Friday July 5, 2019

1. Petrochemicals underperform oil

- The oil majors have undertaken massive investments in petrochemical projects, viewing plastics as a more durable investment than simply producing crude oil. With the spread of electric vehicles and peak demand looming, the soaring use of plastics is seen as one of the last refuges for oil companies.

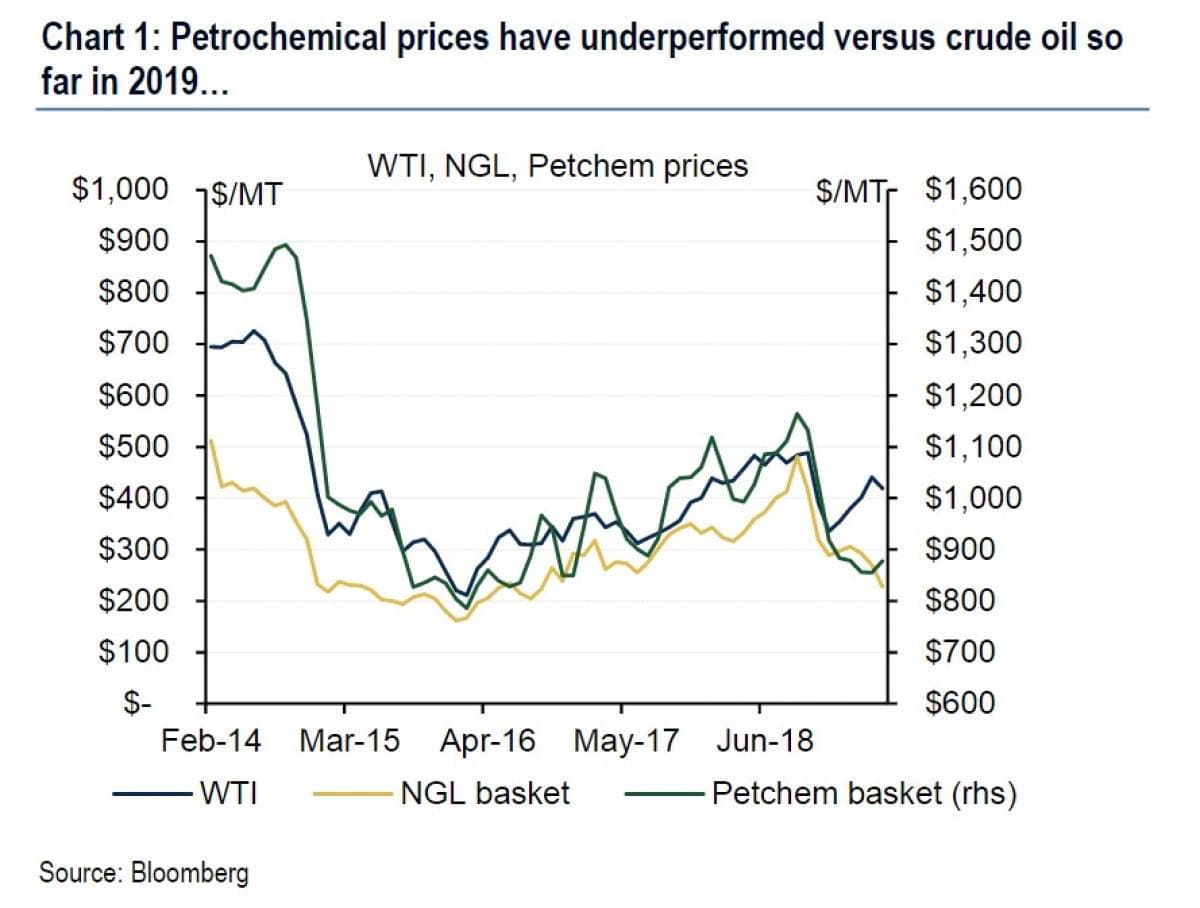

- But chemical prices have underperformed oil and natural gas liquids since 2014, according to Bank of America Merrill Lynch. “The petchem market has struggled to regain the premium it commanded over oil and NGLs ever since,” the bank said. “More recently, as oil rebounded from 4Q18 lows, NGLs and petchems continued to decline.”

- Production of oil, gas and natural gas liquids has skyrocketed, but much of it remained trapped in the U.S. As a result, companies have invested in major petrochemical capacities, such as ethane crackers. But the products they produce – ethylene and polyethylene – are also somewhat trapped.

- “US export and downstream infrastructure has stranded NGLs, causing prices to collapse, particularly for ethane, which is now trading around $0.16 per gallon, down nearly 50% from the start of the year and approaching natural gas value,” Bank of America said.

- The infrastructure bottlenecks will likely be ironed out over the next few years, but the economic deterioration now has demand up in the air.

