Friday, June 7, 2019

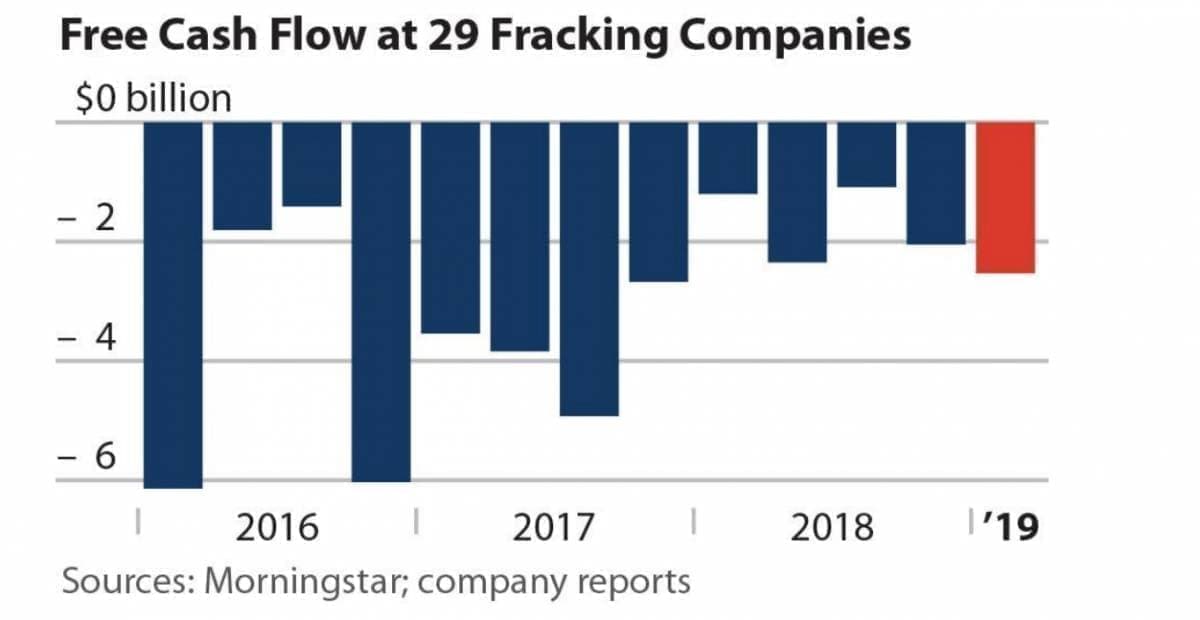

1. U.S. shale still burning cash

- A cross-section of 29 U.S. shale companies reported more than $2.5 billion in negative cash flow in the first quarter of 2019, which was worse than the fourth quarter of 2018, according to a new report from the Sightline Institute and the Institute for Energy Economics and Financial Analysis (IEEFA).

- For instance, Hess (NYSE: HES) posted $433 million in negative cash flow, while EOG (NYSE: EOG) reported $393 million in negative cash flow. Cabot Oil & Gas (NYSE: COG) and EQT (NYSE: EQT) – two Marcellus shale gas producers – posted $390 million and $500 million in positive cash flow.

- The report also found that between 2010 and 2019, the companies posted $184 billion in negative cash flow.

- “Frackers’ persistent inability to produce positive cash flows should be of grave concern to investors,” the report’s authors wrote. “Until fracking companies can demonstrate that they can produce cash as well as hydrocarbons, cautious investors would be wise to view the fracking sector as a speculative enterprise with a weak outlook and an unproven business model.”

- The recent decline in the oil market could hurt these figures even more if prices fail to rebound.

2. Permian gas flaring breaks records

- Gas flaring in the Permian basin surged to a record high in the first quarter at an average of 661 million cubic feet per day (MMcfd), according to Rystad Energy.

-…

Friday, June 7, 2019

1. U.S. shale still burning cash

- A cross-section of 29 U.S. shale companies reported more than $2.5 billion in negative cash flow in the first quarter of 2019, which was worse than the fourth quarter of 2018, according to a new report from the Sightline Institute and the Institute for Energy Economics and Financial Analysis (IEEFA).

