Friday, August 16, 2019

1. Oil highly sensitive to trade war

- Oil prices have whipsawed in recent weeks, gyrating on every whim and whisper relating to the U.S.-China trade war. Oil plunged by more than 7 percent when President Trump announced tariffs on China; rebounded by nearly 4 percent when Trump subsequently delayed them; but then fell a day later (August 14) when bad economic data emerged.

- The “dramatic price response came as no surprise given that oil prices also suffered the heaviest losses of all commodities when US President Trump announced the punitive tariffs on 1 August,” Commerzbank said in a note.

- The reaction of base metals was “considerably more muted,” Commerzbank said, which was surprising since metals are usually sensitive to economic fluctuations. But there are a few reasons for this. “For one thing, metals prices recently have been virtually immune to negative headlines concerning the trade conflict between China and the US and have stopped reacting to them,” Commerzbank said.

- But the upside has been limited too. The postponement of tariffs does not mean they will never happen. The trade war is a long way from being resolved.

2. Corn prices plunge again

- Corn, like other agricultural goods, was hit hard from the trade war beginning last year. But prices rallied this spring when horrific floods delayed plantings in the U.S. farm belt, raising concerns about adequate supply.

- Prices…

Friday, August 16, 2019

1. Oil highly sensitive to trade war

- Oil prices have whipsawed in recent weeks, gyrating on every whim and whisper relating to the U.S.-China trade war. Oil plunged by more than 7 percent when President Trump announced tariffs on China; rebounded by nearly 4 percent when Trump subsequently delayed them; but then fell a day later (August 14) when bad economic data emerged.

- The “dramatic price response came as no surprise given that oil prices also suffered the heaviest losses of all commodities when US President Trump announced the punitive tariffs on 1 August,” Commerzbank said in a note.

- The reaction of base metals was “considerably more muted,” Commerzbank said, which was surprising since metals are usually sensitive to economic fluctuations. But there are a few reasons for this. “For one thing, metals prices recently have been virtually immune to negative headlines concerning the trade conflict between China and the US and have stopped reacting to them,” Commerzbank said.

- But the upside has been limited too. The postponement of tariffs does not mean they will never happen. The trade war is a long way from being resolved.

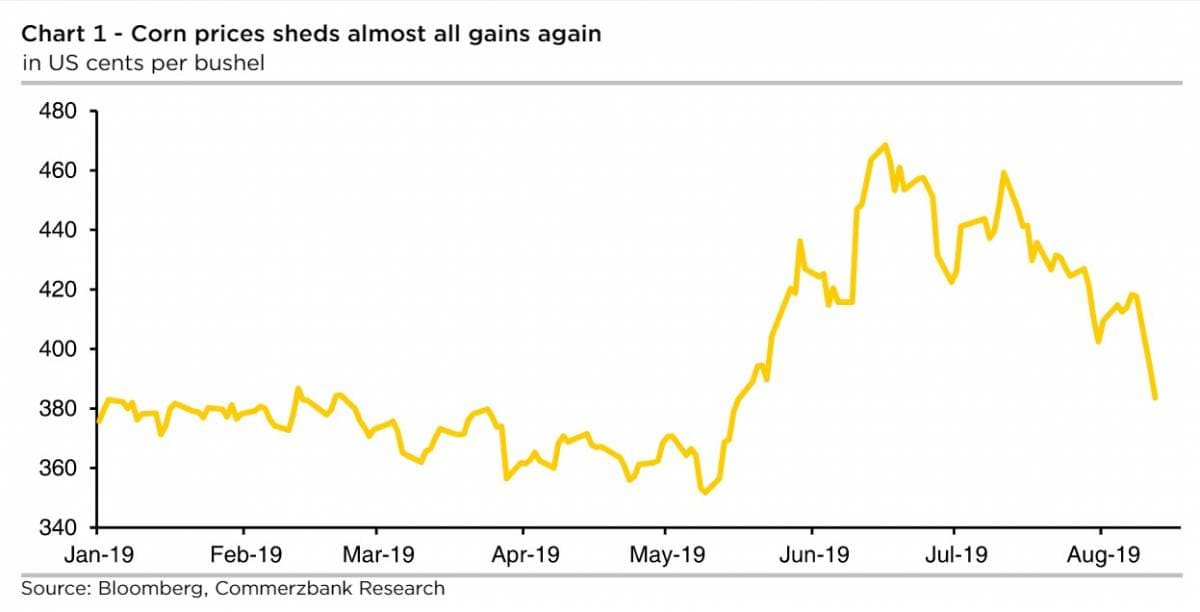

2. Corn prices plunge again

- Corn, like other agricultural goods, was hit hard from the trade war beginning last year. But prices rallied this spring when horrific floods delayed plantings in the U.S. farm belt, raising concerns about adequate supply.

