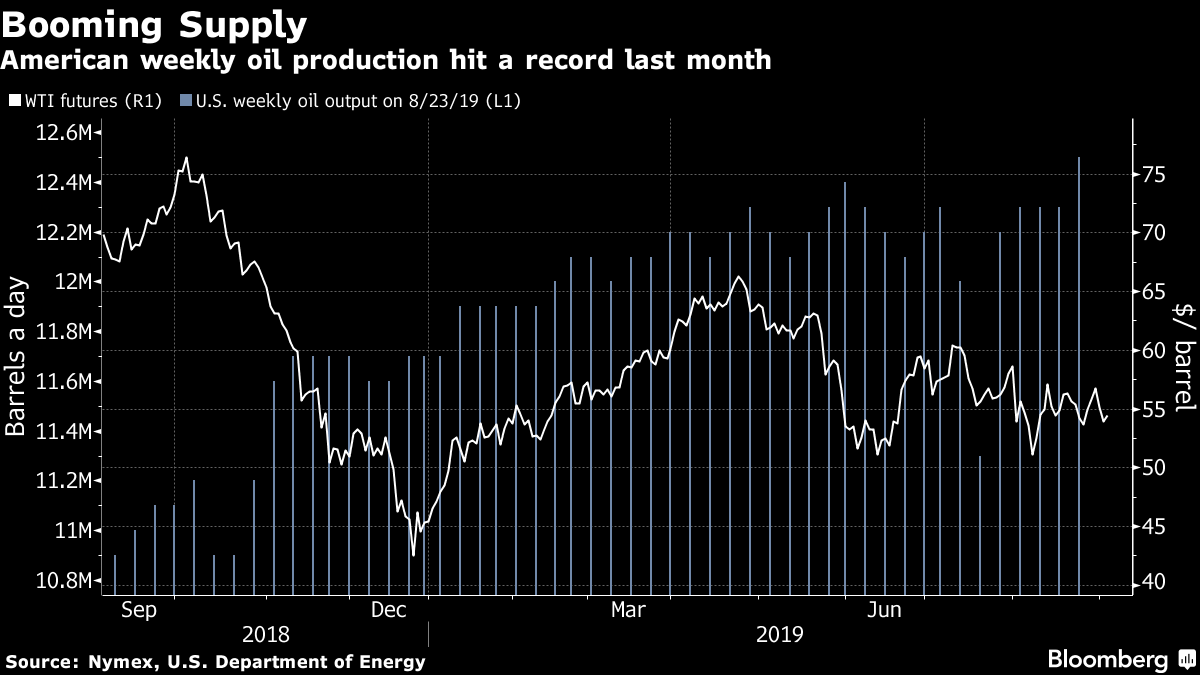

The first week of September continued on the course set by August, most of the market motion can be boiled down to the US-China trade conflict jeopardizing growth prospects across the world and US stocks decreasing providing a counteracting short-term relief for crude prices. Trade negotiations with China did not progress much in the past seven days, except for President Trump warning his Chinese counterparts that getting a deal after his (possible) 2020 re-election might be much more difficult than now. Analysts expect a 3 MMbbl drawdown in US crude inventories for the week ended August 30 – thus, despite a drop in prices on Friday-Monday, crude prices on Wednesday roughly the same as they were a week ago.

Global benchmark Dated Brent traded around $60 per barrel on Wednesday afternoon, whilst US benchmark WTI was assessed at $55.3-55.5 per barrel.

