Friday October 20, 2016

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil majors, or gas majors?

(Click to enlarge)

- Over the past decade, the oil majors have made decisive moves to “gasify” their portfolios. The result is that many of the oil majors are producing nearly as much gas as they are oil. Royal Dutch Shell (NYSE: RDS.A) is the largest LNG exporter in the world.

- Diversification makes sense as concerns over peak oil demand grow. But they have built out gas export capacity to such a degree that they have crashed prices. LNG prices in East Asia are trading at half of what they were three years ago.

- Moreover, demand projections are questionable. The EIA slashed its long-term forecast for gas demand growth – last year it predicted consumption would expand by 2.1 percent per year through 2040. This year, it lowered that estimate to just 1.7 percent. The gap between those two figures, over time, would be equivalent to the entire U.S. market.

- Some analysts even think that lower figure is too optimistic.

2. Oil demand growth slowed in Q3

(Click to enlarge)

- In the second quarter of this year, global oil demand surged by 2.2 million barrels from a year earlier, the strongest year-on-year…

Friday October 20, 2016

In the latest edition of the Numbers Report, we’ll take a look at some of the most interesting figures put out this week in the energy sector. Each week we’ll dig into some data and provide a bit of explanation on what drives the numbers.

Let’s take a look.

1. Oil majors, or gas majors?

(Click to enlarge)

- Over the past decade, the oil majors have made decisive moves to “gasify” their portfolios. The result is that many of the oil majors are producing nearly as much gas as they are oil. Royal Dutch Shell (NYSE: RDS.A) is the largest LNG exporter in the world.

- Diversification makes sense as concerns over peak oil demand grow. But they have built out gas export capacity to such a degree that they have crashed prices. LNG prices in East Asia are trading at half of what they were three years ago.

- Moreover, demand projections are questionable. The EIA slashed its long-term forecast for gas demand growth – last year it predicted consumption would expand by 2.1 percent per year through 2040. This year, it lowered that estimate to just 1.7 percent. The gap between those two figures, over time, would be equivalent to the entire U.S. market.

- Some analysts even think that lower figure is too optimistic.

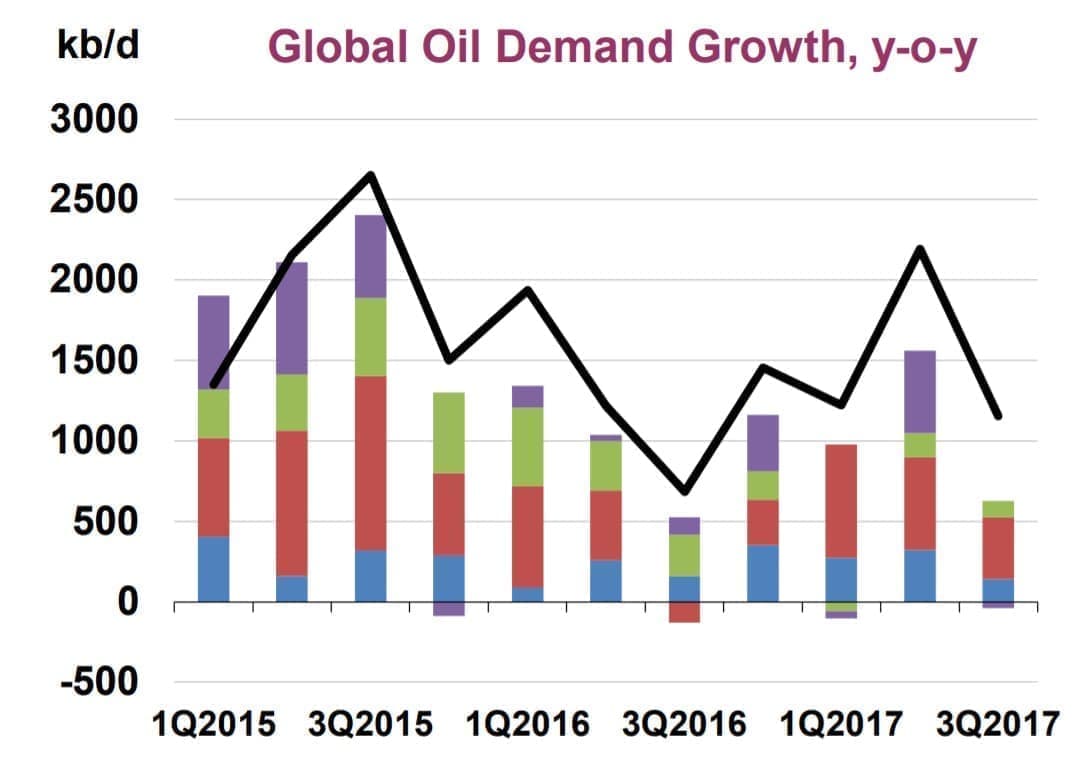

2. Oil demand growth slowed in Q3

(Click to enlarge)

- In the second quarter of this year, global oil demand surged by 2.2 million barrels from a year earlier, the strongest year-on-year growth since 2015.

- That spike in demand helped drain inventories, tighten the market, and lead to a sudden uptick in optimism.

- But third quarter oil demand growth slowed dramatically to just 1.2 mb/d, year-on-year, the second slowest pace in years. That deflated expectations about higher prices.

- However, the IEA kept its full-year projections unchanged at 1.6 mb/d for 2017, an impressive figure. That will translate into oil inventories draining at a rate of 0.3 mb/d this year, helping erase the surplus.

3. Long-term oil demand slows to a trickle

(Click to enlarge)

- Oil demand in 2017 remains rather robust, but over the long run, things start to fizzle for crude oil.

- There is no shortage of projections predicting the precise date when the world will hit peak oil demand. Wood Mackenzie does not see it coming anytime soon, but the consultancy does predict that oil demand will grow at a meager pace beginning in the 2020s.

- Digging deeper, WoodMac says that gasoline demand will, in fact, peak and begin to decline, with EVs eating into oil’s market share. But oil will find solace in the petrochemical industry, which will offset the demand loss from transportation.

- The result is a sort of “two-track” market, with oil demand in transportation falling, but oil demand in petrochemicals rising. Put it all together, and the market for oil starts to look like a plateau.

4. Norwegian Arctic is a flop so far

(Click to enlarge)

- Norway’s mature oil and gas fields have been in decline for years, but the industry has looked north to stave off decline.

- There has been a lot of hype surrounding the Barents Sea, which is expected to hold most of Norway’s undiscovered oil and gas reserves. The hype reached a fever pitch earlier this year, as explorers lined up a record number of exploration wells.

- A combined 15 wells were drilled in the Barents Sea, an all-time high. But the results have been highly disappointing.

- Statoil (NYSE: STO), Norway’s flagship oil company, drilled five wells, four of which were a bust. The fifth might be worth developing, but it only holds an unimpressive 50 million barrels of oil, at most.

- The Korpfjell stood out as the single most disappointing development of the year, a highly-anticipated well in an unexplored area that was thought to hold massive volumes. But it turned up an uncommercial amount of natural gas.

- “It’s been very disappointing for everyone,” John Olaisen, an analyst at ABG Sundal Collier Holding ASA, said in a Bloomberg interview.

- The industry is not giving up hope yet – it has another busy drilling year in 2018, with more wells planned.

5. Kurdistan oil exports in focus

(Click to enlarge)

- The seizure of the Kirkuk oil fields by Iraqi forces sent a jolt through the oil market on Tuesday.

- Kurdistan has been exporting between 500,000 and 600,000 bpd through Turkey for several years, using its own pipeline system that it constructed.

- There were reports of a brief outage of 350,000 bpd after Iraqi government forces moved in. There are conflicting reports on whether production and exports have been restored with Baghdad now in control. The Kurdish government said it would not impede exports.

- Mediterranean refiners would be most affect by any disruption, with Kurdish oil exported via a Turkish port in Ceyhan on the Mediterranean coast.

- The Iraqi government wants to export oil through its own pipeline system, but it needs repair.

- The FT reported that the Iraqi government approached BP (NYSE: BP) this week to develop the Kirkuk oil fields, although BP’s CEO somewhat disputed that report.

6. High-yield energy debt is back

(Click to enlarge)

- New debt issuance in the high-yield energy sector is surging in October, a sign that investors are willing to roll the dice again on some risky shale drillers.

- October is only half-way done and it is on track to be the largest month for debt issuance in years.

- Yields for the sector are way down from the dark days of 2016, standing at about 5.5 percent. Back in early 2016, when oil prices crashed below $30 per barrel, yields on the high-yield energy sector debt spiked to about 10 percent.

- New debt issuance and low yields can be attributed to “survivorship bias,” as Bloomberg Gadfly notes – the most distressed drillers have been forced out of business. The Bank of America Merrill Lynch U.S. High Yield Energy Index is about a fifth smaller than it used to be.

- But the spike in new issuance suggests the sector is back in business. More than 90 percent of debt issuance in the third quarter was to refinance existing debt. It is also not surprising the recent uptick in issuance occurred at a time when oil prices jumped above $50 per barrel, allowing risky drillers to roll over debt at reasonable levels.

7. Time needed to drill a shale well not falling anymore

(Click to enlarge)

- There are growing signs that the “efficiency gains” achieved by the U.S. shale industry are starting to reach their limits.

- Production per rig is falling, after peaking last year. The Eagle Ford in particular has seen a steep drop in productivity per rig. But as the FT notes, that metric is clouded by the fact that there has been a huge leap in the number of drilled but uncompleted wells (DUCs). The Eagle Ford’s DUC list, for example, has climbed 20 percent this year.

- However, the FT also points out that the time it takes to drill a shale well had been declining for years, but has recently leveled off. Between 2013 and 2016, E&Ps stepped up pad drilling, or drilling multiple wells from a single pad, reducing the time needed to move rigs around to drill the next well.

- There are a series of other metrics all pointing in the same direction: the shale industry is running out of ways to become more efficient.

That’s it for this week’s Numbers Report. Thanks for reading, and we’ll see you next week.