- Prices crashed again more recently after U.S. Department of Agriculture data showed only a slight dip in expected acreage. Most analysts expected a more sizable decrease.

- “Together with the record crop in Ukraine, this gives rise to a higher estimate of global production, whereas demand – not least because of China – is now actually expected to be slightly down on last year,” Commerzbank said. The supply deficit will only be about 21 million tons rather than the expected 30 million tons.

- Corn prices fell by the maximum limit allowed on Monday, by about 6 percent. Prices fell below $4 per bushel for the first time since May.

- Meanwhile, higher-than-expected waivers for oil refiners on biofuels blending requirements won’t help, a decision that pushed down prices for biofuels credits. The corn and ethanol industries cried foul.

3. Dollar putting pressure on emerging markets

- In late July, the U.S. dollar rallied when the Federal Reserve cut interest rates by 25 basis points, more or less in line with expectations. But Fed Chairman Jerome Powell essentially told the markets not to get used to it, deflating hopes of a more accommodating position.

- But the strength of the dollar is part of a decade-long trend. The Bloomberg Dollar Index has gained 25 percent since 2009.

- A strong dollar makes commodities more expensive for the rest of the world. It also makes dollar-denominated debt – for individuals, companies and governments – more costly. That becomes an increasingly important concern when the economy starts to slowdown, as is currently the case.

- However, the perverse dynamic is that as investors become skittish, they flee to safer assets, such as the dollar. So, as the economy becomes rickety – exacerbated by the strength of the greenback – the dollar gains by even more.

- “Where the dollar is now could push the global economy into a more difficult situation and raise the risks of a recession,” Hans Redeker, Morgan Stanley’s London-based global head of FX strategy, told Bloomberg. “Any further appreciation could be challenging.”

4. Argentina rocked by surprise vote; Vaca Muerta in doubt

- The shockingly poor performance for Argentina President Mauricio Macri in the August 11 primary leaves him with a vanishingly small chance of reelection in October. Markets plunged on the news as investors viewed his opponent as a greater risk of default.

- Macri responded on Wednesday with a stimulus package of sorts, including higher wages and price controls on fuel. The Argentine peso was in freefall this week, and the price freeze on fuel is intended to prevent runaway inflation.

- The price freeze for oil could slow drilling in the Vaca Muerta because companies are now subjected to fixed (i.e. lower) prices for the next few months.

- Vista Oil & Gas (BMV: VISTAA), a fledgling Argentine oil company that just went public in July on the Mexican stock exchange, saw its share price nosedive by more than 25 percent this week. On Wednesday alone, the company’s share price fell 7 percent.

- Vista is a small producer, but YPF (NYSE: YPF), the partially state-owned oil company, fell by more than 35 percent.

- Skyrocketing inflation, the increased odds of a debt default, and a rapidly deteriorating currency will throw up significant hurdles to the Vaca Muerta, which saw a sizable jump in oil and gas production over the past year.

5. Shale bankruptcies on the rise

- The number of bankruptcies in the U.S. shale industry is picking up pace once again as financial pain spreads and creditors lose patience.

- From 2015 through August 2019, there have been a total of 192 bankruptcies in the North American oil industry, according to Haynes and Boone, LLP. That affected more than $47 billion in debt.

- 2016 was the worst year, when WTI briefly fell below $30 per barrel. Roughly 70 companies went under.

- Through August, there have already been 26 bankruptcies this year, including 8 in the past two months. With another four months to go, 2019 could easily be the worst year since 2016.

- The latest was Sanchez Energy (OTCMKTS: SNECQ), which succumbed to bankruptcy on August 11, affecting $2.275 billion in debt.

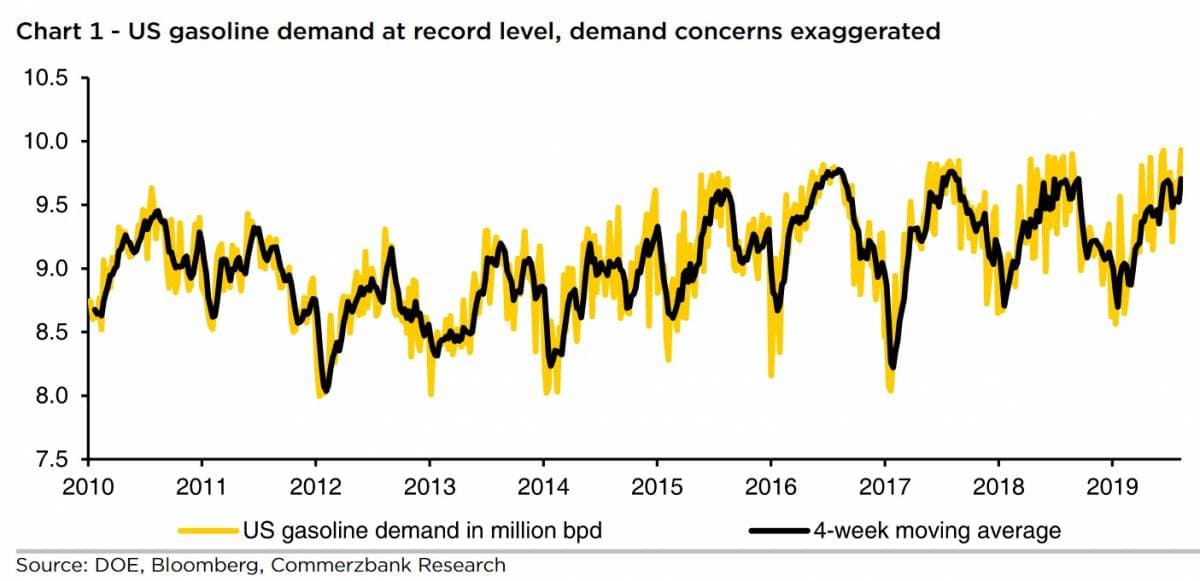

6. Demand concerns exaggerated?

- The jump in U.S. crude stocks this week helped accentuate the broader market selloff, pushing crude oil down only a day after benchmark prices appeared poised for a rebound.

- However, Commerzbank argues that markets are likely overreacting. At “1.6 million barrels the inventory build was considerably smaller than the API had reported a day earlier. And the rest of the data, apart from a lower rate of crude oil processing, was even bullish for the most part,” the investment bank said.

- Also, gasoline stocks fell unexpectedly, which highlights record high gasoline demand. Distillate inventories also declined.

- Amrita Sen, chief oil analyst at Energy Aspects, voiced a similar sentiment. “I don’t think there is a lack of demand right now. It’s the ‘fear of’ – that there would be a lack of demand,” Sen said on Bloomberg TV. Investors are spooked, even though demand is still growing.

- Still, it’s hard to overcome much larger fears about a global economic recession. Even if market fundamentals are tight (in the short run at least) oil will remain at the mercy of economic dangers.

7. Permian prices narrow

- West Texas Sour (WTS) is produced in West Texas and New Mexico. It is a bit heavier (33-34 degrees API) and more sour than much of the oil produced in the Midland region.

- Prior to 2016, WTS was consumed locally, or sent to the Midwest via Cushing, OK. Even though it was a lower quality, it traded at a premium to WTI in Midland, according to Argus Media. Refinery demand helped boost WTS prices. Also, the light market was well-supplied (and bottlenecked) with rising shale production from the Permian.

- However, in early 2016, a new pipeline connected Canadian oil to much of the mid-continent in the U.S. That increased competition for WTS, pushing down WTS prices. So, WTS traded at a discount to WTI between February 2016 and July 2018.

- Once again, however, bottlenecks from Canada have allowed WTS to rise again.

- Here’s the kicker though – soaring production of light sweet oil in the Permian has actually increased the importance of WTS because the extreme lightness of the oil needs to be blended with a heavier oil.

- So much light oil has led to the creation of West Texas Light (WTL), which makes WTS useful to blend together to make an oil that closely resembles WTI.