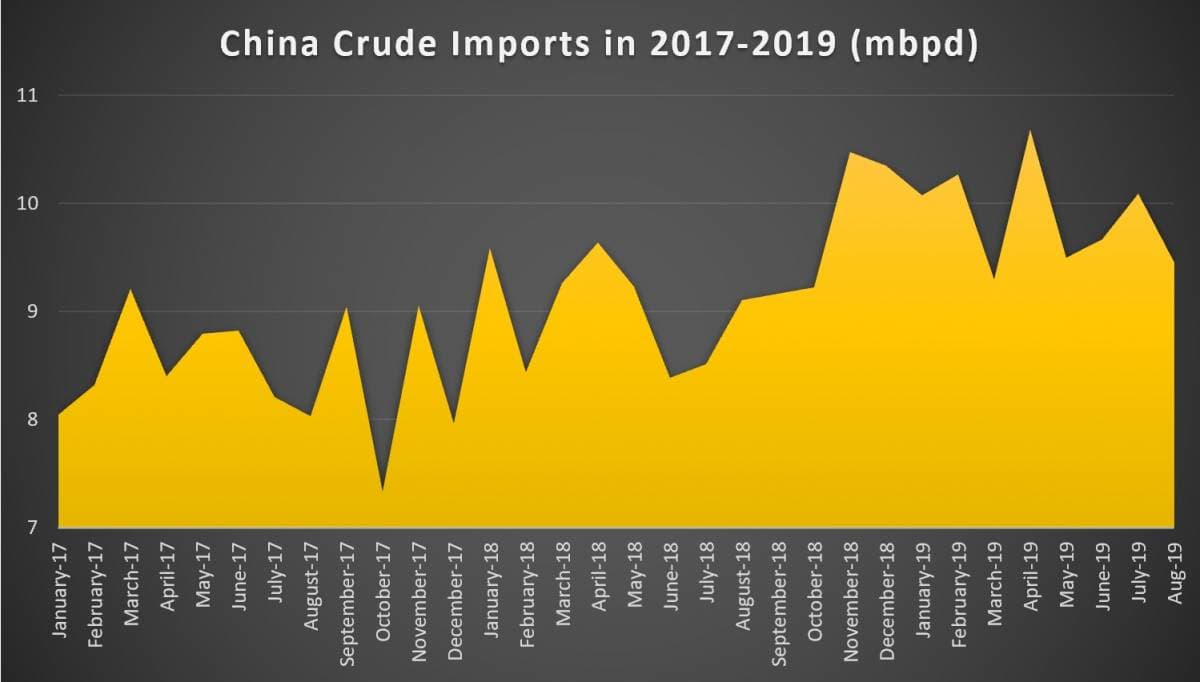

1. China Crude Imports Drop in August

- Chinese crude imports in August 2019 were palpably hit by the ramifications of Typhoon Lekima which constrained Shandong refinery operations mid-month.

- September imports will most probably bounce back from August’s 5-month low (7mbpd worth of crude already booked) as the 400kbpd Rongsheng Zhejiang refinery eats up bonded storage reserves.

- The Zhoushan-based private refiner has started up in July this year, yet has sourced its feed primarily from nearby storage so far.

- For the fourth month in a row, aggregate Asian crude imports in August…

The first week of September continued on the course set by August, most of the market motion can be boiled down to the US-China trade conflict jeopardizing growth prospects across the world and US stocks decreasing providing a counteracting short-term relief for crude prices. Trade negotiations with China did not progress much in the past seven days, except for President Trump warning his Chinese counterparts that getting a deal after his (possible) 2020 re-election might be much more difficult than now. Analysts expect a 3 MMbbl drawdown in US crude inventories for the week ended August 30 – thus, despite a drop in prices on Friday-Monday, crude prices on Wednesday roughly the same as they were a week ago.

Global benchmark Dated Brent traded around $60 per barrel on Wednesday afternoon, whilst US benchmark WTI was assessed at $55.3-55.5 per barrel.

1. China Crude Imports Drop in August

- Chinese crude imports in August 2019 were palpably hit by the ramifications of Typhoon Lekima which constrained Shandong refinery operations mid-month.

- September imports will most probably bounce back from August’s 5-month low (7mbpd worth of crude already booked) as the 400kbpd Rongsheng Zhejiang refinery eats up bonded storage reserves.

- The Zhoushan-based private refiner has started up in July this year, yet has sourced its feed primarily from nearby storage so far.

- For the fourth month in a row, aggregate Asian crude imports in August 2019 have remained under the 25mbpd mark at 24.86mbpd.

- Most notable among the Chinese downstream markets trend are US crudes’ waning appeal amid narrowing WTI-Brent spreads and the cessation of direct crude purchases from Venezuela with teapot refiners buying it from Russian NOC Rosneft instead.

- African exporters to China experienced a relatively weak August, with volumes dropping 20 percent month-on-month to 1.51mbpd.

