Oil prices have dipped a bit this week, but still remain at their highest levels in nearly three and a half years. The reasons are by now familiar to most readers who pay attention to the daily whims of the oil market: OPEC cuts, falling inventories, geopolitical unrest and strong demand growth, to name a few.

But at what point do higher prices start to destroy some of that demand, erasing one of the most significant bullish factors influencing the market right now? As John Kemp over at Reuters points out, there isn’t a magical threshold in which demand is humming along swimmingly and then suddenly drops off a cliff. There isn’t a binary response in that way.

Consumers respond in different ways to different prices, and the duration of high prices also matters quite a bit. Auto fleet turnover takes time, and people don’t rush out and buy a more fuel efficient car immediately when prices spike. And as John Kemp rightly argues, demand will likely take a hit before we can detect it in the data.

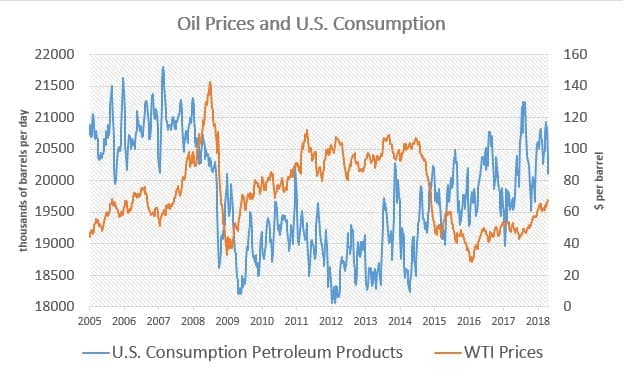

Nevertheless, demand is sensitive to prices, which is to say it will slow or even decline if prices rise high enough. A brief look at recent history bears that out. Crude oil prices saw a historic run up in prices in the years preceding the 2008 record high spike and subsequent meltdown. That rally essentially ended a century-long upward trend in demand, which hit a high above 21 million barrels per day (mb/d) in the U.S. in 2006-2007. The financial crisis, a terrible economy, more efficient cars and a somewhat saturated auto market led to a temporary peak in oil demand, which was followed by several years at lower levels.

(Click to enlarge)

When oil prices rose back to $100 per barrel in 2011 following the Arab Spring, demand dipped even further.

Related: Can Japan Dodge Trump’s Trade War?

Only when prices collapsed in 2014 did the U.S. start to see a revival in demand. U.S. consumers enjoyed more than three years of cheap oil, causing them to fall back in love with SUVs and pickup trucks.

However, we could be on the verge of another shift in the cycle, with WTI at a three-year high, sitting just shy of $70 per barrel. More importantly, the OPEC cuts, the prospect of supply outages in Iran and Venezuela, and the depletion of inventories down to average levels promise to push prices even higher. We haven’t seen any discernable change in demand just yet, but again, these things take time to show up in the data.

The IEA projects oil demand will rise by a robust 1.5 mb/d in 2018. The agency believes total demand will outstrip supply for the rest of this year, with the supply gap growing as time passes. That, of course, is predicated on the assumption that demand does indeed grow at that projected rate of 1.5 mb/d. But, at some point, if demand exceeds supply by enough, and inventories fall below average levels, prices will spike to much higher levels

(Click to enlarge)

At that point, say, $80 or $90 or $100 per barrel, demand will have to start taking a hit. To reiterate, forecasting the precise price level, and the magnitude of the demand response, is tricky. But, suffice it to say, the oil market won’t see consistently high levels of demand growth – at 1.5 mb/d – year after year if prices are approaching triple-digit territory.

Related: Oil Majors Are Abandoning Venezuela

Then there is the matter of the short-term versus the long-term. Demand destruction might not occur instantaneously. It will take an extended period of high prices before consumers start really cutting back in a big way. But if prices stay high for several years – and there are plenty of reasons why that might not occur – the hit to demand could have more permanent consequences.

In other words, this time could be different. Unlike a decade ago, electric vehicles are increasingly competitive with traditional gasoline or diesel-fueled cars and at some point in the 2020s will reach cost-parity without subsidies. Higher oil prices tilt that equation in favor of EVs and could shift that timeline forward. A sustained period of high prices could accelerate the energy transition that most analyst see as inevitable.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- Expect Much Tighter Oil Markets

- World Bank: Oil Prices To Average $65 This Year

- Oil Majors Are Abandoning Venezuela

Low oil prices actually kill the economies of the world but prices of oil are dropped BY DESIGN whenever the world oil exporters dedollarize as the BRICS are doing. So in summary, low oil prices are simply a weapon to collapse nations like Venezuela and the BRICS and to force them back on the dollar.

The USA makes no money on expensive oil unless that oil is transacted in dollars. The currency being used is the key to the decision to either raise oil prices when the world is back on the dollar or drop the oil prices when the world is dedollarizing.

It is a geopolitical inelastic commodity and when the world is forced to trade it in dollars, the USA can continue to export it's debt around the world - the dollar fiat paper money game. Dollar wars rage on. IMHO

Still, we need to differentiate between opportunistic and fair prices. A very sound economic principle is for oil-producing nations to try to maximize the return on their finite assets to whatever level the global economy can tolerate. This means that oil prices could go up beyond $100 with impunity. If oil prices become too excessive, the global oil market will tell us in no uncertain terms.

A fair price for oil according to my research ranges from $100-$130. Such a price is good for the global economy as it invigorates the three biggest chunks that make up the global economy, namely, global investments, the economies of the oil-producing nations and the global oil industry.

Therefore, oil prices still have a big scope to rise before they start to adversely impact the global economy.

And while wider use of electric vehicles (EVs) will decelerate global demand for oil in coming years, they can’t replace it. Oil will continue to reign supreme through the 21st century and far beyond. A post-oil era is a myth.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

2008 -500,000 bpd (2008 and 2009 were the first years since the start of the Iraq war where we had declining consumption because of a price spike)

2009 -1,500,000 bpd

2010 2,100,000 bpd

2011 2,600,000 bpd

2012 800,000 bpd

2013 2,000,000 bpd

2014 800,000 bpd

2015 2,100,000 bpd

2016 1,800,000 bpd

2017 1,600,000 bpd

2018 1,500,000-1,600,000 bpd(expected this year)

We have to be careful when we talk about demand destruction and demand just not growing as much. What we are talking about here is demand just no growing as much.

With oil solidly over $100/barrel from 2011 to 2014 we didn't see the kind of demand growth reductions one would expect. I wouldn't count on demand growth reductions until oil gets over $100/barrel.

We talk a lot about supply because it is a little easier to quantify but we have had run away demand the last few years. The global auto fleet stands at about 1.3 billion(cars and light trucks). We are adding about 80 million(a little less with scraping) cars to the fleet every year with about 1-2% being electric. It is hard to come up with scenarios where consumption won’t continue to rise for many years at a minimum of 1.0 million bpd even with increased penetration of electric cars and much higher oil prices.

To High, To Fast, It Won't Last!