Oil is set to post a loss this week despite a wave of bullish news.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Oil prices are set to post a loss for the week despite being bolstered by the OPEC+ deal and the forthcoming restart of trade talks between Washington and Beijing. It seems that economic concerns will continue to weigh on the market in the coming weeks.

U.S. shale production faces spacing problem. According to the Wall Street Journal, a drilling test conducted by Encana (NYSE: ECA), has proved to be a dramatic disappointment. Encana’s “cube” development envisioned packing dozens of wells together – originally supposed to be as much as 60 – from a single location. However, instead of cutting costs and boosting output, the wells performed poorly, and they are expected to produce as little as half of the oil as other wells drilled farther apart. The result suggests U.S. shale could peak sooner than expected, the WSJ said.

UK seizes Iranian oil tanker. The British Royal Marines seized an Iranian oil tanker in Gibraltar on Thursday for attempting to take oil to Syria, which violates European Union sanctions. But the move could escalate tension between Iran and the West. “This is the first time that the EU has done something so public and so aggressive. I imagine it was also coordinated in some manner with the U.S. given that NATO member forces have been involved,” Matthew Oresman, a partner with law firm Pillsbury Winthrop Shaw Pittman who advises firms on sanctions, said in a Reuters interview. Related: Are Asian LNG Prices About To Rally?

BP: Some oil reserves “won’t see the light of day.” A BP (NYSE: BP) official admitted that some of the company’s “more complicated to extract” resources will have to be sold or otherwise will stay in the ground. More expensive and time-consuming reserves “won’t see the light of day,” Dominic Emery, BP’s head of strategy, told Bloomberg. Climate change, peak demand and investor pressure to focus on short-cycle projects will ultimately mean that some resources “won’t come out the ground.”

U.S. shale destroyed 80% of its value since 2008. Former EQT (NYSE: EQT) chief executive Steve Schlotterbeck said that the shale industry continues to destroy capital “every time they put the drill bit to the ground.” He spoke at a petrochemical conference where he said that the industry has destroyed 80 percent of its value since 2008.

Trump considers quiet waiver for China on Iran imports. The Trump administration is reportedly weighing whether to allow China to continue to import Iranian oil in order to avoid looking powerless as China imports oil anyway. The U.S. had vowed to “sanction any imports of Iranian crude oil,” threatening to enact punishment on anyone buying oil from Iran. However, as China recently did just that, the Trump administration fears looking impotent. According to Politico, U.S. officials are considering using a loophole to grant China a waiver.

OPEC production drops to new low. OPEC’s production declined to a five-year low in June, largely due to sharp losses from Venezuela and Iran, according to Reuters. The group produced 29.6 mb/d, down 170,000 bpd from May. Reuters estimates that Iran’s oil exports have fallen below 400,000 bpd.

Europe building battery supply chain. Europe is aiming to funnel over 100 billion euros into building a supply chain for lithium-ion battery packs for electric vehicles, according to Bloomberg. In addition to greenhouse gas reductions, a significant motivator is ensuring that top European automakers can pivot to the electric future, as well as fears that China will dominate the industry.

U.S. auto sales plunge, jobs up. While Europe and China are showing signs of an economic deceleration, the U.S. is throwing up mixed signals. Manufacturing data is weak, and auto sales could dip below 17 million this year for the first time since 2014. Also, more than 80 percent of companies in the S&P 500 revised their earnings forecast lower, a sign of a deterioration in the broader business environment. But the latest jobs report showed the U.S. added an unexpectedly strong 224,000 jobs in June, easing concerns about a slowdown. However, the job gains lessen the pressure on the Federal Reserve to cut interest rates.