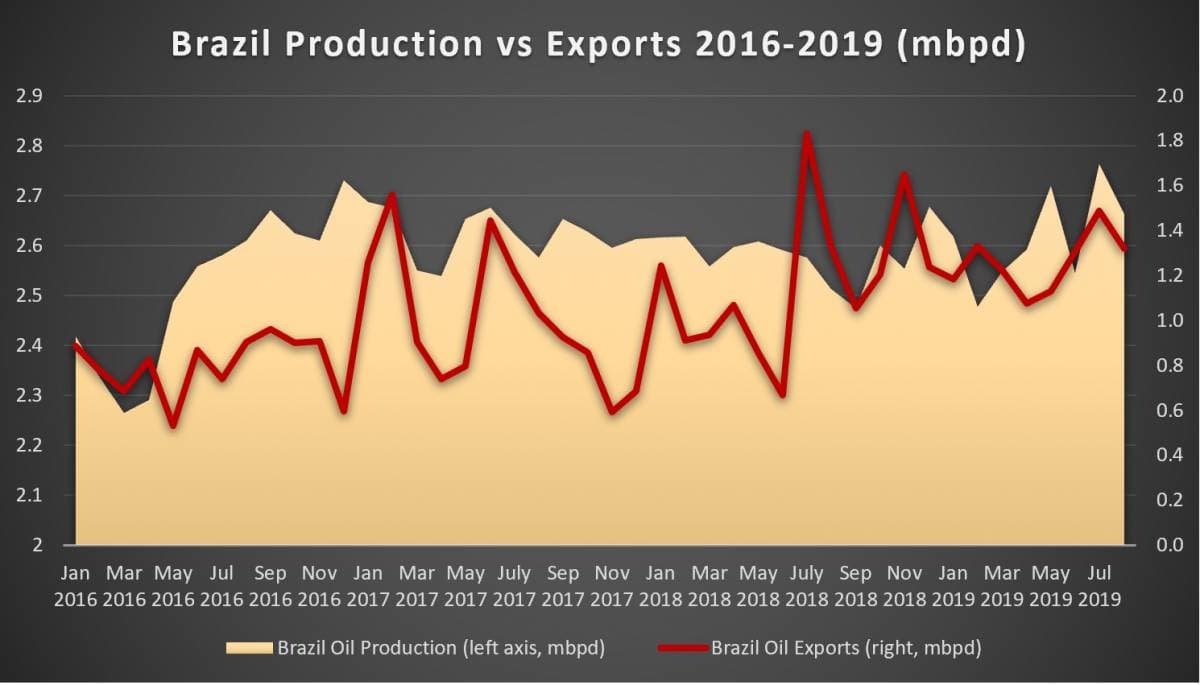

2. Brazilian Crude Output Stronger Than Ever

- Buttressed by recent pre-salt commissionings and their ramp-up (platforms P-76 and P-77), Brazil’s crude production has edged to an all-time high of 2.775mbpd in July 2019.

- The domestic hydrocarbon sector regulator ANP has set a production target of 2.91mbpd for this year, so far underfulfilled throughout the year, with the annual average standing at 2.62mbpd.

- The South American country’s pre-salt deposits are the backbone of the recent increments – now 61 percent of Brazil’s total hydrocarbon production (3.556mboepd) is produced from pre-salt layers.

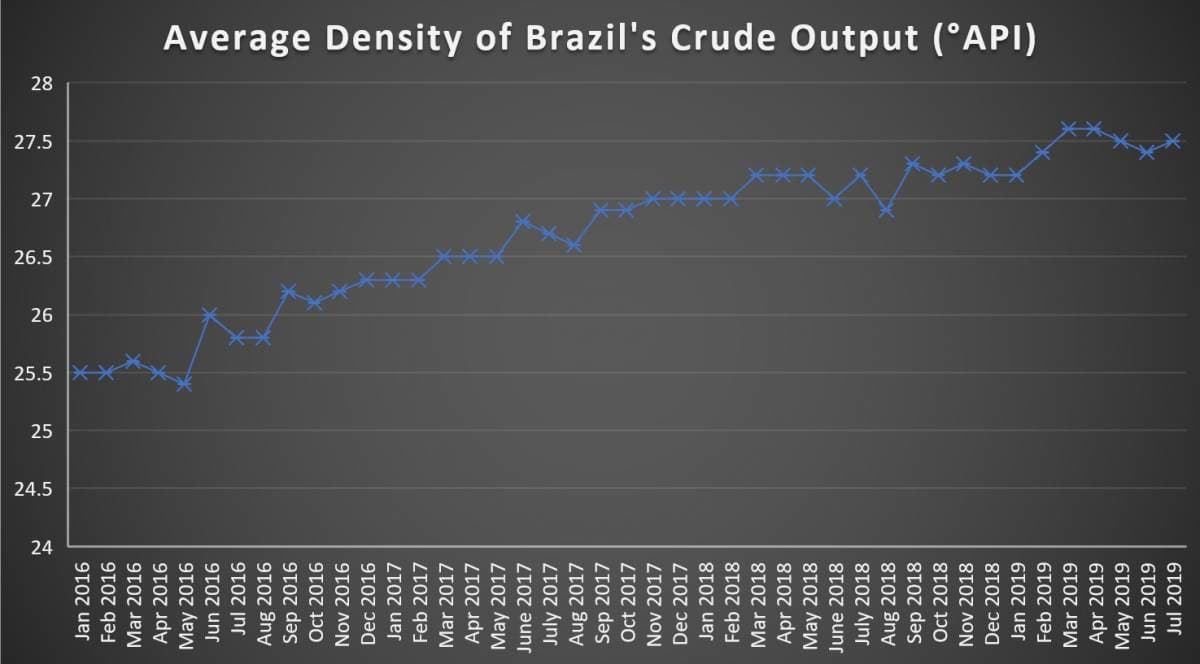

- New production from the Búzios field (28° API) has lightened Brazil’s average crude density, reaching 27.5° API in July 2019, almost 1° API higher than one year ago.

- Brazil will be the leading FPSO force on the market in the upcoming 5 years, with a total of 20 new FPSO vessels expected to be deployed in its offshore by 2025 (13 of them operated by Petrobras).

