Friday November 17, 2017

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Shale earnings reports move oil prices

(Click to enlarge)

- In the past, the earnings reports from the long list of shale E&Ps have tended to spark selloffs in crude oil prices. Why? Because for years, shale companies reported strong production growth figures and often laid out details on even more aggressive drilling campaigns.

- From mid-2014 through August 2017, according to the WSJ, oil prices fell by an average of 2.2 percent during earnings season.

- However, that changed recently. Oil prices jumped by more than 4 percent.

- The reason is that the shale industry finally is taking a more conservative approach, after years of incredible production growth has failed to translate into profits.

- The tenor of the quarterly report also changed. Shale executives sang a familiar tune to their shareholders, promising they would remain prudent and refrain from increasing spending, even if oil prices rose.

2. Shale to be free cash flow positive?

(Click to enlarge)

- The newfound restraint from the U.S. shale sector might actually help them finally report something that has proven to be elusive: positive free cash flow.

-…

Friday November 17, 2017

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Shale earnings reports move oil prices

(Click to enlarge)

- In the past, the earnings reports from the long list of shale E&Ps have tended to spark selloffs in crude oil prices. Why? Because for years, shale companies reported strong production growth figures and often laid out details on even more aggressive drilling campaigns.

- From mid-2014 through August 2017, according to the WSJ, oil prices fell by an average of 2.2 percent during earnings season.

- However, that changed recently. Oil prices jumped by more than 4 percent.

- The reason is that the shale industry finally is taking a more conservative approach, after years of incredible production growth has failed to translate into profits.

- The tenor of the quarterly report also changed. Shale executives sang a familiar tune to their shareholders, promising they would remain prudent and refrain from increasing spending, even if oil prices rose.

2. Shale to be free cash flow positive?

(Click to enlarge)

- The newfound restraint from the U.S. shale sector might actually help them finally report something that has proven to be elusive: positive free cash flow.

- ConocoPhillips (NYSE: COP) was slightly cash flow negative in the third quarter, but expects to swing to positive cash flow in the fourth quarter. EOG Resources (NYSE: EOG) told investors it was in a similar situation.

- Occidental Petroleum (NYSE: OXY) might post positive cash flow after burning through a large volume of cash in the third quarter.

- Anadarko Petroleum (NYSE: APC) and Pioneer Natural Resources (NYSE: PXD) don’t expect positive cash flow, but they are narrowing their losses.

- The new “balanced operating model is in contrast to the industry’s historical behavior of aggressively chasing top line growth at the ultimate expense of shareholders," Dave Hager, CEO Devon Energy Corp. (NYSE: DVN), told analysts on an earnings call. “This is not a populist philosophy that we are paying lip service to. We are absolutely committed to doing business differently."

3. Saudi oil exports to U.S. plunging

(Click to enlarge)

- Saudi Arabia has explicitly targeted U.S. inventories in its quest to balance the oil market, going out of its way to cut crude exports to its longtime strategic ally.

- The logic behind the strategy is that the U.S. has the most transparent and up-to-date inventory data. Everywhere else in the world, inventory data is opaque and published on a time lag, if at all. If Saudi Arabia can divert cargoes elsewhere, and U.S. data reflects stronger drawdowns, the market will appear to be rebalancing faster.

- As a result, Saudi crude oil exports to the U.S. have dropped to a 30-year low to just 525,000 bpd in October, down from 1.5 mb/d from a few years ago.

- The strategy carries risks. Saudi Arabia is already ceding market share to competitors like Iraq, which will be difficult to reverse.

4. Canadian oil discount widens

(Click to enlarge)

- Western Canada Select (WCS), a benchmark for heavy crude from Alberta, tends to trade at a discount to WTI. There are a few reasons for this, including its relatively higher sulfur content, the long distance it has to travel to get to Gulf Coast refineries, as well as the shortage of pipeline capacity from Canada to the U.S.

- WCS also trades at a discount to Mexico’s heavy Maya blend, less because of quality issues since they are of similar type, but more because of the much greater distance from the U.S. Gulf Coast. The WCS discount to Maya has historically been just a few dollars per barrel, reflecting those higher transportation costs.

- The steeper discount is because a handful of oil sands projects have come online in Alberta, leading to higher supply at a time when pipeline ca+pacity is stuck.

- Bloomberg Gadfly notes that futures prices for the next two years imply a WCS-to-Maya discount of a staggering $17 per barrel.

- There is about 330,000 bpd of capacity in Canada that is struggling to find space on pipelines. That surplus is set to jump to 600,000 bpd in 2018 and 700,000 bpd by 2019.

5. IEA killed oil price rally with bearish demand prediction

(Click to enlarge)

- The IEA poured ice cold water on the oil rally this week, publishing a report that downgraded global oil demand and blew up expectations of an oil market that was rapidly moving towards balance.

- The IEA lowered its 2017 demand forecast by 50,000 bpd to 1.5 mb/d, but reported that 4Q2017 demand was going to come in more than 300,000 bpd lower than expected, which could end up being the second lowest quarterly growth figure in years.

