• Since then, drillers have begun completing more wells than they drilled, reducing the DUC count to 7,642 as of October.

• This phenomenon also likely has multiple drivers, such as new midstream capacity, but also because of companies cutting drilling costs, and instead relying on completing already-drilled wells.

• The whittling away at the DUC backlog will allow the industry to continue to grow production even as they slow drilling. But that can’t keep up indefinitely.

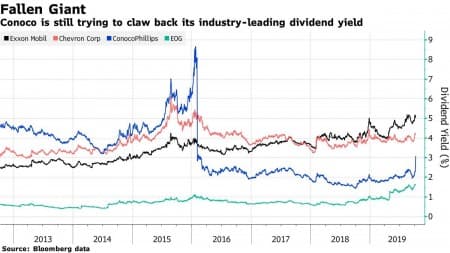

5. ConocoPhillips $30 billion share buyback

• ConocoPhillips (NYSE: COP) announced a 10-year plan to buy back $30 billion worth of shares, which is equivalent to about half of its market cap.

• Conoco also said that it would pay dividends of $20 billion and keep capex at only 10 percent above current levels.

• The plan stands out as the industry is losing favor with investors. “The industry faces a flight of sponsorship by investors,” CEO Ryan Lance said. There’s a “struggle for relevance unless the industry can create value on sustained basis.”

• As Bloomberg analyst Liam Denning put it, the oil industry “is a mature business with a bad track record of capital management and a future clouded by climate change.”

• Conoco may be charting a path forward that aims to keep costs low and return any excess cash to shareholders.

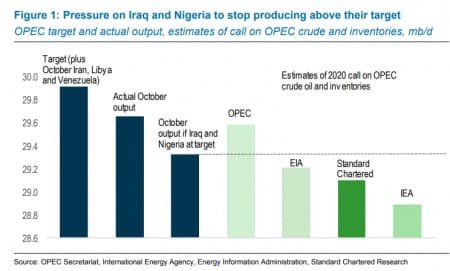

6. Eyes on OPEC+ as surplus looms

• OPEC+ is set to meet in about two weeks, and they are widely expected to extend the production cuts (currently slated to expire in March) through the end of 2020.

• There is not a ton of momentum to deepen the cuts, despite the potential for a surplus. Instead, the main goal might be to pressure Iraq and Nigeria to bring output down to targeted levels.

• “Two countries are overproducing; Nigeria and Iraq exceeded targets by 131kb/d and 200kb/d, respectively in October,” Standard Chartered wrote in a note. “There is a downside price risk from OPEC in that Nigeria and Iraq might not appreciate the extent to which the patience of key members has been exhausted.”

• However, the forecasted surplus from many agencies and analysts hinge on strong U.S. shale supply growth in 2020, which may or may not materialize.

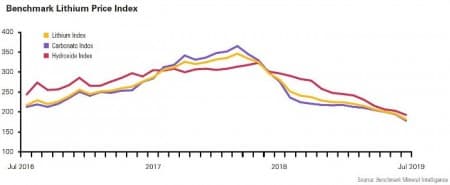

7. Lithium prices continue to slide

• Chilean mining giant SQM (NYSE: SQM) said that its third quarter profits had fallen sharply due to lower lithium prices. Earnings were down by 27.5 percent, year-on-year.

• SQM said that lithium prices were down by 28 percent, and profits declined even as sales grew.

• Demand is still growing strongly, expected to be up by 14 percent this year. But that is a slower pace of growth than SQM’s long-term forecast of 16 to 20 percent annually.

• But it has been a perfect storm for lithium producers. China is scaling back subsidies for EVs, and a rush of new mining capacity has come online.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.