Friday, December 20, 2019

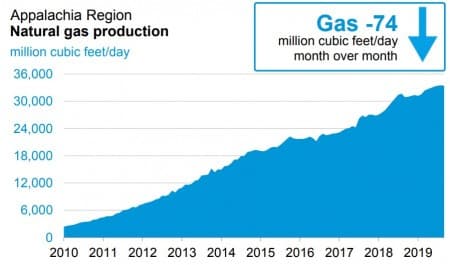

1. Shale gas boom flatlines

- The more than decade-long boom in shale gas production is coming to an end. The Appalachian region is expected to see gas output decline by 74 million cubic feet per day between December and January.

- Natural gas prices are wallowing at multi-year lows, and the financial squeeze in the shale sector is particularly acute for gas-focused companies.

- Gas output is also set to decline in the Anadarko basin by 132 mcf/d in January and in the Eagle Ford by 69 mcf/d.

- Gas production is still expected to rise by 213 mcf/d in the Permian, as drillers aiming for oil still have around 400 rigs in operation. Overall, though, the U.S. gas bonanza could be in for a down period, at least until prices rebound.

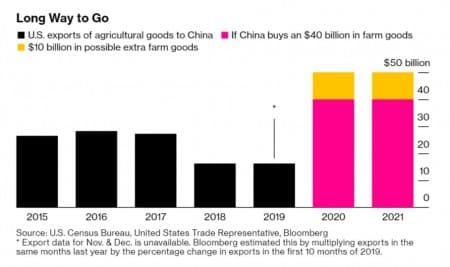

2. China’s $50 billion farm promise

- As part of the “Phase 1” trade deal between the U.S. and China, the U.S. will reduce tariffs in exchange for China buying $50 billion worth of agricultural goods. The Trump team insisted on that figure, and China has been cagey about committing to it.

- For good reason. Many analysts don’t think $50 billion is feasible, as it would be almost double what China was buying before the trade war. In 2017, China purchased $27 billion worth of U.S. agricultural goods.

- In the interim, China has looked elsewhere, building relationships with other suppliers, including Brazil.

- Bloomberg reports on the variety of ways the…

Friday, December 20, 2019

1. Shale gas boom flatlines

- The more than decade-long boom in shale gas production is coming to an end. The Appalachian region is expected to see gas output decline by 74 million cubic feet per day between December and January.

- Natural gas prices are wallowing at multi-year lows, and the financial squeeze in the shale sector is particularly acute for gas-focused companies.

- Gas output is also set to decline in the Anadarko basin by 132 mcf/d in January and in the Eagle Ford by 69 mcf/d.

- Gas production is still expected to rise by 213 mcf/d in the Permian, as drillers aiming for oil still have around 400 rigs in operation. Overall, though, the U.S. gas bonanza could be in for a down period, at least until prices rebound.

2. China’s $50 billion farm promise

- As part of the “Phase 1” trade deal between the U.S. and China, the U.S. will reduce tariffs in exchange for China buying $50 billion worth of agricultural goods. The Trump team insisted on that figure, and China has been cagey about committing to it.

- For good reason. Many analysts don’t think $50 billion is feasible, as it would be almost double what China was buying before the trade war. In 2017, China purchased $27 billion worth of U.S. agricultural goods.

- In the interim, China has looked elsewhere, building relationships with other suppliers, including Brazil.

- Bloomberg reports on the variety of ways the reality of the deal falls short of the hype. For instance, China may reroute shipments that currently run through Hong Kong to ports on the mainland. Imports into Hong Kong aren’t currently counted in the same way, but if they arrive at mainland Chinese ports, Beijing can take credit for the increase.

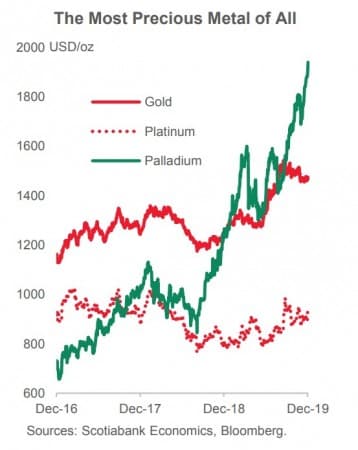

3. Palladium’s very good year

- Commodity prices have been lackluster in 2019, but palladium has been a big winner.

- Palladium prices surged 54 percent this year.

- “Unlike its sister metals where jewelry and fine circuitry play a starring end-use role, palladium keeps far more practical company with 85% of annual consumption destined for the exhaust systems of gasoline-fueled engines,” Scotiabank wrote in a note.

