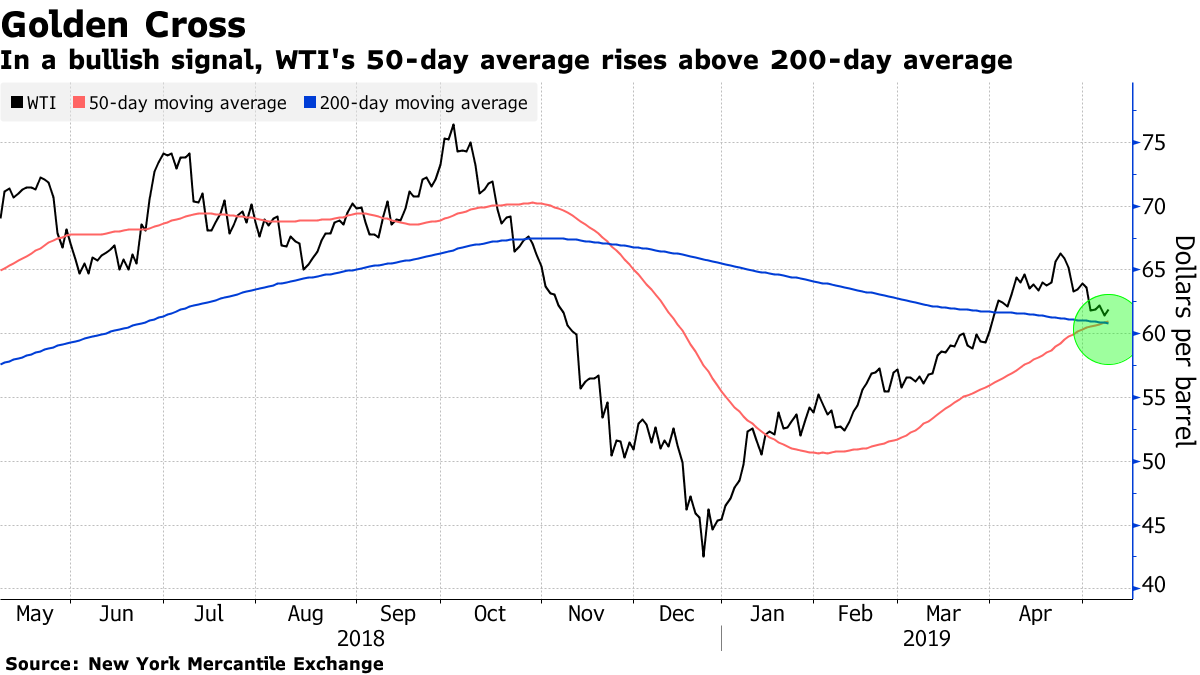

After a brief spell of geopolitical extravaganza, Brent prices dropped back below $70 per barrel this week as the oil market started worrying about the fragile future of US-China trade talks, with threats of tariffs getting back to the agenda. The European market is still struggling to fully digest the issue of Urals contamination with the port of Ust-Luga coming back to uncontaminated loadings later this week, still leaving open the question of what to do with the dozen organic chloride-rich cargoes already on seas. This has made the sour shortage in Europe even more acute against the background of the United States making good on its promise not to issue any waivers beyond May 05, 2019.

(Click to enlarge)

As a consequence, Brent Dated traded around $69.5 per barrel, whilst WTI traded in the $60.5-60.8 per barrel interval.

1. Saudi OSPs Forestall Further Appreciation of Middle Eastern Crude

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

- With Iranian volumes scraped off the Asian crude landscape, Saudi national oil company Saudi Aramco has hiked Asia-bound June-loading OSPs steeply to many-year highs.

- The Asia-destined increases ranged from 40 cents to 1.2 USD per barrel, with Arab Super Light seeing the most substantial hike.

- Even though Arab Heavy was raised only by 40 cents per barrel, at +0.15 USD per barrel against Oman/Dubai average it moved to its highest level since December…

After a brief spell of geopolitical extravaganza, Brent prices dropped back below $70 per barrel this week as the oil market started worrying about the fragile future of US-China trade talks, with threats of tariffs getting back to the agenda. The European market is still struggling to fully digest the issue of Urals contamination with the port of Ust-Luga coming back to uncontaminated loadings later this week, still leaving open the question of what to do with the dozen organic chloride-rich cargoes already on seas. This has made the sour shortage in Europe even more acute against the background of the United States making good on its promise not to issue any waivers beyond May 05, 2019.

(Click to enlarge)

As a consequence, Brent Dated traded around $69.5 per barrel, whilst WTI traded in the $60.5-60.8 per barrel interval.

1. Saudi OSPs Forestall Further Appreciation of Middle Eastern Crude

![Saudi] Saudi]](https://d1o9e4un86hhpc.cloudfront.net/)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

- With Iranian volumes scraped off the Asian crude landscape, Saudi national oil company Saudi Aramco has hiked Asia-bound June-loading OSPs steeply to many-year highs.

- The Asia-destined increases ranged from 40 cents to 1.2 USD per barrel, with Arab Super Light seeing the most substantial hike.

- Even though Arab Heavy was raised only by 40 cents per barrel, at +0.15 USD per barrel against Oman/Dubai average it moved to its highest level since December 2011.

- Saudi OSPs heading to NW-Europe were lifted by 0.5-1.1 USD per barrel, with Arab Extra Light seeing the biggest month-on-month increase (to a +1.45 USD per barrel premium against ICE Bwave).

- Similarly, June-loading Mediterranean-bound prices were hiked by 0.5-1.1 USD per barrel, bolstered by the persisting robustness of Urals quotations.

- After several months of effectively rolling over US-bound OSPs, Aramco’s June-loading prices were dropped by as much as 30 cents per barrel (Arab Extra Light), with Light, Medium and Heavy cut by 10 cents per barrel.

2. Chinese Demand for W-African Crudes Wanes

(Click to enlarge)

- China’s demand for West African barrels has dropped to a nine-month low against a tangible end to the Chinese stockpiling drive of the past couple of months.

- A total of 40 vessels will reach China in May 2019, bringing the daily average import rate down by 0.3mbpd month-on-month to 1.31mbpd.

- Chinese refiners have built up a safety buffer of crude as a sort of risk insulation tactic against the US’ decision not to prolong Iran waivers.

- Yet there are other ways the US is responsible for the abating demand – namely, USGC refiners seeking to replace missing Venezuelan volumes by heavy sweet Angolan grades.

- Concurrently with the above, West African grades saw their position weaken by the widening Brent-Dubai spread that has reached 2 USD per barrel for the first time this year.

3. Alberta Seeks Ways to Punish Anti-Pipeline British Columbia

(Click to enlarge)

- The new Jason Kenney-led Alberta government has proclaimed the “turn off taps” act into law, whereby it reserves the authority to stop oil and gas exports to British Columbia.

- Kenney’s move reflects the growing vexation of Alberta authorities with BC objecting tot he 590kbpd Trans Mountain pipeline expansion.

- The Preserving Canada’s Economic Prosperity Act („turn-off-the-taps act” in laymen’s parlance) would require crude producers to obtain licenses so as to be able to move crude outside of the province.

- It would be the Alberta government’s discretion to approve of crude shipments towards BC, hinting at a potential risk that it might alter the crude and products flow so as to pressurize Vancouver.

- This creates a risk of BC seeing even higher fuel prices, reliant on Alberta refined products as it is currently, despite having the most expensive fuel prices in North America already.

- After the Canadian National Energy Board reaffirmed its support for the Trans Mountain line, it will be the federal government that will ultimately tie the Gordian knot of intra-province feuds.

4. US Grants Venezuela Sanction Waivers to Curaco

(Click to enlarge)

- The US Treasury granted Curacao a waiver which would exempt the Dutch islands in the Caribbean from the operation of Venezuelan sanctions.

- Curacao’s 320kbpd Isla Refinery is operated by the Venezuelan PDVSA under a long-term lease yet in the past months it has been barely operating due to a lack of feedstock.

- The authorities of Curacao are actively searching for someone else to take over the refinery once the PDVSA lease contract runs out in December 2019, to no avail so far.

- The Saudi-owned Motiva was on the tapis for the deal, yet it has withdrawn its interest after the parent company deemed it unwise to invest in projects that might influence the long-mooted Saudi Aramco IPO.

- By getting the US waivers, Curacao can now can continue seeking for new partners without incurring the risk of breaching US sanctions on Venezuela, at least until the waivers run out on January 15, 2020.

- Curacao has made its political preferences clear by allowing the US to store Venezuela-destined humanitarian aid on its territory.

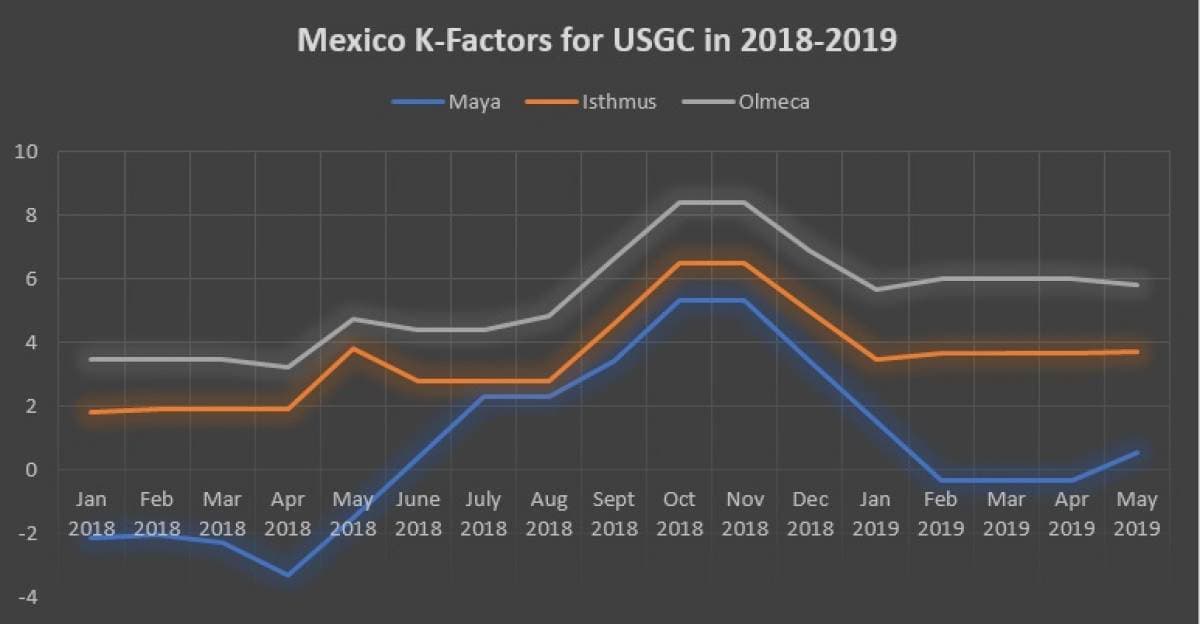

5. Mexico Hikes K-factors for May Cargoes

(Click to enlarge)

(Click to enlarge)

- PMI Comercio International, the trading arm of the Mexican national oil company PEMEX, has increased all but one of its K-factors, an instrument used to adjust its official prices.

- The K-factor for USGC-destined Maya bounced back into positive territory with a 0.9 USD per barrel month-on-month jump (to +0.55), whilst Isthmus and Olmeca saw only minor alterations.

- Against the background of a global shortage of heavy crudes, Maya’s K-factor for Europe and Middle East rose 1.85 USD per barrel to a 3.50 USD per barrel discount.

- The Maya appreciation effect was evident in Asia Pacific prices, too, which were hiked by 1.55 USD per barrel m-o-m to a 5.80 USD per barrel discount.

- Mexican crude exports have averaged 1.23mbpd in 2019 YTD, compared to last year’s 1.18 annual average.

6. Vietnam, Indonesia buy First-ever US cargo

(Click to enlarge)

- Last week Vietnam received its first-ever US cargo, a 1MMbbl of WTI, with BP supplying the volume aboard the Suezmax vessel Almi Horizon.

- Officials at the Binh Son Refining (BSR) company claimed they have bought the cargo for testing, enticed by WTI’s price competitiveness and fitting quality parameters.

- Concurrently, Indonesia is also on the brink of receiving its first-ever US cargo, with the Aframax vessel China Dawn expected to reach the Indonesian port of Cilacap June 06.

- The Indonesian NOC Pertamina is buying WTI Midland off Dated Brent, whilst similarly to BSR checking the refinery feasibility and pricing competitiveness of the crude.

- US crude exports to Southeast Asia in May 2019 were triple of the 2018 average (at 0.39mbpd), with new customer demand hiking the total crude moved there to more than 12 Mbbls.

- Even traditional US buyers as Singapore have been experimenting lately – for instance, by taking a 550kbbls Alaskan North Slope cargo aboard MT Aristaios, a rarity in the region.

7. ExxonMobil Wants Larger Share of UAE Pie

(Click to enlarge)

- After ADNOC announced the start of its second oil and gas exploration licensing round, ExxonMobil reached out to the UAE state-owned oil company ADNOC to strengthen its positions.

- The second licensing round will be launched in Q4 2019 and the results will be announced in the first months of next year.

- ExxonMobil is using its Permian Basin experience to demonstrate it can facilitate ADNOC’s long-term goal of becoming gas-independent (and potentially even becoming an exporter).

- ADNOC CEO Sultan al-Jaber claimed they are „keen to strenghten the (Exxon) relationship”, all the more so as the 2nd licensing round will be replete with unconventional projects.

- ExxonMobil already has a 28 percent stake in the Upper Zakum field, having committed to the 0.75mbpd capacity project in 2006.

![Saudi] Saudi]](https://d32r1sh890xpii.cloudfront.net/tinymce/2019-05/1557334793-o_1dac663ln1f95vgpts914nthl58.jpg)