Logistics have been pushed to the forefront of oil trade as Houthi missile and drone attacks continue to disrupt navigation through the Red Sea and the Suez Canal. The list of companies avoiding the Bab el Mandeb Strait and the Red Sea keeps on expanding with each passing day, ranging from oil majors like BP or Shell and all the way to Asian refiners such as the UAE’s ADNOC or India’s Reliance. Whilst the oil exports of Middle Eastern crude producers to Asia have not been impacted so far by any strikes, reaching the Atlantic Basin is becoming an increasingly difficult task as freight rates spiral out of control. Faced with such an uphill battle, Saudi Arabia and Iraq responded by scaling their formula prices lower, simultaneously pressured by disappearing backwardation in key futures contracts as well as weakening European demand.

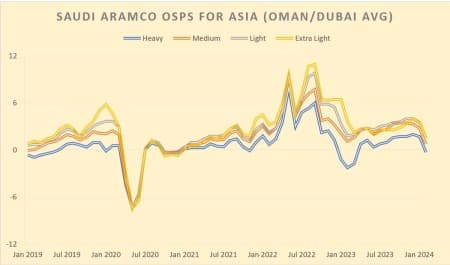

Chart 1. Saudi Aramco’s Official Selling Prices for Asian Cargoes (vs Oman/Dubai average). Source: Saudi Aramco.

Asian refiners expected hefty cuts in Saudi Aramco’s formula prices, however the ultimate price-slashing done by the Saudi national oil company might have surprised even the most ambitious among all buyers. The month-on-month change in the Dubai cash-to-futures spread amounted to $1.40/bbl, with the Middle Eastern futures contract ending December in contango, so the pricing cut was inevitable. However, Saudi Aramco cut all its February-loading formula prices to Asia by $2 per barrel, bringing the OSP of Arab Light in the Asian continent to the lowest level since November 2021, at $1.50 per barrel above the Oman-Dubai average. Because the price cut was uniform, the relatively narrow grade-by-grade spreads remain in place; there’s less than $2 per barrel separating Arab Light and Arab Heavy. Despite the huge downward revision, Saudi Arabia will need more to convince Chinese buyers that its prices are competitive with market reports indicating that next month’s loading nomination have not changed much from the 1.35 million b/d seen in January. Perhaps the ongoing talks on allowing China’s Rongsheng to purchase a 50% stake in the Sasref refinery in Saudi Arabia are one of the more creative steps to deepen the Saudi-Chinese relationship. Related: China’s Oil Giant CNOOC Raises Output and Capex Targets to Record Highs

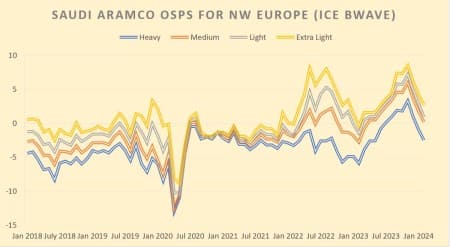

Chart 2. Formula prices of Saudi cargoes bound for the Northwest Europe by selected grades (vs ICE Brent). Source: Saudi Aramco.

Saudi Aramco extended its unexpected generosity to other continents, too. For European buyers the February formula prices were slashed by a uniform $1.50/bbl compared to January, with Arab Light being the only notable exception. Arab Light in Northwest Europe was lowered by the same $2/bbl as Asian OSPs, decreasing to a mere $0.90 per barrel premium to ICE Brent, whilst for Mediterranean refiners the same grade is looking even better at $0.40 per barrel above Brent. Seeing that Saudi Aramco has been emptying its inventories at home and pre-moving oil into Sidi Kerir in anticipation of higher demand.

Breaking with the tradition of keeping US prices as high as possible, Saudi Aramco has also softened its pricing strategy vis-a-vis legacy buyers in the Gulf Coast, slashing formula prices by the same $2/bbl. Arab Light remains the cheapest grade for any US buyer, assessed at a $5.15 per barrel premium to the Argus Sour crude index, indicating that Aramco would prefer to see it getting higher traction in the United States. Overall, Saudi Aramco made a bold statement about taking pricing seriously (again), and ad hoc buyer demands for more crude next month suggest their strategy shift might be bearing fruit.

