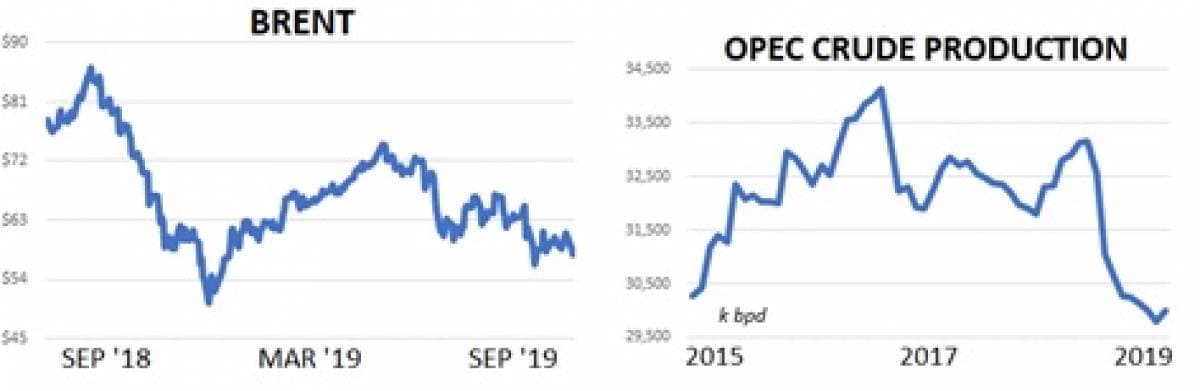

Oil prices shifted lower to start the week on the back of a fresh round of tariffs placed by Trump on Chinese goods, another contraction-territory print in China’s manufacturing PMI and news that OPEC production increased in August. Prices, however, veered back on Wednesday morning, with WTI rising over 4% as a result of positive economic activity in China’s services sector

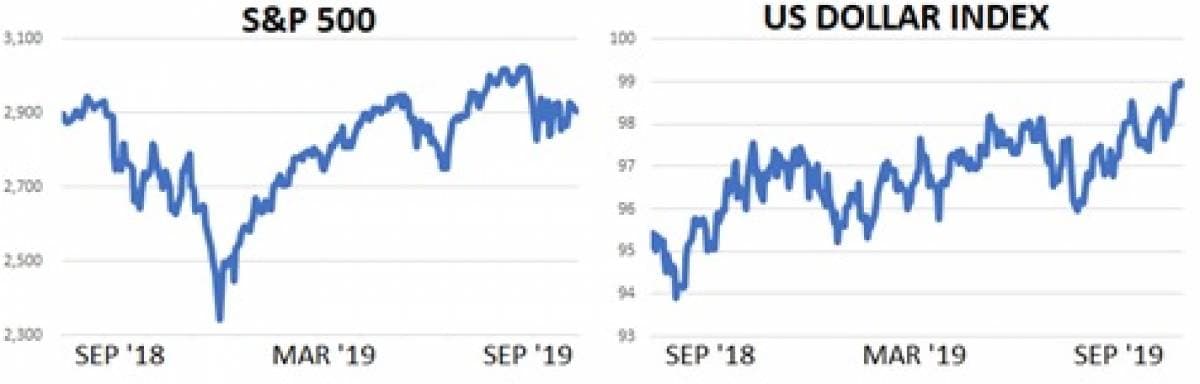

The trading week began with a thud as Asian markets open Monday morning after President Trump announced another 15% tariff hike on about $110 billion worth of Chinese goods. Brent crude fell below $59 while WTI was just south of $55. The S&P 500 fell towards the 2,900 before smoothing out about 4% below its all-time high mark July. Traders are still anxiously awaiting yet another round of tariffs to be triggered in mid-December as trade officials from the US and China don’t appear to be able to get each other to the negotiating table. On the US side it was leaked from the White House that the conversations with Beijing Trump had tweeted about last week never actually occurred. Meanwhile China’s state newspapers continued to ask Washington to change their posture without offering any hint that they were ready to meet Washington in the middle.

China’s Manufacturing PMI registered 49.5 for August for its 6th contraction territory print through the first eight months of the year. Asian equity markets were reassured by a better mark in the Caixin PMI and news from policymakers that further stimulus…

Oil prices shifted lower to start the week on the back of a fresh round of tariffs placed by Trump on Chinese goods, another contraction-territory print in China’s manufacturing PMI and news that OPEC production increased in August. Prices, however, veered back on Wednesday morning, with WTI rising over 4% as a result of positive economic activity in China’s services sector

The trading week began with a thud as Asian markets open Monday morning after President Trump announced another 15% tariff hike on about $110 billion worth of Chinese goods. Brent crude fell below $59 while WTI was just south of $55. The S&P 500 fell towards the 2,900 before smoothing out about 4% below its all-time high mark July. Traders are still anxiously awaiting yet another round of tariffs to be triggered in mid-December as trade officials from the US and China don’t appear to be able to get each other to the negotiating table. On the US side it was leaked from the White House that the conversations with Beijing Trump had tweeted about last week never actually occurred. Meanwhile China’s state newspapers continued to ask Washington to change their posture without offering any hint that they were ready to meet Washington in the middle.

