Last year, the energy industry was rocked by record bankruptcies and write-downs that did not spare even the oil majors. According to Energy and Restructuring law firm Hayes and Boone’s, a grand total of 50 energy companies filed for bankruptcy last year, including 33 oil and gas producers, 15 oilfield services companies and two midstream companies. Meanwhile, Chevron Corp., Schlumberger, and Royal Dutch Shell announced multi-billion dollar asset impairments citing unfavorable macro outlook. And this specter of doom and gloom appears set to continue for much longer, with concerns mounting that the ax could now fall on debt-ridden oilfield services companies. North American oilfield services and drilling companies face a $32 billion wave of debt that will come due this year through 2024, a daunting prospect considering that oil prices have crashed to nearly 20-year lows.

The outlook appears particularly grim for companies in dire need of a capital infusion and those with weak credit ratings as drilling work dries up amid the oil price crash; rising COVID-19 infections and the Saudi Arabia and Russian price war that threatens to flood global markets with even more crude output.

The poor state of the oilfield services companies is clearly reflected in the sector’s favorite benchmark, the VanEck Vectors Oil Services ETF (NYSEARCA:OIH), down 72% YTD and considerably lower than the 30% plunge by the S&P 500.

Sources: CNN Money

Junk Bonds

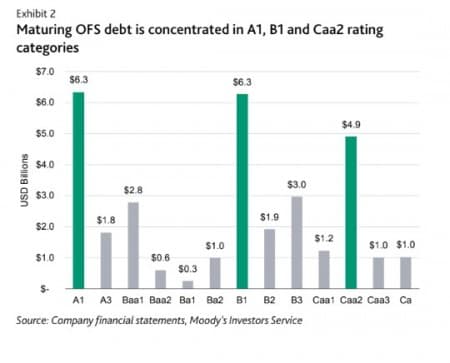

Oilfield services and drilling companies have some of the most high risk debt, with

junk-rated companies accounting for 65% of the $32B debt tab by the sector. Of these companies, Transocean (NYSE:RIG) has $4.3B; Valaris (NYSE:VAL) has $1.8B, Nabors Industries (NYSE:NBR) owes $1.4B and Superior Energy Services (NYSE:SPN) has $1.3B of debt set to mature within the next two years as per Moody's.

Related: Oil Majors Are Preparing For $10 Oil

According to Moody’s senior analyst Sreedhar Kona, “The rapid and widening spread of the coronavirus outbreak, deteriorating global economic outlook, falling oil prices, and asset price declines are creating a severe and extensive credit shock across many sectors, regions and markets.”

The sector’s biggest investment-grade firms such as Schlumberger (NYSE:SLB), Halliburton (NYSE:HAL), Baker Hughes (NYSE:BKR) and National Oilwell Varco (NYSE:NOV) are better placed to weather the storm since they offer other services that can offset reduced drilling activity.

Default risk

Source: MarketWatch

The energy sector in general is poorly regarded by investors with energy bonds well represented in the $1.5 trillion U.S. junk-bond market. Nearly a third of junk bonds were trading at distressed ratios last week with the market expecting energy bonds to default at a 14.08% clip, nearly double the 7.66% average default rate expected for the sector.

More Bankruptcies

And with debt defaults comes the specter of even more bankruptcies.

Related: U.S. In Lockdown: The Biggest Threat To The Oil Industry Ever?

North American producers have filed for bankruptcy involving $121.7 billion in aggregate debt since 2016 when oil prices began to drop. According to Moody’s, the U.S. oil and gas industry has about $86 billion of rated debt due over the next four years, one of the highest for any sector. The oil price crash makes it especially hard for these companies to comply with their debt obligations.

Indeed, Cramer sees a new wave of bankruptcies hitting the industry. The pundit has predicted that 9-10 oil and gas companies out of the 35 he covers will go under if low energy prices persist.

Unfortunately, the current situation looks really tenuous, with neither Saudi Arabia nor Russia willing to be the first to blink in the ongoing price war.

With the Saudis holding out and flooding the market with oil, the oil glut could reach a staggering 1 billion barrels in a matter of months and $10 oil is suddenly looking like a distinct possibility. Even though the American government plans to purchase a total of 77 million barrels of oil for its strategic reserves, this can only be done at a 2 million barrels per day clip, thus leaving a massive excess of nearly 20 million barrels per day as the coronavirus continues to crush global demand.

However, predictions for negative oil prices are exaggerated. Normally, a buying opportunity presents itself whenever stocks get pulverized as badly as they have right now. But with the perfect storm of poor demand, a global pandemic and an all-out price war, trying to call a bottom on this energy market is a fool’s errand.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Saudi Arabia And The U.S. Could Form The World’s Newest Oil Cartel

- This Supermajor Is About To Slash Permian Oil Production

- Saudi Arabia’s Oil Price War Is Backfiring