Oil prices have bounced back after Monday's $3 per barrel decline, but markets remain on edge ahead of the latest Fed meeting.

Investor Alert: Whether you are new to the oil and gas industry or an energy market veteran, Global Energy Alert is an absolute must-read. Oilprice.com's premium newsletter provides everything from geopolitical analysis to trading analysis, all for less than a cup of coffee per week.

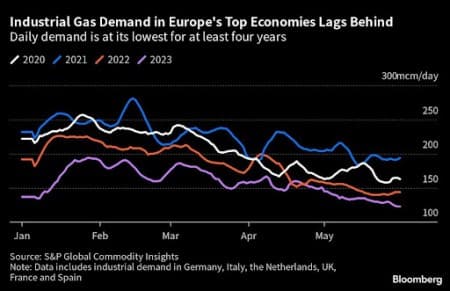

Chart of the Week

Europe’s Industrial Gas Demand Just Won’t Come Back

- Even though European natural gas prices have plummeted some 60% compared to June 2022 figures, with prompt-month TTF futures hovering around the €30 per MWh mark, the continent’s industrial gas demand remains weak.

- Aggregated gas consumption in Germany, Italy, France, Spain, the UK, and the Netherlands is down 9.7% year-on-year, showing the growing pains of Europe to get its industry back on a path of growth.

- The Eurozone’s manufacturing PMI came in last month at the weakest reading since the first COVID months of 2020, at a mere 44.8, marking the weakest moment so far after a year of industrial contraction.

- Germany’s demand destruction is by far the largest of all major European countries, down 15% year-on-year, with key energy consumers such as steelmakers and chemical holdings still reluctant to fully restore production.

Market Movers

- Shares of Brazil’s petchem producer Braskem (NYSE:BAK) soared this week after chlorine producer Unipar (BVMF:UNIP6) bid for a controlling stake in the company at a 43% premium to market price.

- US oil major Chevron (NYSE:CVX) has allocated more than $500 million to develop its Trapial block in western Neuquen province in the Vaca Muerta play, doubling down on shale investments globally.

- US upstream-focused oil company Apache (NASDAQ:APA) suspended drilling in the UK North Sea after the windfall tax rate made operations less competitive and is seeking to reduce the workforce.

Tuesday, June 13, 2023

Another week, another tough Monday for oil markets. Whilst oil prices recovered on Tuesday after the steep $3 per barrel decline the day before, weak Chinese data and the prospect of another surprise from the U.S. Federal Reserve are keeping oil markets on edge.

Saudi Aramco Allocates Full Volumes Despite Cut. According to media reports, Saudi Arabia’s national oil company has assured its Asian term buyers that they would get full crude volumes they had asked for in July, despite committing to a 1 million b/d production cut.

US Announces Second SPR Purchase. The US Department of Defense said it awarded supply deals for 3.1 million barrels of oil going to the Strategic Petroleum Reserve in August, adding that it is seeking firm bids for another 3 million barrels to the same SPR site in Big Hill, TX for September delivery. Related: Oil Soars Nearly 4% Ahead Of Fed Rate Decision

Shell Rethinks Its Strategy. Walking back pledges to reduce oil production by 1-2% per year, Shell’s (LON:SHEL) top management now seeks to keep crude output steady until at least 2030 as the energy giant faces weak returns on renewable investments and booming oil and gas profits.

Norway Oil Workers on Strike Alert. More than 900 workers on Norwegian offshore drilling platforms will go on strike from June 29 unless protracted salary talks result in a deal, impacting the operations of service companies such as Seadrill (NYSE:SDRL) or Odfjell (LON:0J77).

OPEC Maintains Its 2023 Demand Forecast. Brushing aside weak Chinese macroeconomic data and flattening backwardation, OPEC has maintained its outlook for demand growth this year at 2.35 million b/d, equivalent to a 2.5% uptick year-on-year.

Pakistan Buys First Russian Cargo. Pakistan’s Prime Minister Shehbaz Sharif said the first-ever cargo of Russian oil under a new deal between Islamabad and Moscow had just arrived at the country’s main oil port of Karachi, hinting that the payment will be carried out in Chinese yuan.

Nigeria Goes After ExxonMobil. Nigeria’s downstream oil regulator NMDPRA alleged US oil major ExxonMobil (NYSE:XOM) was involved in the illegal lifting of butane from the Bonny River offshore terminal, accusing it of economic sabotage and of stealing the country’s resources.

Glencore-Teck Saga Gets a New Twist. Following Glencore’s (LON:GLEN) unsuccessful takeover of Canadian miner Teck Resources (NYSE:TECK), the Swiss trading conglomerate has reportedly approached the firm about purchasing its coal assets only.

Iraq Set to Pay Its Iranian Gas Debt. Having received a sanctions clearance from the United States, the government of Iraq has agreed to pay its $2.76 billion debt to Iran for imports of natural gas and electricity, to be carried out soon via the Commercial Bank of Iraq.

Calcasieu Pass LNG Sees Arbitration. Two European energy companies, Italy’s Edison (BIT:EDN) and Spain’s Repsol (BME:REP) sued the US LNG developer Venture Global LNG for failing to start commercial deliveries to term buyers, despite 128 spot-traded cargoes going to Europe over the last 12 months.

Chemicals No Longer a Coveted Business. According to the Wall Street Journal, UK energy holding Shell (LON:SHEL) is carrying out a comprehensive review of its chemicals business after its 2022 performance ended with a $1.4 billion loss whilst other divisions have ramped up their profitability.

US Crude Supply Growth Slows Down. The EIA expects US shale oil production to hit an all-time high in July, hitting 9.38 million barrels per day, but month-on-month increases are narrowing down as next month’s figure would be only 0.1% higher than this month.

Iron Ore Loses Steam on Goldman Warning. Chinese iron ore futures fell to $107 per metric tonne this week after Goldman Sachs (NYSE:GS) warned China’s property market weakness will be a persistent problem for Beijing, expecting the recovery to be “L-shaped” rather than immediate.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- EIA Sees Record U.S. Shale Output Despite Slow Growth

- Bargain Hunters Boost Oil Prices Ahead Of Fed Meeting

- U.S. Energy Infrastructure To Get A Major Bump