- The weaker-than-expected demand figure comes as the agency sees robust supply growth, particularly from the U.S. Total non-OPEC production expands by 1.4 mb/d, a figure so large that “demand growth will struggle to match this.”

- As a result, the agency predicted the oil market would move back into a state of surplus in the first quarter of 2018, with supply exceeding demand by 0.6 mb/d. That surplus continues into the second quarter, narrowing to 0.2 mb/d.

- After publishing the findings, oil prices tanked, ending a several-month rally.

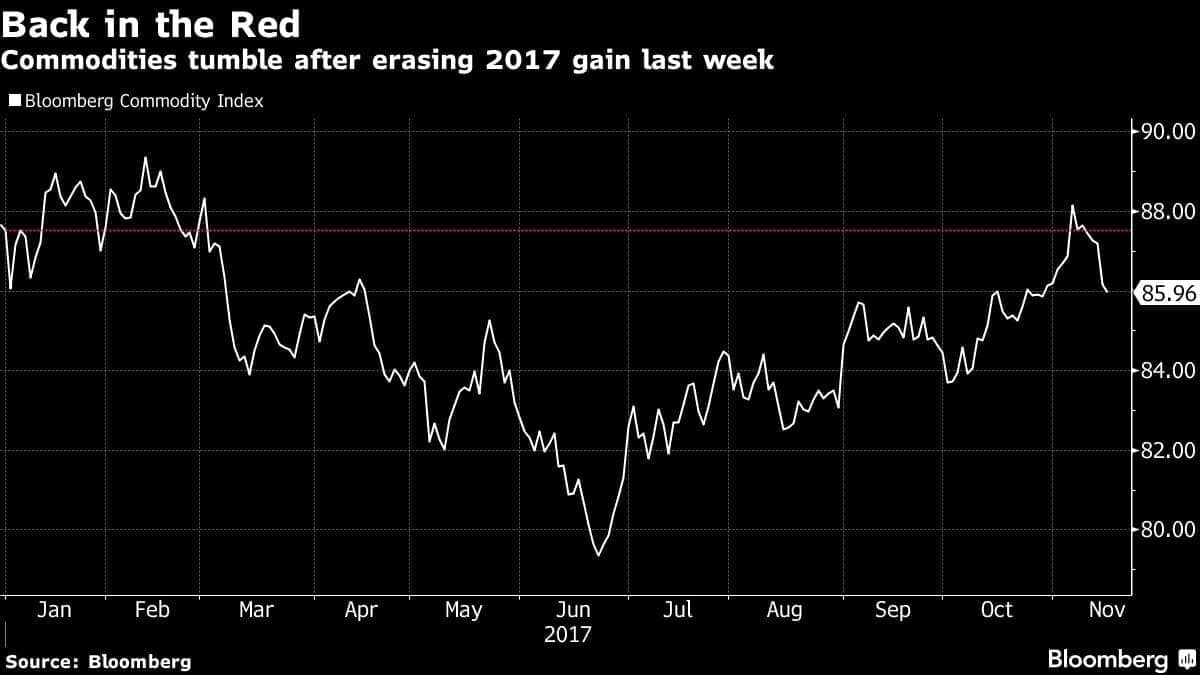

6. Commodity prices sink

(Click to enlarge)

- After 10 months of soaring price gains, commodity prices have plunged since the start of November.

- The Bloomberg Commodity Index fell the most in six months this week, on fears that China is shifting its economic policy after years of blistering growth.

- Metals prices have skyrocketed, largely because of hopes pinned on Chinese growth.

- “China focusing on the quality of economic expansion signals the pace of its growth will slow, which is pretty bad for commodities,” Will Yun, a commodities analyst at Hyundai Futures Corp., told Bloomberg.

- Prices for nickel, iron ore and crude oil have fallen steeply in the past two weeks.

7. Venezuela defaults, crude output to slide

(Click to enlarge)

- Venezuela officially defaulted this week on missed debt payments, the first in what most analysts expect could be many more – and much larger – defaults.

- The economic crisis continues to get worse, and the bankrupt country has no money to halt what has been a nearly two-decade erosion of its oil production. It has lost nearly 0.5 mb/d since 2015, and the declines are expected to accelerate.

- Deteriorating quality has meant that some refiners abroad have rejected shipments. No cash could mean that Venezuela cannot afford to import diluent, which could mean sharper declines in its heavy oil production.

- A Bloomberg survey of analysts expects production to dip to 1.84 mb/d in 2018, the lowest total in three decades.

- Energy Aspects, a consultancy, predicts it could be an even lower 1.65 mb/d in 2018.

- Beyond that, things only get worse. “Output will remain in decline beyond 2020 due in large part of the extensive deterioration of equipment and the loss of skilled labor in Venezuela, both of which will take multiple years to repair,” Mara Roberts Duque, an analyst for BMI Research, told Bloomberg. “There’s little if any investment traveling upstream and, with forthcoming debts still in limbo, investments will be held back by both PDVSA and private sector participants.”

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.