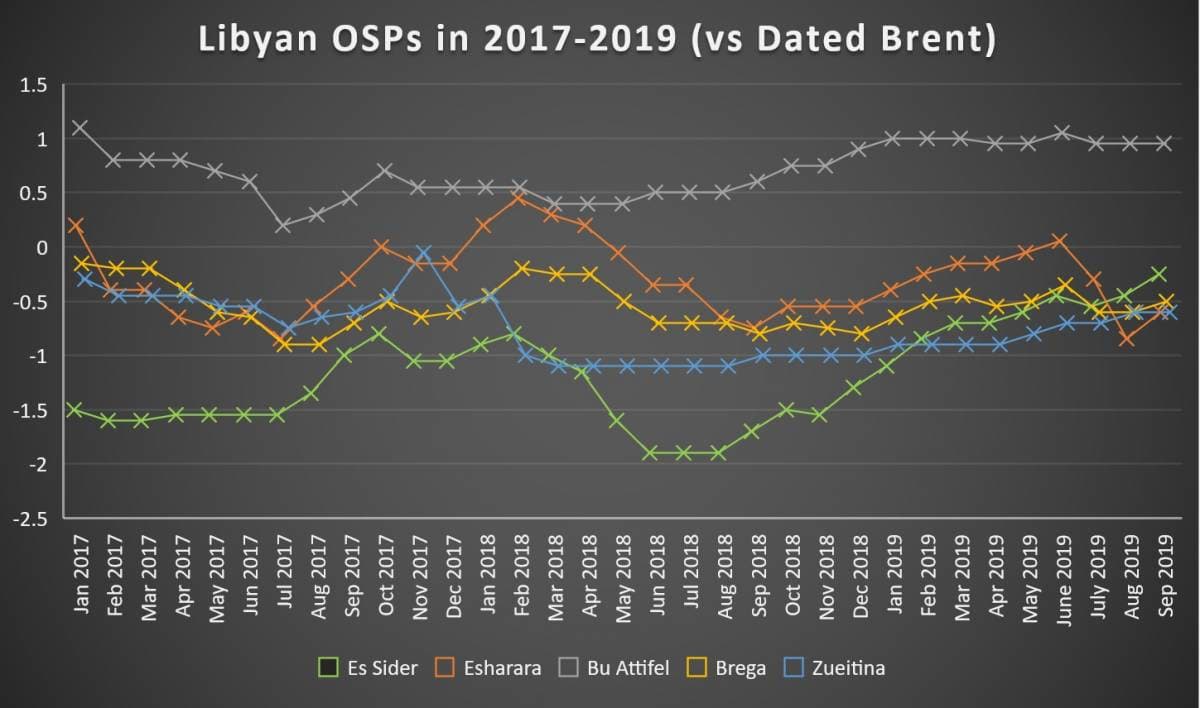

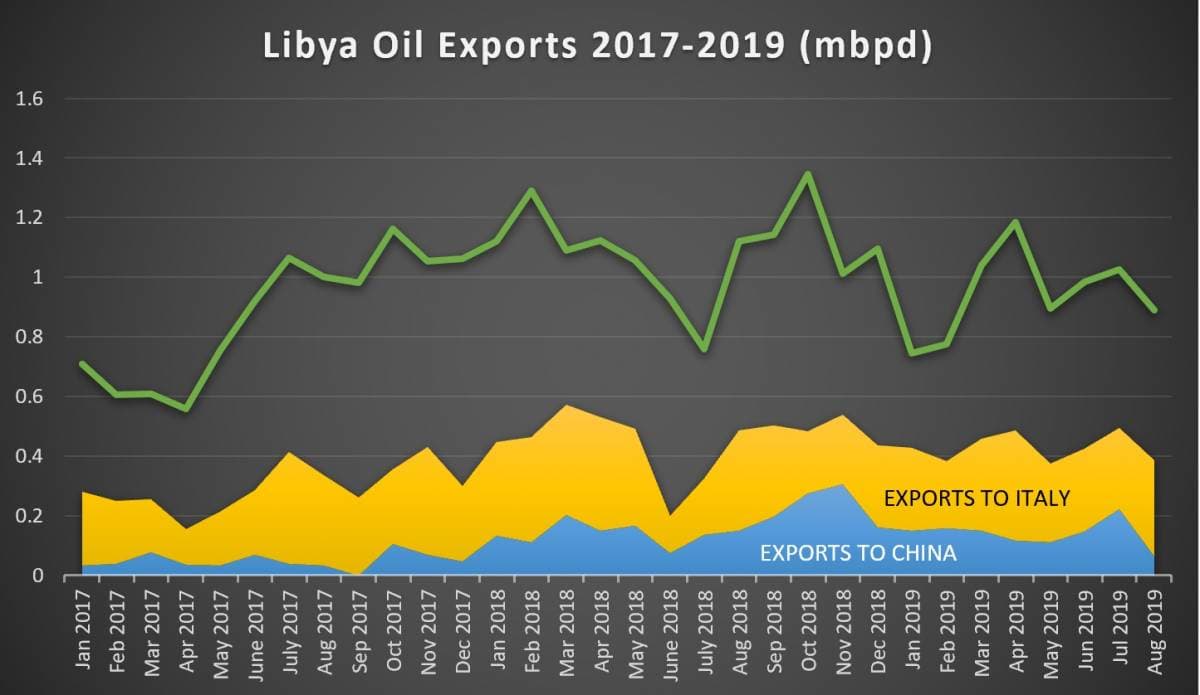

3. Libya Hopes to Bounce Back From Export Drop

- Libyan national oil company raised most of its September-loading official selling prices as things started to slowly normalize in the war-torn African country.

- NOC hiked Es Sider to its highest in 5 years at a $0.25 per barrel discount to Dated Brent, up 20 cents month-on-month, despite a sharp decline in rival CPC in the past few days.

- Libya’s second-largest export stream, Esharara, started producing again from August 08 after a string of militia sabotage attacks and saw its September OSP grow by 25 cents m-o-m to a $0.60 per barrel discount to Dated.

- The only grades to have their OSPs cut (by 10 cents per barrel) from August were Libya’s sour crudes, Bouri and Al Jurf, both of which are benchmarked to Med Urals.

