December West Texas Intermediate crude oil is in a position to close lower for the week as investors continue to wait for enough bullish news to drive the market out of its current trading range and into territory not traded since early April.

Ongoing tension in the Middle East boosted prices earlier in the week because of the threat of supply disruptions, however, Thursday’s price action indicates that those concerns may now be priced into the market.

Prices were also pressured by larger-than-expected product inventories in this week’s U.S. Energy Information Administration’s report.

Weekly Technical Analysis

(Click to enlarge)

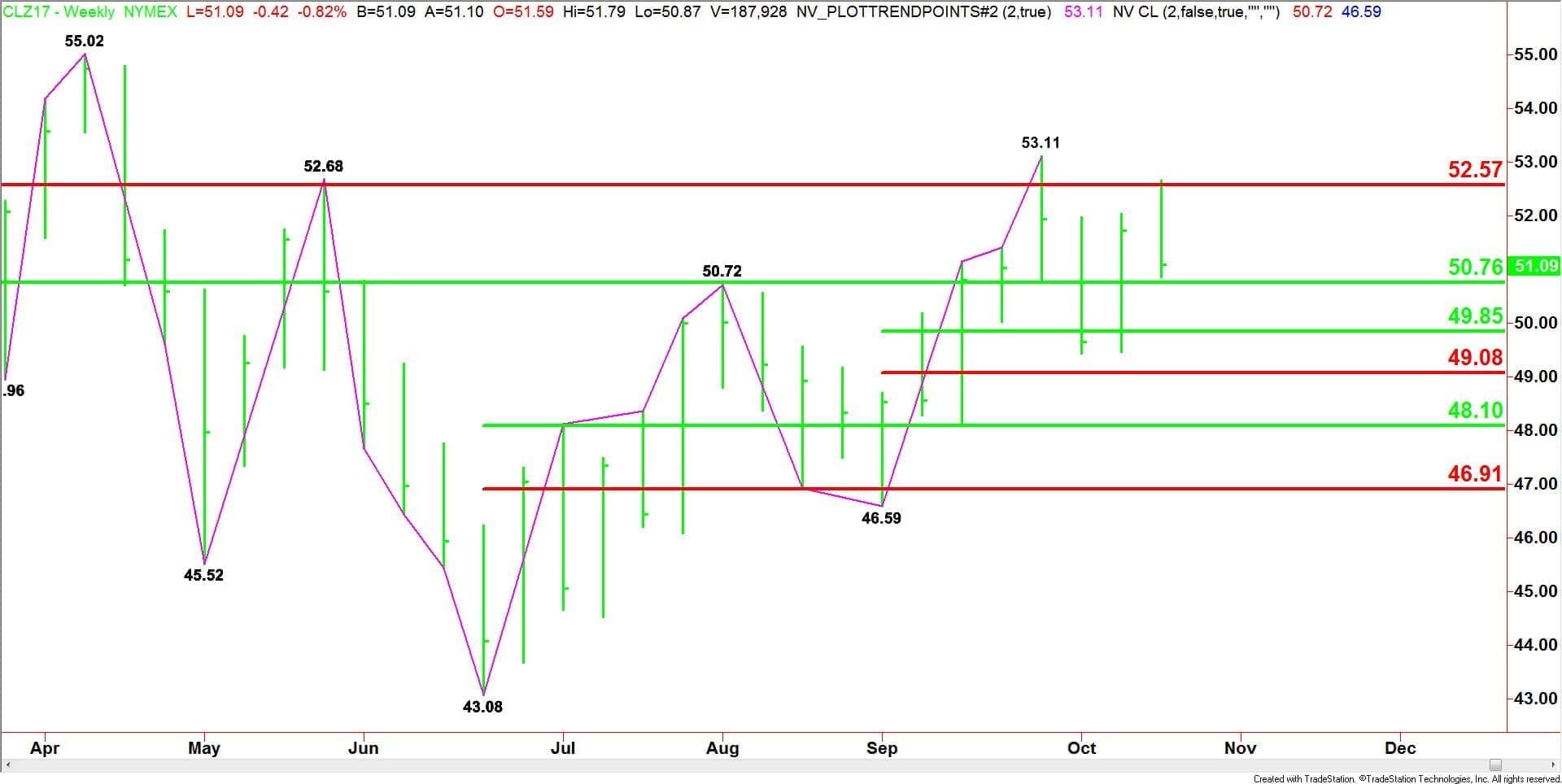

The main tend is up according to the weekly swing chart. A trade through $53.11 will signal a resumption of the uptrend. This could lead to a test of the next main top at $55.02.

On the downside, the nearest main bottom is $46.59. A trade through this level will change the main trend to down.

On the upside, one price level seems to be preventing crude oil from taking off to the upside. On the other hand, one level is stopping the market from retreating into a series of retracement levels which could lead to a labored break.