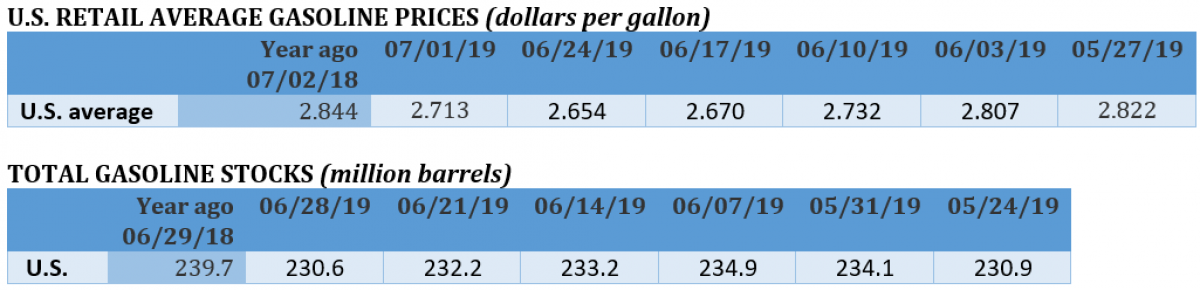

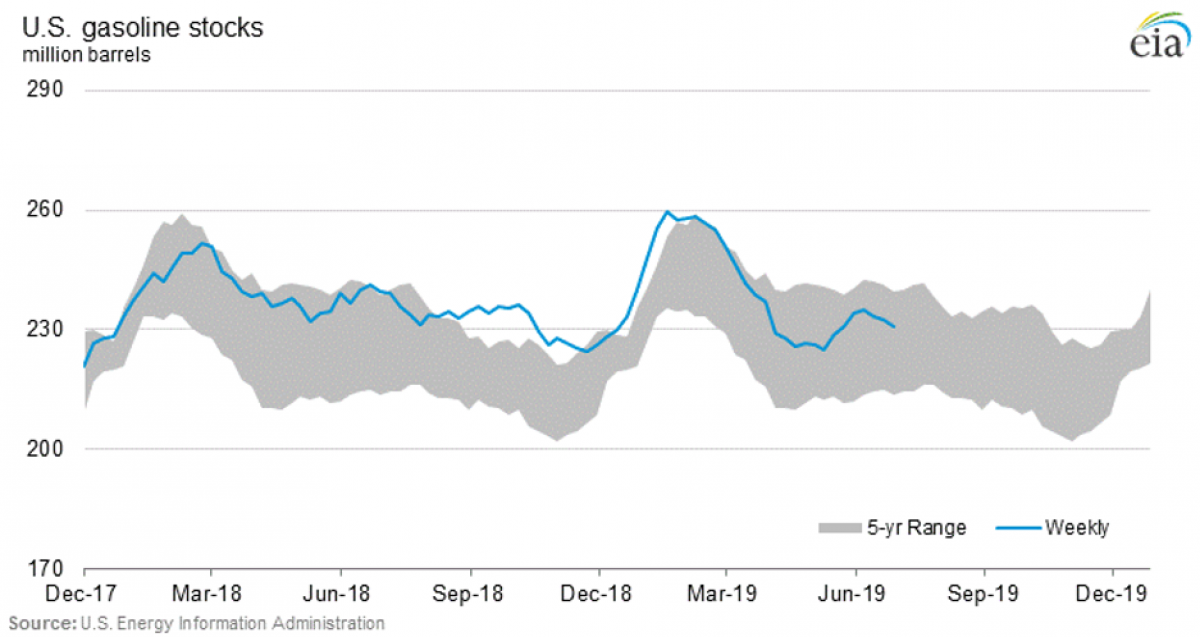

U.S. gasoline imports from Europe up on Philadelphia outage. The shutdown of the crippled refinery in Philadelphia, the largest on the east coast, means that the eastern seaboard will have to import more gasoline. The U.S. east coast accounts for a third of the country’s gasoline demand and 70 percent of its imports. Gasoline stocks at the key European ARA hub plunged by 9.4 percent this week, a sign that more gasoline is heading from Europe to the U.S., according to Commerzbank. “The refinery outage could therefore push up gasoline prices in Europe,” the investment bank said in a note. Related: Why The Clean Energy Revolution Isn’t Taking Off In Russia

Tesla hits sales target. Tesla (NASDAQ: TSLA) delivered a record number of vehicles in the second quarter, easing the pressure on Elon Musk. After reporting that it had delivered 95,200 cars, Tesla’s stock jumped 7 percent.

Oil and gas industry hit by tariffs. The U.S. oil and gas industry was relieved that Trump and Xi decided to restart trade negotiations, but existing tariffs still impact drilling operations. “Section 301 tariffs have been levied on more than 100 products - including bearings, drill collars, electronic circuits, fluids, lithium batteries, meters, motors, pumps, pump parts, rotors/stators, steel, turbines, and valves - are hurting the natural gas and oil industry,” Aaron Padilla, American Petroleum Institute's senior advisor for international policy, recently told the U.S. Trade Representative in a testimony. U.S. oil and gas exports to China have plunged, with no LNG cargoes delivered during the second quarter.

Eni starts production in Mexico. Eni (NYSE: E) began production at the first offshore oil project in Mexico since the country launched its reforms five years ago. The field, off the coast of Campeche, is estimated to hold 2.1 billion barrels of oil equivalent.

Saudi Arabia and Kuwait nearing deal on Neutral Zone. Saudi Arabia and Kuwait have reportedly made a breakthrough in negotiations over the restart of the Neutral Zone oil fields along their shared border. The fields have around 500,000 bpd of capacity, but have been offline for years as both countries dispute their sovereignty.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com: