2019 has been good for oil bulls. Hedge funds largely poured into the long side of the market this year as OPEC+ showed strong discipline in removing barrels from the supply chain and geopolitical disruption festered in Venezuela, Libya and Nigeria. The Trump administration’s surprise decision to end their waiver program for buyers of Iranian oil to drive the country’s exports to zero was supposed to be the bullish nail in the coffin permitting a run to $80 or higher.

Except one pesky data point seems to be preventing that for now- ballooning US crude oil inventories. Last week’s DOE report showed a surprise 9.5m bbl w/w increase in US crude stocks driven by elevated imports, surging US crude production and extremely weak refiner run levels. We were admittedly on the bullish train last week following the Iran waiver news from the White House, but it seems the longs will have to wait for some fundamental confirmation before the market can extend its winning streak.

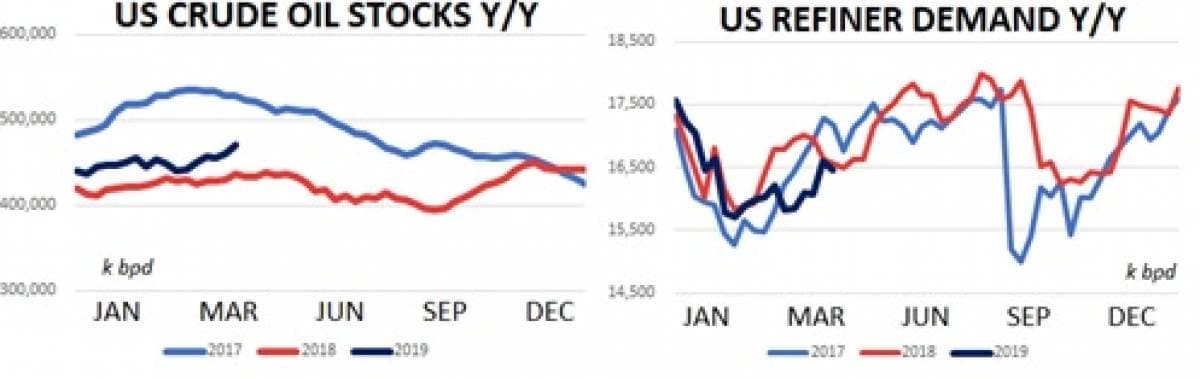

The market is correct to pause at current levels before another surge higher because the fundamental situation in the US isn’t pretty. US crude oil stocks are higher y/y/ by more than 7% while refiner demand is lower by about 500k bpd. The high supply / low demand regime has Days of Cover for US crude stocks at 28.9 versus 26.0 in early May of 2018.

The situation is further complicated by the continued presence of Iranian tankers across the Middle East and in East Asia. Bloomberg’s tanker tracking…

2019 has been good for oil bulls. Hedge funds largely poured into the long side of the market this year as OPEC+ showed strong discipline in removing barrels from the supply chain and geopolitical disruption festered in Venezuela, Libya and Nigeria. The Trump administration’s surprise decision to end their waiver program for buyers of Iranian oil to drive the country’s exports to zero was supposed to be the bullish nail in the coffin permitting a run to $80 or higher.

Except one pesky data point seems to be preventing that for now- ballooning US crude oil inventories. Last week’s DOE report showed a surprise 9.5m bbl w/w increase in US crude stocks driven by elevated imports, surging US crude production and extremely weak refiner run levels. We were admittedly on the bullish train last week following the Iran waiver news from the White House, but it seems the longs will have to wait for some fundamental confirmation before the market can extend its winning streak.

The market is correct to pause at current levels before another surge higher because the fundamental situation in the US isn’t pretty. US crude oil stocks are higher y/y/ by more than 7% while refiner demand is lower by about 500k bpd. The high supply / low demand regime has Days of Cover for US crude stocks at 28.9 versus 26.0 in early May of 2018.

The situation is further complicated by the continued presence of Iranian tankers across the Middle East and in East Asia. Bloomberg’s tanker tracking tool currently identifies more than 35 Iranian NOC ships at sea suggesting deliveries are still being made despite recent US policy changes. Will this continue? We’re not sure. But the bearish fundamental scene in the US seems to justify some skepticism on the bullish narrative that many have adopted. In the meantime, we’re reading uncorroborated reports of Iranian crude finding its way into the global market by trading its way through Turkey.