The main range is $58.44 to $43.08. The market is currently trading inside its retracement zone at $50.76 to $52.57. This zone is controlling the longer-term direction of the market.

The short-term range is $46.59 to $53.11. Its retracement zone at $49.85 to $49.08 is…

December West Texas Intermediate crude oil is in a position to close lower for the week as investors continue to wait for enough bullish news to drive the market out of its current trading range and into territory not traded since early April.

Ongoing tension in the Middle East boosted prices earlier in the week because of the threat of supply disruptions, however, Thursday’s price action indicates that those concerns may now be priced into the market.

Prices were also pressured by larger-than-expected product inventories in this week’s U.S. Energy Information Administration’s report.

Weekly Technical Analysis

(Click to enlarge)

The main tend is up according to the weekly swing chart. A trade through $53.11 will signal a resumption of the uptrend. This could lead to a test of the next main top at $55.02.

On the downside, the nearest main bottom is $46.59. A trade through this level will change the main trend to down.

On the upside, one price level seems to be preventing crude oil from taking off to the upside. On the other hand, one level is stopping the market from retreating into a series of retracement levels which could lead to a labored break.

The main range is $58.44 to $43.08. The market is currently trading inside its retracement zone at $50.76 to $52.57. This zone is controlling the longer-term direction of the market.

The short-term range is $46.59 to $53.11. Its retracement zone at $49.85 to $49.08 is the first support zone.

The intermediate range is $43.08 to $53.11. Its retracement zone at $48.10 to $46.91 is the next retracement zone.

Forecast

Look for a bullish tone on a sustained move over $52.57 and a bearish tone to develop on a sustained move under $50.76.

The weekly chart indicates the market has room to rally if $52.57. However, if $50.76 fails then prices could stair-step to the downside and this could create a choppy, two-sided trade.

Essentially, the chart pattern indicates the way of least resistance is to the upside.

(Click to enlarge)

Summary

This week’s price action sent a message to investors that the hedge funds and money managers are not likely to bite on short-term speculative events, but would rather play the long-side when they become confident that the oil markets are balancing.

The market is being supported by signs of tightening supply and demand fundamentals. However, capping gains is a warning about excessive China optimism.

After posting four-straight days of gains this week, crude oil investors were enticed into selling on Thursday after outgoing governor of China’s central bank warned of a “Minsky moment”, a reference to excessive optimism about economic growth fueled by vast debt and speculative investment.

There are signs that crude oil prices could pick up strength over the long-run, but bullish investors would rather wait for the announcement that OPEC and its major producing partners will extend production cuts through the end of 2018. Until this occurs, we’re likely to see a rangebound trade.

Natural Gas

December Natural Gas futures continue to hold on for dear life which straddling a major retracement zone. Bullish and bearish traders are trying to hold things together while they ride out the current weather pattern and supply/demand reports.

(Click to enlarge)

The main trend is down according to the weekly swing chart. The main trend will turn up on a trade through $3.353. Look for a possible acceleration to the downside if the psychological $3.000 level fails as support.

The main range is $2.640 to $3.747. Its retracement zone at $3.194 to $3.063 is acting like support. The market has been straddling this zone for more than four months.

A bullish tone could develop on a sustained move over $3.194, but I suspect that gains will be limited unless the weather turns cold sooner than expected.

We could see a steep break to the downside on a sustained move under $3.063. The trigger point may be $3.000. The weekly chart indicates there is room to the downside with $2.640 the next likely, however, I don’t think we’ll hit this level before the start of winter.

Fundamentally, total stocks now stand at 3.646 trillion cubic feet, down 179 billion cubic feet from a year ago, and 35 billion cubic feet below the five-year average, the government said.

Additionally, according to an outlook released Thursday by NOAA, winter 2017-2018 will feature a nationwide split between cold and wet conditions in parts of the northern states, while the southern tier will see warm and dry conditions overall.

Weak La Nina conditions are expected to develop this winter, and that may influence the large-scale weather conditions this winter ahead. Last week, NOAA indicated there was a 55 to 65 percent chance of La Nina conditions during the upcoming winter.

Last winter, a weak La Nina was in place and much of the East into the South and Midwest had one of their warmest winters while the Northwest was colder-than-average.

The U.S. is currently cold in the west and warm in the east. Even with the east turning colder next week, I don’t expect to see the start of a prolonged rally. This is because the weather system is only expected to give the region a blast. It is not expected to linger which is what bullish investors would like to see.

Forecast

Short-covering could drive December natural gas prices into $3.194 but then the buying is likely to dry up. The major short-sellers are not likely to be spooked by this price action to bail out of their positions.

The downside is another story. We could see increased selling pressure under $3.063 with the market vulnerable to a steep correction.