- “In light of the recent deterioration in economic activity,…

Friday July 5, 2019

1. Petrochemicals underperform oil

- The oil majors have undertaken massive investments in petrochemical projects, viewing plastics as a more durable investment than simply producing crude oil. With the spread of electric vehicles and peak demand looming, the soaring use of plastics is seen as one of the last refuges for oil companies.

- But chemical prices have underperformed oil and natural gas liquids since 2014, according to Bank of America Merrill Lynch. “The petchem market has struggled to regain the premium it commanded over oil and NGLs ever since,” the bank said. “More recently, as oil rebounded from 4Q18 lows, NGLs and petchems continued to decline.”

- Production of oil, gas and natural gas liquids has skyrocketed, but much of it remained trapped in the U.S. As a result, companies have invested in major petrochemical capacities, such as ethane crackers. But the products they produce – ethylene and polyethylene – are also somewhat trapped.

- “US export and downstream infrastructure has stranded NGLs, causing prices to collapse, particularly for ethane, which is now trading around $0.16 per gallon, down nearly 50% from the start of the year and approaching natural gas value,” Bank of America said.

- The infrastructure bottlenecks will likely be ironed out over the next few years, but the economic deterioration now has demand up in the air.

- “In light of the recent deterioration in economic activity, we are concerned that demand growth is at risk of another slowdown given current market conditions,” Bank of America said. “One consultancy suggests ethylene demand growth could fall by nearly 50% this year.”

2. Well interference a major problem for shale

- The Wall Street Journal reported on the poor results from Encana’s (NYSE: ECA) “cube” development, in which dozens of wells are drilled from one location at varying depths.

- The test was supposed to lead to greater productivity, more output while spending less due to economies of scale. But well interference has made the wells much less productive than similar wells spaced further apart.

- Encana’s 33-well cube project offers clear results. Each well may end up producing 300,000 bpd over 30 years, or about half of what Encana said a typical well produced in 2017.

- As a result, shale drillers may need to space out wells more, which ultimately means that they will run out of acreage sooner. “[S]ome executives and analysts have warned that U.S. production could peak far sooner than expected,” the WSJ said.