- Libyan exports have dropped 14 percent month-on-month in August to 0.888mbpd, the lowest since February 2019.

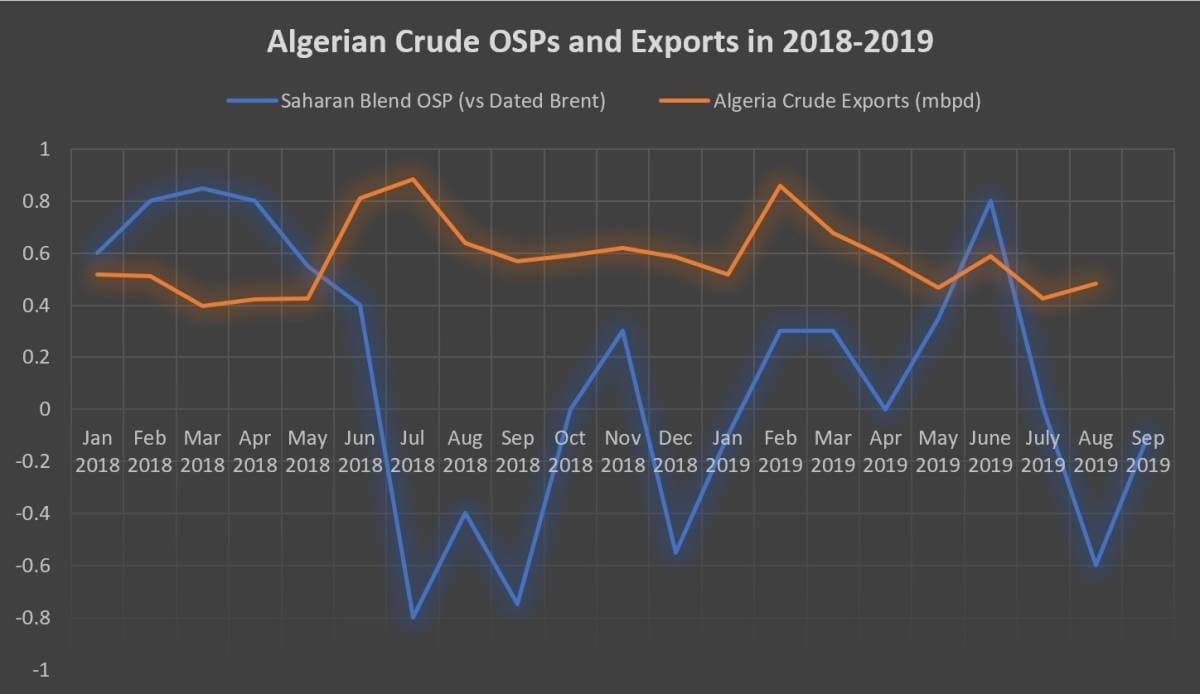

4. Algeria Hikes September OSPs Amid Robust Demand

- The Algerian national oil company Sonatrach has increased the September-loading official selling price of its flagship crude Saharan Blend by 50 cents per barrel month-on-month.

- Higher demand for Saharan Blend and the Sharara outage boosted Algeria’s pricing prospects, bringing it closer to the 2019 average of flat Dated Brent after August’s 11-month low OSP.

- Algerian exports have averaged 0.485mbpd, some 100kbpd lower than the YTD average of 0.587mbpd.

- It is not only Algeria’s crude that has been rising in prominence but also its products – the Skikda-produced low-sulphur straight-run fuel oil (LSSR) grew to a $4 per barrel premium against November’s Brent futures amid robust Asian demand.