Bulls were also hit this week by tough talk from Trump regarding his efforts to forge a US trade pact. You can read the Tweets if you wish but we think markets mostly spoke for themselves. S&Ps fell 99 points from their all time high to a print of 2,886 representing a 3% drop while the Shanghai Composite moved lower by an incredible 13% from its recent high two weeks ago. Oil markets followed equities lower with Brent trading below $70 for first time in more than a month. Brent’s reversal from a high print of $75.60 on April 25th to a low of $68.79 on May 6th represents a serious retracement of recent bullish enthusiasm equaling a 9% fall in just seven trading sessions.

Just one short week ago it appeared President Trump had created a clear path for $80 oil with his decision to terminate the Iranian waiver program. Seven days later it appears that bulls will have to wait for more clarity on US inventory draws and progress towards a US/China trade deal in order to get what they want.

Quick Hits

(Click to enlarge)

- Crude oil prices fell sharply as last week’s DOE debacle was compounded by Trump’s decision to turn up the volume on global macro threat #1 aka the US/China trade war. President Trump revealed frustration that China is dragging their feet on the deal and announced a new round of tariffs on Chinese goods set to begin on Friday. Markets understandably panicked with oil prices falling from their recent high near $76 to a low of $68.79.

- Meanwhile spread markets didn’t seem to understand what all the fuss was about. The prompt Brent 6-month spread traded north of $3/bbl yielding more than 50-cents per month of backwardation and aggressively incenting traders to bring barrels out of storage for sale to refineries. Iranian exports continued to shrink which is creating headaches for buyers of crude in the Middle East and Asia and clearly having ramifications on trade in the Atlantic as well.

- We’re seeing reports that Russia is still having contamination issues with deliveries to some of their Eastern European customers which is putting additional upward pressure on spreads and creating headaches for refiners. Russian authorities believe the issues have been caused by several individuals involved in an oil theft scheme.

- In deal making, Anadarko’s board has determined that Occidental’s latest proposal represents a superior offer to Chevron’s last overture. Chevron will have four days to counter.

- Global equity markets took a serious bath this week suggesting current valuations will be tough to hold if Trump and Xi don’t appear cooperative. The Shanghai Composite is down a whopping 13% over the last two weeks while S&Ps fell by about 3%. It’s possible that recently strong US economic data has emboldened Trump to play a bit more hardball with the Chinese. Regardless, we still expect the two sides to reach a deal sometime later this year so Mr. Trump can flaunt his deal-making prowess on the campaign trail.

- US gasoline prices have fallen sharply alongside crude oil this week with NY Harbor deliveries trading at $1.95/gl down from $2.20/gl just two weeks ago.

DOE Wrap Up

(Click to enlarge)

- Last week’s DOE report was highlights by a jaw-dropping build in overall crude oil stocks. US crude stocks added over 9.5m bbls and are higher y/y by 7% over the last four weeks. The entire build came into PADD III- representing the USGC / Houston region- and seemingly driven by increase imports, heightened production and a slight dip in refiner demand. Crude stocks in the USGC are higher y/y by nearly 10%.

- The aforementioned production data was a 12.3m bpd print representing a new record effort from the US oil industry. US production continues to overwhelm the takeaway infrastructure and has Midland crude sinking to trade at a $3.50 discount to WTI.

- Meanwhile the heft imports we mentioned earlier came in a 7.4m bpd for their largest total since February. The mark represented a 1.6m bpd increase versus just two weeks prior.

- The surge in imports and increase in production could very well be absorbed by the market if demand was adequate. Sadly it isn’t even close. US refiner demand sank about 150k bpd last week to 16.4m bpd. Demand has averaged 16.3m bpd over the last month which is lower y/y by an incredible 500k bpd. No wonder crude inventories are swooning!

- US gasoline stocks had been rapidly drawing in recent weeks giving bulls some hope to hold on to amidst the increases in crude oil inventories. Unfortunately, that didn’t materialize this week as overall gasoline stocks added about 1m bbls. On the bright side, gasoline supplies in PADD IB- which includes the New York Harbor delivery hub- are lower y/y by about 4%.

- US distillate inventories fell by about 1.3m bbls w/w to 126m and are higher y/y by about 2.5%.