- For instance, Hess (NYSE: HES) posted $433 million in negative cash flow, while EOG (NYSE: EOG) reported $393 million in negative cash flow. Cabot Oil & Gas (NYSE: COG) and EQT (NYSE: EQT) – two Marcellus shale gas producers – posted $390 million and $500 million in positive cash flow.

- The report also found that between 2010 and 2019, the companies posted $184 billion in negative cash flow.

- “Frackers’ persistent inability to produce positive cash flows should be of grave concern to investors,” the report’s authors wrote. “Until fracking companies can demonstrate that they can produce cash as well as hydrocarbons, cautious investors would be wise to view the fracking sector as a speculative enterprise with a weak outlook and an unproven business model.”

- The recent decline in the oil market could hurt these figures even more if prices fail to rebound.

2. Permian gas flaring breaks records

- Gas flaring in the Permian basin surged to a record high in the first quarter at an average of 661 million cubic feet per day (MMcfd), according to Rystad Energy.

- The surge in oil and gas output has run into a wall of fixed pipeline capacity. Rather than throttle back on oil drilling, associated gas production – and flaring – continues to soar.

- “We anticipate that basin-wide flaring will stay above 650 MMcfd before the Gulf Coast Express pipeline comes online in the second half of 2019,” says Artem Abramov, Head of Shale Research at Rystad Energy.

- The volume of gas burned off or vented into the atmosphere is more than twice as large as the largest gas producing project in the Gulf of Mexico. Shell’s Mars-Ursa offshore complex produces 260 to 270 MMCfd per day.

3. Economic concerns mounting

- Oil prices fell sharply over the past two weeks, dipping into a bear market. The overarching concern is a weakening economy, made worse by the ballooning trade war.

- Manufacturing activity, measured in PMIs, has been heading south since the start of the year.

- In the Eurozone and Japan, PMIs have fallen below 50, signaling a contraction.

- In the U.S., and indeed around the world, manufacturing activity is in danger of an outright contraction.

- “The decline in Global Manufacturing PMIs that started around the first round of US tariffs shows no signs of abating in the midst of the ongoing multiple open trade wars, another factor that could further depress oil markets in 2H19,” Bank of America Merrill Lynch wrote in a note to clients.