- Singapore refiners are storing LSSR as a blending component for the production of IMO 2020-compliant marine fuel.

- Algeria’s LSSR was assessed at an annual average $4 per barrel discount to Dated Brent in 2018 – at that point more than 90 percent of it ended up in the United States.

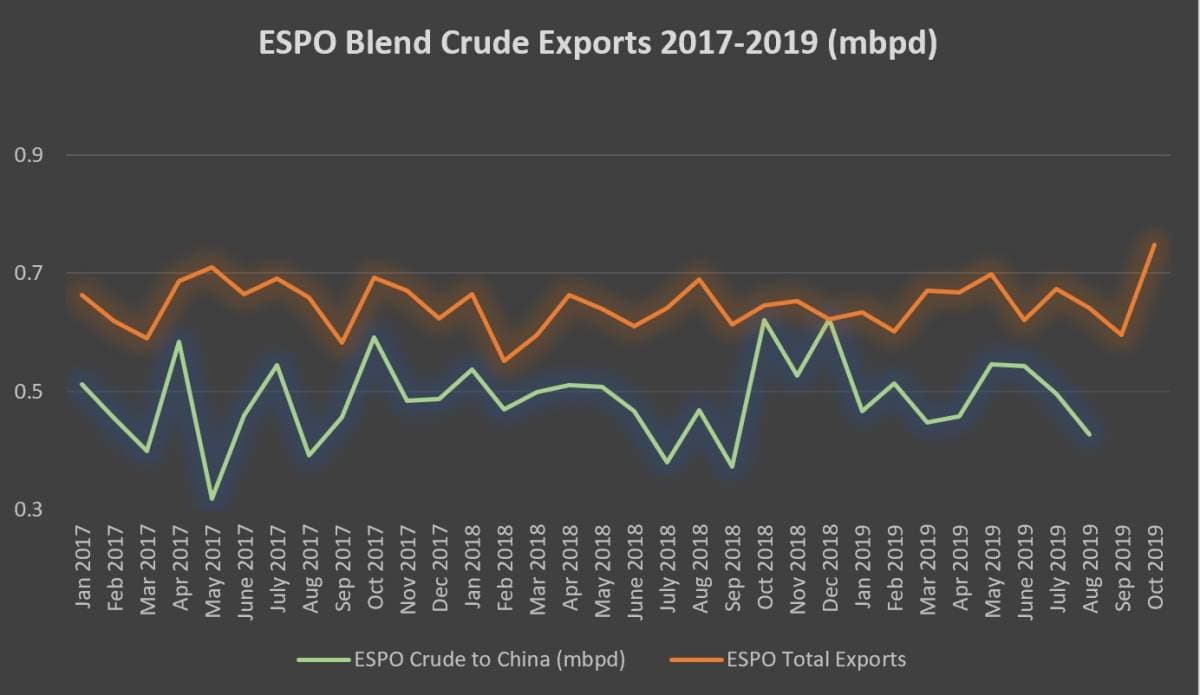

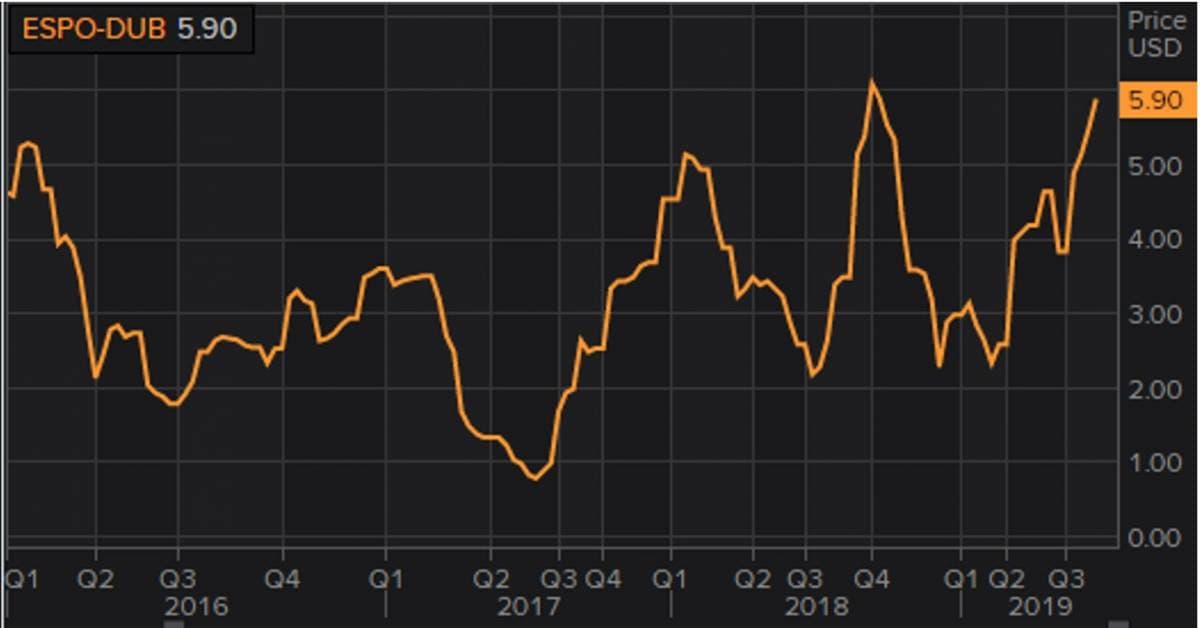

5. Russian ESPO Hits All-Time Export Record

- Russia’s second-largest crude stream ESPO will reach an all-time high this October, with the export schedule set at 0.75mbpd, up 15 percent from the YTD average of 0.65mbpd.

- Interestingly, the port of Kozmino from which ESPO loads has a nominal export capacity of 0.62mbpd (2.5 million tons per month), yet virtually every month this year the actual loaded volume was higher than that.

- The record level is due to output surpluses accumulating during the September maintenance season at Kozmino, although new records should be expected in the next couple of months.

- Russian pipeline monopoly Transneft is increasing the throughput capacity of the Skovorodino-Kozmino spur that feeds the port, hoping to reach 50mtpa in 2020 (up from 36mtpa now).

- The bottleneck might lie in Kozmino technically not being able to handle more than 36mtpa, thus far no port capacity expansion project has been announced.

- Concurrently, ESPO spot prices rose to their highest since October 2018, hovering around the threshold of a $6 per barrel premium against front-month Dubai.