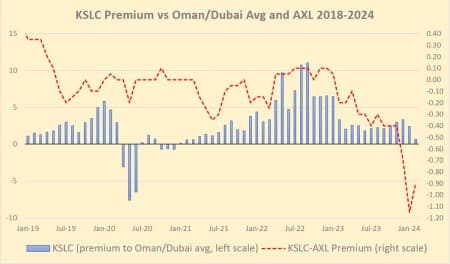

Chart 3. Kuwait Super Light Crude official selling prices into Asia, compared with Arab Extra Light (vs Oman/Dubai average). Source: KPC.

Kuwait’s national oil company KPC has reluctantly followed the lead of Saudi Aramco, cutting slightly less than its Saudi peer in Asia, with the country’s main export grade Kuwait Export Grade cut by $1.85 per barrel, selling at a $0.25 per barrel premium to the Oman/Dubai average in February. For most of 2022 pricing changes between Arab Medium and Kuwait aligned across the months, however Kuwait is increasingly positioning its crude as a slightly better value purchase, with KEB being$ 0.50 per barrel cheaper than Arab Medium. Similarly with Kuwait’s lightest grade KSLC which was cut by the same $1.80 per barrel to a $0.65 per barrel premium over Oman/Dubai, it is almost a dollar cheaper than Saudi Arabia’s Arab Extra Light. Meanwhile, following many government changes over the past years Kuwait has a new cabinet of ministers, the first under the new emir Sheikh Mishal, with the oil ministry to be led by a seasoned oil industry veteran Imad Muhammad al-Atiqi. Kuwait still maintains a target to bring production capacity to 4 million b/d by 2035, despite headwinds in maintaining output at its maturing legacy assets such as the supergiant Burgan field.

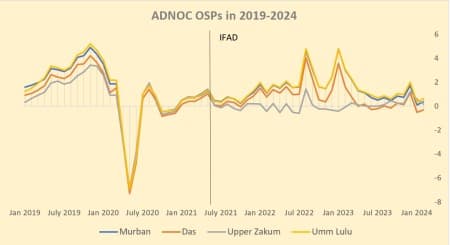

Chart 4. ADNOC Official Selling Prices for 2017-2024 (set outright, here vs Dubai). Source: ADNOC.

Considering exchange traded Murban futures set the February price of the UAE flagship grade, putting it almost $6 per barrel lower than in January at $77.69 per barrel, the national oil company Adnoc had a seemingly easier job than most. That didn’t make the exercise any more enjoyable as Murban managed to pull off only a slight recovery against Dubai, with the December monthly spread coming in at $0.38 per barrel, well below where the UAE sees the relative value of Murban. Moreover, spot trades in other UAE grades have prompted Adnoc to lower the prices of Das and Upper Zakum, too, with both set as a differential against Murban, with the latter medium sour grade seeing a whopping $0.70 per barrel month-on-month cut. As the Ruwais refinery is nearing the completion of the crude flexibility project that will allow UAE refining to run also on heavier grades such as Upper Zakum, there should be even more Murban in the markets from March onwards as Adnoc raised the forecast for the grade’s availability to 1.6 million b/d.

Internationally, ADNOC keeps on expanding beyond the crude oil markets, intent on smoothing over all differences with Austria’s OMV to create a $20 billion petrochemical giant by merging Borealis and Borouge. In different splits, ADNOC and OMV co-own both petrochemical companies, so the markets generally expect them to be successful in their endeavour. Simultaneously, ADNOC has carried out its first investment into carbon management, buying a 10% stake in the UK carbon capture and storage developer Storegga, the first steps in the company’s $15 billion decarbonization drive that would most probably see it buying several low-carbon technology firms.

Chart 5. Iraqi Official Selling Prices for Asia-bound cargoes (vs Oman/Dubai). Source: SOMO.