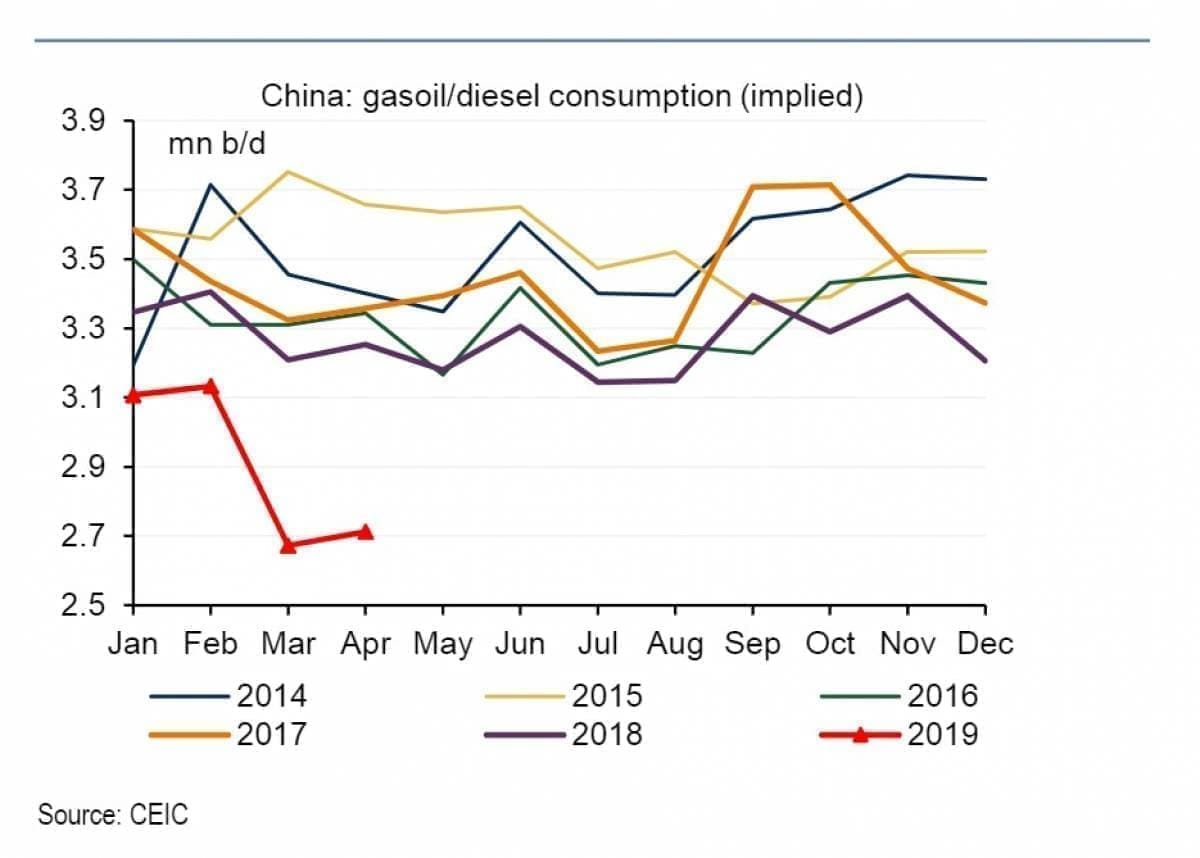

4. China’s distillate demand weakening

- Weaker manufacturing activity, as mentioned above, is one factor driving demand down. Distillate demand is particularly weak this year in China.

- Distillate demand is a leading indicator of economic health, as it is used heavily in cyclical industries such as manufacturing.

- China’s “implied demand growth averaged - 180k b/d in 2018, but this has dropped to - 400k b/d during the first four months of 2019,” Bank of America Merrill Lynch said. “Fallout from the US-China trade war could keep Chinese demand growth depressed over the coming months.”

- Diesel demand is weak across the OECD, but also in Turkey, Russia and India.

5. Lithium miners looking to move up value chain

- Almost three-quarters of global lithium production comes from Australia and Chile. But the refining, electrochemical production, cell production and battery assembly happens elsewhere.

- For instance, China accounts for more than 80 percent of lithium refining, while Japan accounts for half of battery assembly.

- Australia and Chile are hoping to attract these value-added industries so that they are not just a source of raw material. By 2025, the market for raw lithium could be worth $20 billion, but the market for battery cells could top $424 billion, according to Bloomberg.

- Albemarle Corp. (NYSE: ALB) broke ground earlier this year on a $690 million lithium processing facility in Australia, which will be the largest of its kind in the world. A unit of Samsung and Posco are planning a facility to build the chemical components used in batteries.

- Breaking out of the trap of only being a source of raw materials is difficult in the commodity business, but Chile and Australia have the advantage of controlling a high concentration of lithium production.

6. Investors flock to gold

- The largest gold ETF, SPDR Gold Shares, rose by the most in three years on Monday, benefitting from fears of the U.S-China trade war.

- The SPDR ETF rose by 2.2 percent, as investors flocked to safety. Gold prices jumped above $1,330 on Thursday, hitting a 3-month high and close to the highest price in a year.

- Helping gold is the dovish stance from the U.S. Federal Reserve. The Fed chairman Jerome Powell hinted at a rate cut later this year, a move that would help gold.

- “Gold is once again trying to reclaim its role as a safe haven amid growing trade tensions and consequent risks to growth,” Joni Teves, a strategist at UBS Group AG, said in a note on Monday. The price “looks like it is getting comfortable above $1,300, with aspirations of testing this year’s highs.”

7. Energy storage hits new high in U.S.

- Installations of energy storage capacity shot up by more than 230 percent in the first quarter of 2019, compared to a year earlier.

- Over 148 megawatt-hours came online in the first quarter, an increase of 110 percent from the year before, and up six percent from the record-setting fourth quarter of 2018. The figures do not include front-of-the-meter storage.

- California has led the sector to date, but Wood Mackenzie sees growth surging elsewhere.

- “Based on activity this quarter, we’re keeping an eye on New York state,” said Wood Mackenzie Power & Renewables senior energy storage analyst Brett Simon. “When the New York bridge incentive opened at the end of April 2019, the first block of the retail incentive was fully subscribed in a little over a week, showing how much pent up storage demand there was in New York.”

- WoodMac sees annual energy storage deployment of over 4.3 GW by 2024.