3. Wind and solar competitive with gas

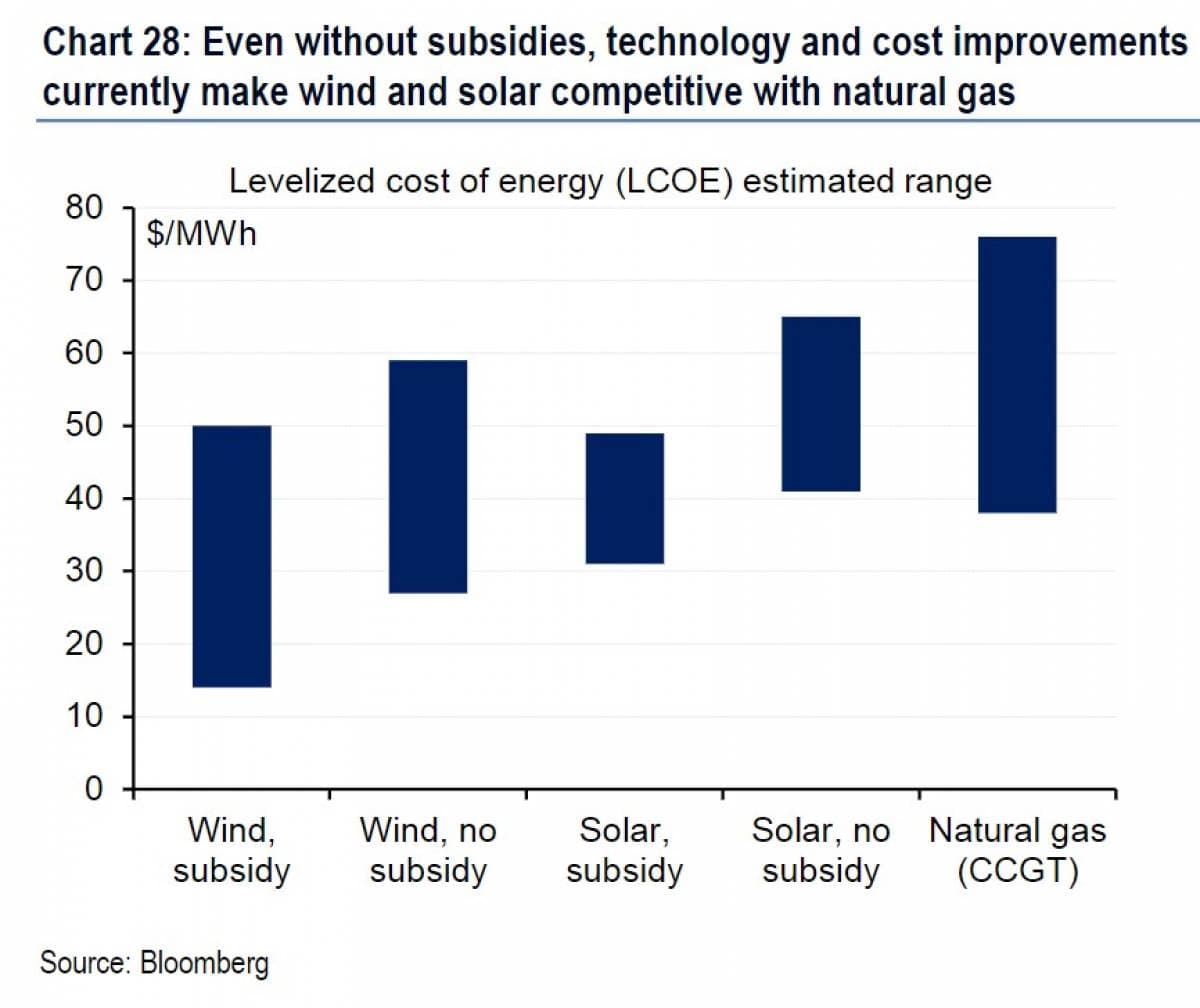

- Expiration of subsidies for solar and wind are looming over the next few years, but solar and wind are already competitive with natural gas on an unsubsidized basis. In some cases, renewable energy is the cheapest option.

- With coal in terminal decline and nuclear power not far behind, new capacity additions in the U.S. electricity grid have been dominated by solar, wind and natural gas over the last five years.

- “We expect shale gas growth to continue to support natural gas power generation capacity additions, but natural gas must compete with wind and solar for new build generation market share,” Bank of America wrote in a report.

- Over the next 18 months, a rush of wind could come online as developers seek to benefit from expiring wind subsidies.

4. Soybeans lagging, corn surprises

- According to U.S. Department of Agriculture data, U.S. 2019 corn acreage planted reached 91.7 million acres at the end of June, only 1.1 million acres less than farmers had planned.

- This year, farm country has been lashed by floods, extreme weather and the depressing effects of the U.S.-China trade war. The floods in particular severely delayed planting.

- While farmers managed to keep corn plantings in line with expectations, soybeans lagged farther behind, down more than 9 million acres from 2018 levels.

- Corn prices had surged in the last few months on fears of shortages, but prices crashed upon release of this data in late June. In contrast, soybean prices surged.

- That isn’t the end of the story, however. “Market focus is now likely to shift to crop yields, and the excessively wet weather implies some real damage to corn yields,” Standard Chartered wrote in a note. “While it may be tempting to adopt a bullish stance on soybeans and bearish on corn-based on the Acreage report, we caution that significant uncertainty remains on final acreage and yields.” More data will be released in August.

5. Worrying contraction in global manufacturing

- Manufacturing data from a growing list of countries shows a pronounced decline in activity.

- The rate of decline is the fastest since 2012, according to IHS Markit. Only 12 of 30 countries covered by the consultancy had improved conditions, the lowest number in over six years.

- Worse, contractions are occurring in the manufacturing powerhouses – the Eurozone, the UK, China, Japan, the rest of Asia. The U.S. is “stagnant.”

- Weak diesel demand can be tied to the dip in manufacturing and industrial activity.

- Crude oil has fallen sharply in recent weeks as concern over declining demand and an economic downturn outweigh geopolitical risk in the Middle East.

6. Gold or palladium, which is more precious?

- Palladium prices have consistently traded higher than gold this year, making it the most expensive precious metal. “The two metals have been in a race for the most precious for some time,” R. Michael Jones, president and chief executive officer of Platinum Group Metals Ltd., told MarketWatch. “Palladium is still winning.” Prior to 2019, palladium hadn’t traded above gold in more than a decade.

- Palladium is an important metal used in catalytic converters, used to reduce pollutants from cars and trucks. The rush to clean up air pollution has pushed up prices. Palladium is up 30 percent this year, while gold is up 11 percent.

- At the same time, both have benefited from a weaker dollar and a more dovish turn from the U.S. Federal Reserve.

- “Palladium fundamentals continue to underpin the market,” said Joni Teves, a precious-metal strategist at UBS Group, according to the Wall Street Journal. “And although global car sales, especially in China, have been weak, tighter emissions standards are leading to higher loadings” of palladium inside catalytic converters.

7. Philadelphia refinery explosion impacts East Coast gasoline

- The 335,000-bpd refinery in Philadelphia that suffered from a massive explosion last month is slated to be shut down completely and permanently.

- The closure would decrease the number of refineries on the East Coast to just 7, according to the EIA, with a combined operating capacity of 889,000 bpd. It would slash East Coast gasoline supply by 160,000 bpd and distillate capacity by 100,000 bpd.

- The East Coast will need to import from other areas to make up for the lost output.

- According to Bloomberg, imports of refined products from Canada, Europe and the U.S. Gulf Coast will fill the gap. But the Gulf Coast is hampered by the Jones Act, which requires fuel shipped between American ports to run on U.S.-flagged ships.