Taking its time to issue February formula prices after the shock effect of Saudi Arabia’s sizable price cuts, the Iraqi state oil marketing company SOMO only published its OSPs by the middle of January. Even though Iraq has slashed prices across all continents in the same vein that Saudi Aramco did, however, the extent of changes was very different, especially in the Atlantic Basin. For Asia, pricing cuts were almost identical, with SOMO lowering Basrah Medium by $1.80 per barrel so that now its formula price stands at a $0.80 per barrel discount to Oman/Dubai. Basrah Heavy was cut by $1.90 per barrel, now priced at -$3.80 per barrel below the Oman/Dubai average, the lowest since April 2023. After really high Asia-bound export figures in November-December, Iraqi exports are feeling the pressure of Red Sea disruptions, too, forcing SOMO to keep formula prices competitive as more and more Middle Eastern barrels remain in the region.

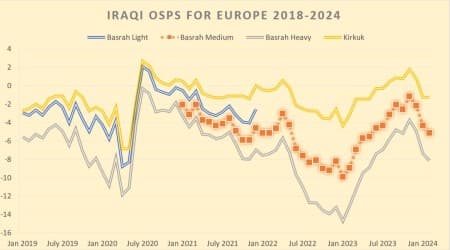

Chart 6. Iraqi official selling prices in Europe (vs Dated Brent). Source: SOMO.

Apart from Houthi attacks that have alerted European buyers to the risks of physical disruptions, Iraqi exports have also suffered from the flare-up in geopolitical tensions after Iran’s IRGC seized a cargo en route to Turkey. Wary of consequences, European buyers have started to send their allocated tankers laden with Iraqi oil around the Cape of Good Hope, with the January loading programme seeing at least six tankers that avoided the Suez Canal. In terms of pricing, however, SOMO did not cut prices as drastically as Saudi Aramco did, despite its cargoes being priced off Dated Brent. Both Basrah Medium and Basrah Heavy were slashed by $0.80 per barrel, dropping the latter as low as a $8.15 per barrel discount to the European physical benchmark.

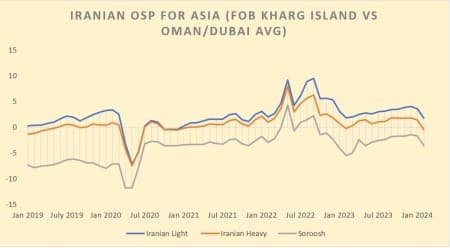

Chart 7. Iranian Official Selling Prices for Asia-bound cargoes (vs Oman/Dubai average). Source: NIOC.

Iran’s state oil company NIOC preferred the Kuwaiti price cuts over Saudi Arabia’s more assertive pricing strategy, cutting formula prices to Asia-bound cargoes by $1.85 per barrel. As a consequence, Iran Light (at least on paper) should trade $0.25 per barrel higher than Arab Light, the widest premium Iran has boasted since 2020. In reality, however, Iran sells its cargoes to China under a parallel pricing mechanism, at discounts to market prices. That said, discounts for Iranian cargoes have been shrinking lately after Venezuelan cargoes have dried up a little for Chinese buyers, with prompt deliveries assessed at a $5 per barrel discount to Brent futures, up almost $10 per barrel since the summer.

At the same time, tensions are running high around Iran after the IRGC seized a tanker that was carrying Iraqi crude to Turkey. The St Nikolas crude tanker was renamed after a 2023 maritime incident that saw it detained by US authorities and the Iranian crude cargo aboard being removed into a storage tank farm in Houston, TX. Tehran seized it back mid-January, despite the tanker being renamed from Suez Rajan to St Nikolas, created another potential chokepoint for shipping in the Strait of Hormuz.

By Gerald Jansen for Oilprice.com

More Top Reads From Oilprice.com:

- Fire Damages Rosneft Refinery in Suspected Ukrainian Drone Attack

- Cold Weather Has Increased Range Anxiety For EV Drivers

- Energy Traders Thrive Amidst Europe’s Renewable Energy Surge