China’s Manufacturing PMI registered 49.5 for August for its 6th contraction territory print through the first eight months of the year. Asian equity markets were reassured by a better mark in the Caixin PMI and news from policymakers that further stimulus is on the way, but crude oil and US stocks were hit hard by yet another fear-inducing data point which was amplified by a contraction-territory print in the US Manufacturing ISM just two days later.

For a bearish kicker, Bloomberg estimated OPEC’s August production increased by 200k bpd while Reuters reported that more Iranian crude oil and refined products could be hitting the market than previously thought. The cartel’s total August output was measured at 29.990m bpd in August representing a 195k bpd increase- it’s first since the cartel reaffirmed its pledge to cut supplies. Saudi Arabia and Nigeria were the two parties responsible for the overall jump with increases of 50k bpd and 160k bpd, respectively. To make matters (potentially) worse, Reuters cited research from FGE suggesting Iran is still selling about $500 million of oil products per day and that their crude exports are only down by 80% instead of the commonly believed > 95%.

This week’s bearish news flow didn’t have us overly worried. We have no doubt that the rest of 2019 will include ups and downs in trade talks, economic data and fundamentals. As China replaces US agricultural products with European and South American competitors and US buyers move away from Chinese manufacturers, we are, however, nervous about how the market might react to a US/China trade deal. As both parties fail to get a deal done and both economies weaken, would a trade deal magically turn on the economic fire? We aren’t so sure. It could end up that if both parties take too long, businesses will simply have to move on from trading with each other and it could do long lasting damage to the health of global economy. We’ve written lengthily about the idea that central bank stimulus can actually cause sentiment to sour because it confirms that the economy is sick and needs help. Could a trade deal result in the same sort of dilemma? The longer the US and China raise tariffs on each other instead of negotiating, the better the odds get that a trade deal won’t pack much punch in terms of generating economic growth.

Quick Hits

- Brent crude traded near the $58 mark this week for a $20 loss over the last twelve months. We think this time frame’s 26% drop in crude prices gives us a good proxy for the combination of macro and US/China stress that traders currently see.

- Bloomberg estimates for OPEC crude production for August came in this week seeing the cartel’s first m/m production increase of 2019. Saudi Arabia (+50k bpd) and Nigeria (+160k bpd) helped drive an overall production increase of 200k bpd.

- As for stocks, the S&P 500 is exactly flat over the last twelve months while the Shanghai Composite is higher by 7%. In Japan the Nikkei is lower by 3% since last September and in Europe the Euro Stoxx 50 is up by about 1%.

- Crude oil options markets are heating up as traders see continued downside risk on the horizon. The CBOE/NYMEX WTI volatility index is trading near 35% for a 5% increase over the last month. Equity markets are sending similar signals with the VIX near 20% after printing just 12.5% at the end of July.

- Speaking of macro concerns, Fed Fund Futures are imply nearly certain odds that the US Fed will vote to decrease rates by 25 basis points at their September 17-th-18th meeting. Meanwhile the US Dollar index is quietly putting pressure on crude by moving to 2.5 year highs.

- President Trump tried to move China towards a deal this week by Tweeting that his proposals will become much more demanding if he is re-elected in 2020. Officials from both sides still have no formal plans to meet again.

- Saudi Arabia removed their Energy Minister- Khalid Al-Falih- from the post of Chairman of Saudi Aramco to remove conflicts of interest as the kingdom prepares for its upcoming IPO.

- Iranian leadership stated on Monday they will begin further steps to enrich uranium if the other members of the JCPOA are unable to get the country some relief from current US sanctions.

- Boris Johnson faced steep losses in Parliament this week after his Brexit proposal was rejected. The House of Commons voted 328-301 in favor of a step towards delaying the Brexit process by an additional three months after Mr. Johnson promised to deliver a deal in October.

DOE Wrap Up

- US crude stocks fell about 10m bbls last week to 428m due to a large drop in imports opposite an increase in exports. US crude inventories have averaged 436m bbls over the last four weeks which is higher y/y by 7%.

- To be specific, traders shipped 5.9m bpd of crude into the US last week and exported 3.0m bpd yielding net imports of just 2.9m bpd. For comparison, the US has seen net imports of 4.3m bpd so far in 2019 and 5.9m bpd in 2018.

- The US currently has 24.4 days of crude oil supply on hand. Days of Supply is higher y/y by 8%.

- Much has been written in recent months about the poor financial status of the US fracking industry and not without cause. Last week, however, producers put their strongest effort on record together pumping 12.5m bpd. US crude production has averaged 12.0m bpd so far in 2019 and has rebounded nicely from its last hurricane-related decline in July.

- On a more bullish note, new infrastructure has allowed the Cushing trading hub to continue to draw out. Crude stocks in the hub fell 2m bbls last week to 40.4m which is lower by 12m bbls over the last month and its lowest overall mark since December.

- US refiner activity had a bearish drop last week of about 300k bpd to 17.4m bpd. Refiner demand has averaged 17.55m bpd over the last month which is lower y/y by 200 bpd.

- US gasoline stocks fell by about 2m bbls last week to 232m and have averaged 233.75m bpd over the last four weeks which is higher y/y/ by about 0.7%.

- US distillate stocks also fell by about 2m bbls last week moving to 136m bbls. Distillate stocks are higher y/y by 6% and we continue to see this as evidence of a possible slowdown in the US agricultural market.