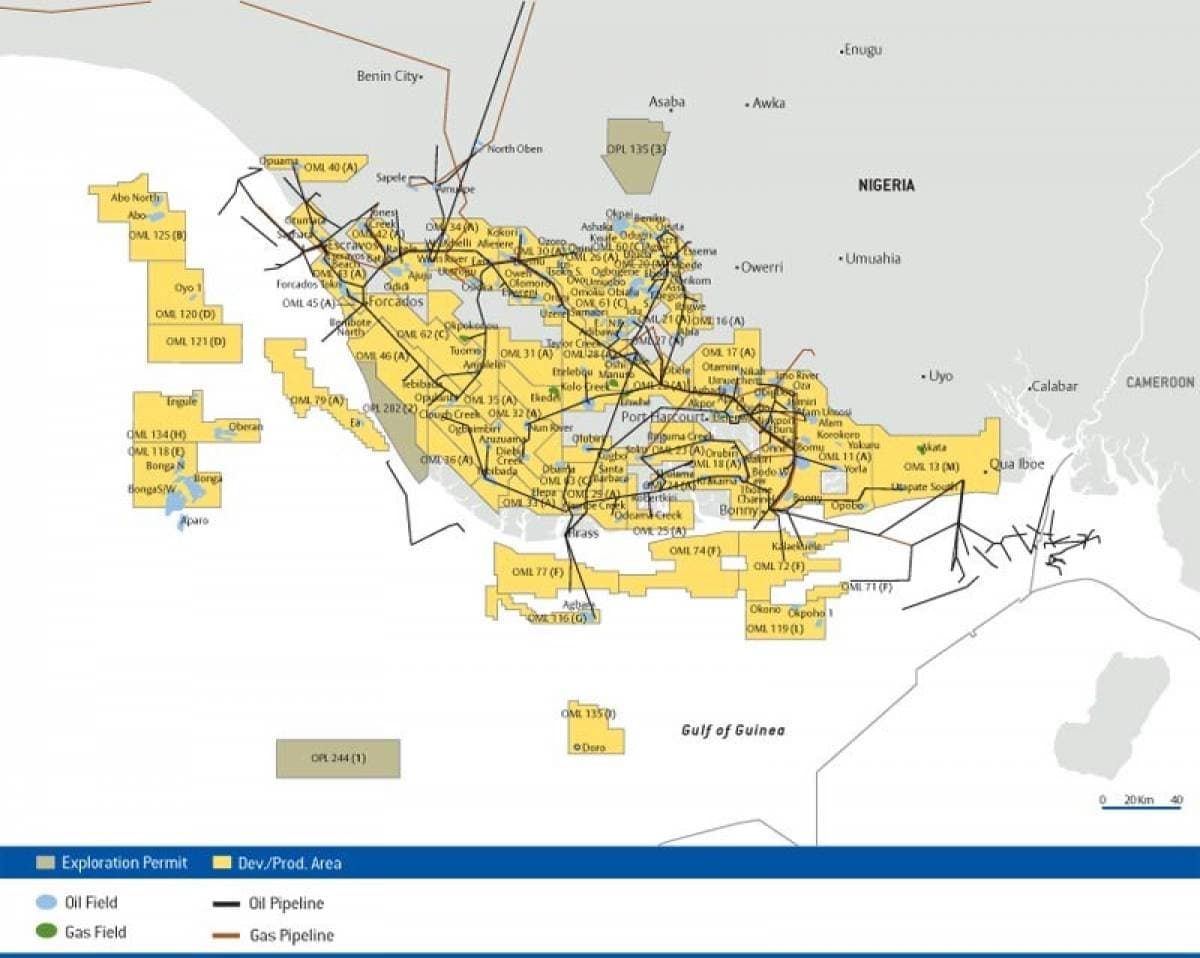

6. ENI Claims 1 TCf Nigerian Discovery

- The Italian oil major ENI has announced a new onshore discovery in the Niger Delta, with reserves estimated at 1 TCf of gas and 60 MMbbls of condensate.

- Despite holding a 20 percent stake alongside national oil company NNPC and local firm Oando, ENI acts as operator of the Obiafu-Obrikom fields and intends to put the discovery immediately on stream.

- The Obiafu-41 well, drilled to a total depth of 4.4km, encountered 130m of high-quality hydrocarbon-bearing sands.

- It is widely expected that the produced gas would feed the nearby Bonny Island LNG liquefaction plant and fuel the 480 MW combined-cycle Okpai Power Plant.

- Despite having the largest gas reserve pool in Africa (estimated by NNPC at 202 TCf of proven and 600 TCF unproven reserves), Nigeria has historically prioritized oil field development.

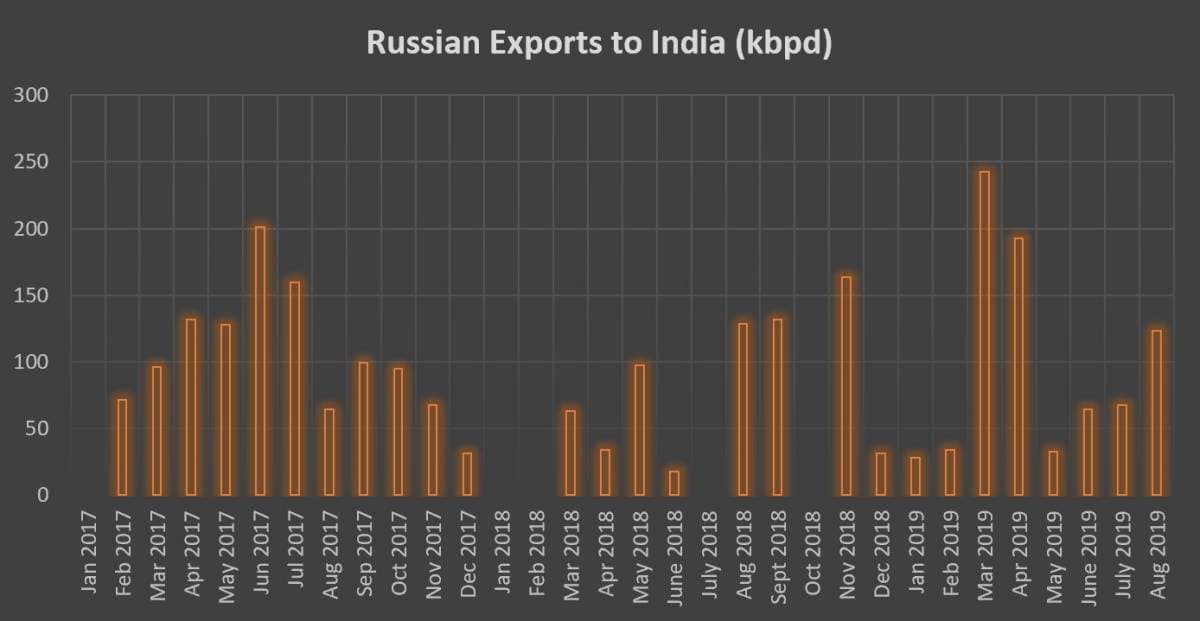

7. India Pushes For New Russia Import Route

- Wary of further conflagration in the Strait of Hormuz, India has been pushing for the start-up of a new maritime trade route with Russia as it seeks to de-risk its crude imports.

- Top-ranking officials from the Indian Petroleum Ministry are pushing for higher imports from the Kozmino port on Russia’s Far East, in an attempt to accomplish a triple objective.

- First, imports from Kozmino would make import routes of Russian crude shorter (and thus faster), by cutting down the journey time from 33-35 days (from Novorossiysk) to 18-19 days.

- Second, this would allow Indian NOCs to bring home its equity production from its Russian assets (in recent years India invested approximately $5 billion in E-Siberian fields).

- Third, might fortify the Indo-Russian partnership amid ESPO exports reaching an all-time high in October.

- India has never taken a Russian cargo from the Far East ports of Kozmino and Sakhalin, buying an average of 98kbpd of Med Urals and CPC, primarily to the Vadinar and Jamnagar refineries.