- “This years-long rally is a simple case of robust demand running up against inflexible supply, draining inventories and forcing consumers to pay ever-more for the metal.”

- More than three-quarters of palladium supply comes from Russia and South Africa.

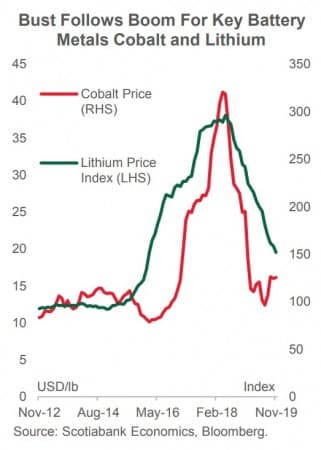

4. Lithium bust in 2019

- While palladium had a banner year in 2019, lithium suffered from the opposite experience.

- Lithium prices are down 38 percent this year. That came after a massive run up in prices between 2016 and 2018.

- “In a classic tale of overshooting, supply advanced faster than expected given lofty prices and demand from the EV sector disappointed,” Scotiabank wrote in its report. “These slower demand conditions come on the back of a wider downturn in global vehicle sales, particularly in China, but EVs are facing specific hurdles like Beijing’s rollback of subsidies to the largest EV market in the world—roughly half of all sales.”

- The fears of a shortage have not materialized, and are unlikely to be a significant problem for the next few years.

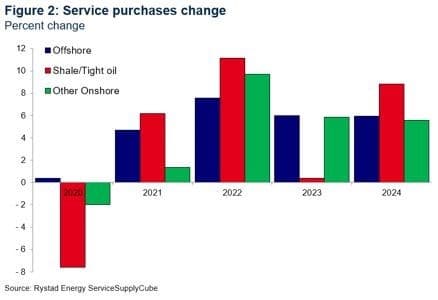

5. Oilfield services hit by slowdown

- The market for oilfield services has been hit hard by the slowdown in drilling generally, but in U.S. shale in particular.

- The global oilfield service sector saw a 3 percent decline in revenues in the third quarter, year-on-year, according to Rystad Energy.

- U.S. shale investments are on track to fall by 6 percent this year, and purchases from service providers could dip by another 7 percent in 2020.

- Offshore is expected to fare better. Rystad says that offshore spending will rise from $200 billion in 2019 to $225 billion in 2020.

6. IMO regs depress heavy fuel oil prices

- International Maritime Organization regulations on sulfur kick in in January, at which point thousands of ships need to switch over to low-sulfur fuels or otherwise scrub the sulfur from traditional fuel oils.

- Prices for fuel with at least 3.5 percent sulfur concentration, which will be out of compliance come January, have fallen sharply in the second half of 2019.

- “The cost of shipping a twenty-foot box-load of goods from Latin America to Europe could rise by $26,” Bloomberg wrote, using data from IHS Markit.

- “When you consider that 90% of global trade is carried out by seas, it is very important,” Robert Hvide Macleod, CEO of the management unit of Frontline Ltd., told Bloomberg.

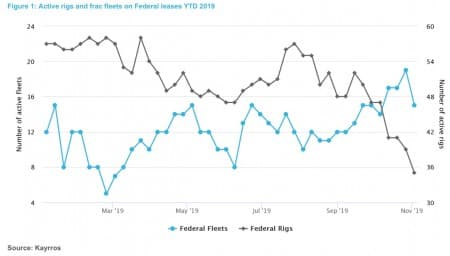

7. Potential fracking ban not trivial, but not a disaster

- Several U.S. presidential candidates have proposed a ban on fracking on federal lands. Most drilling occurs on private lands, so a ban “does not represent an irreplaceable share of US production,” although “neither is it a footnote,” data tracking firm Kayrros said in an analysis.

- The main area that would be impacted would be the specific subsection of the Permian basin: the New Mexico side of the Delaware sub-basin.

- The southeastern corner of New Mexico has been one of the hottest sections of the shale industry in the last two years.

- According to Kayrros, since 2018, this area has added 350,000 bpd of new oil production.

- However, the slowdown in 2019 has been felt more strongly on federal land, with the rig count down 40 percent since August, according to Kayrros, compared to the 15 percent decline in the Permian on the whole.

- “There is more than enough capacity in OPEC countries to make up for a drop in production growth on US Federal leases, so global oil supply is not substantially at stake,” Kayrros concluded.