It’s hard to imagine higher stakes for the oil market over the next week as traders get set for an OPEC+ meeting and the Trump/Xi G20 meeting on the heels of a 33 percent decline in prices over the last two months. Both conferences will be crucial to oil prices for 2019 and while it’s impossible to know what the exact outcomes of these meetings will be, we can start to consider what the market is expecting from the next week in order to get a sense of what oil might do after they’re concluded.

On the OPEC+ side, it seems clear that the market is currently forecasting coordinated production cuts- led by the Saudis of course- to the tune of about 1m bpd. The Russians and Saudis have telegraphed this move with recent public comments and analyst surveys are almost unanimously predicting cuts of 750k bpd – 1.25m bpd. A deal to the tune of 1m bpd seems to be already priced in to the market while significant bearish risks will be introduced if the deal is below 500k bpd (or simply doesn’t get done) and bullish risks will be introduced if the cut exceeds 1.5m bpd. On the down side, we’re concerned that the Saudi’s and Russians may fail to cooperate because they’re too far apart in terms of budgetary needs. The Saudis currently need oil near $75/bbl to balance their budget while the Russians need oil near $55/bbl. (Putin added this week that he’s completely pleased with oil near $60/bbl.) The Saudis have also hemorrhaged foreign currency reserves at a scarily rapid pace over…

It’s hard to imagine higher stakes for the oil market over the next week as traders get set for an OPEC+ meeting and the Trump/Xi G20 meeting on the heels of a 33 percent decline in prices over the last two months. Both conferences will be crucial to oil prices for 2019 and while it’s impossible to know what the exact outcomes of these meetings will be, we can start to consider what the market is expecting from the next week in order to get a sense of what oil might do after they’re concluded.

On the OPEC+ side, it seems clear that the market is currently forecasting coordinated production cuts- led by the Saudis of course- to the tune of about 1m bpd. The Russians and Saudis have telegraphed this move with recent public comments and analyst surveys are almost unanimously predicting cuts of 750k bpd – 1.25m bpd. A deal to the tune of 1m bpd seems to be already priced in to the market while significant bearish risks will be introduced if the deal is below 500k bpd (or simply doesn’t get done) and bullish risks will be introduced if the cut exceeds 1.5m bpd. On the down side, we’re concerned that the Saudi’s and Russians may fail to cooperate because they’re too far apart in terms of budgetary needs. The Saudis currently need oil near $75/bbl to balance their budget while the Russians need oil near $55/bbl. (Putin added this week that he’s completely pleased with oil near $60/bbl.) The Saudis have also hemorrhaged foreign currency reserves at a scarily rapid pace over the last four years and seem to

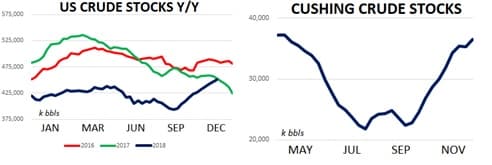

need the deal much more than any other party involved. These opposite forces in incentives could ultimately impede a deal. Alternatively, there is no denying the need for supply side market managed from major producers after the U.S. has seen crude inventories jump by 56m bbls over the last three months- a seasonal period which typically produces inventory draws. Adding to the bullish risk, we think hedge funds have introduced upside potential in the form of enormous short positions which will have to be reversed if the market is shocked with a more aggressive than expected pact. Hedge funds currently hold their most bearish position in crude oil futures and options in about three years and the swing in prices could be drastic if speculators are unable to hold bearish bets in the face of more bullish than expected news.

On the macro side, equity and bond markets are clearly hesitant to forecast a breakthrough trade deal between Trump and Xi. At present, it seems the market is forecasting something in between a complete break down of negotiations and strongly productive, cooperative conversation with small concessions coming from the Chinese side to prevent more tariffs. Over the last six months the U.S. stock market is virtually flat as measured by the S&P 500 while the Shanghai Composite is down by 16% and copper prices are down about 9%. Those numbers don’t exactly scream economic confidence and we think the pessimism creates some upside risk heading into the meeting after Trump suggested that he could “do something” with Xi this coming week. This was a move in the right direction from Trump after several weeks of threats and negativity from both sides which have driven macro expectations lower. We also see bullish risk on US/China trade driven by the fact that the US President will be eager for some sort of ‘win’ he can market to his voters. US stocks have struggled as of late, the US Fed is rising rates (to Trump’s very public disappointment) and trade-related news such as GM’s recent round of layoffs and the utter failure of subsidies to US corn farmers affected by the trade war could limit Trump’s ability to take a hard tack with his counterpart and risk creating more negative economic news. The US President is constantly in campaign mode and could be eager for some of the positive economic data that he loves to tout on his Twitter feed. We think this introduces some bullish risk heading into the meeting slightly above what commodity and equity markets seem to be forecasting.

Next week the market will look for strong action from OPEC+ and a small ‘win’ for Trump/Xi on trade where both sides can show strength but also a willingness to avert drastic economic stress. Regardless of the outcome, both stories will remain key influencers on oil prices for the foreseeable future.

Quick Hits

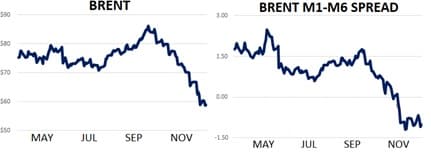

- Oil prices trended slightly lower this week with prompt Brent futures hitting a 14-month low at $57.50 on Thursday. The mark represented a loss of $29 since October 3rd.

- OPEC+ is set to meet next week to formally discuss production cuts aimed at balancing supply/demand and reversing the free-fall in prices. Analysts are expecting the group to agree to cut 1m – 1.1m bpd in a deal led (of course) by Saudi Arabia. Vladimir Putin and Mohammed bin Salman are set to meet informally at the G20 this week and will likely make an informal pact then. We still think the two will lead a supply-cut deal despite having very different budget needs in terms of prices (Russia needs roughly $55/bbl to balance their budget while the Saudis need closer to $75/bbl.)

- Recent production data highlighted the need for cuts. The Saudis are reportedly on pace to produce 11.2m bpd in November while Russian production was steady at 11.4m bpd and US production was flat m/m near 11.7m bpd. Meanwhile global supply stocks continue to soar as demand can’t keep pace.

- Beyond flat price, time spreads continue to illustrate the bearish state of physical markets which are increasingly oversupplied. For brent, the 1-month / 6-month spread is currently trading near -1.10 yielding nearly 20-cents per month of contango. For WTI the same spread is yielding about 14-cents per month of contango. Both structures will ultimately push more barrels into storage by incentivizing later-dated sales where prices on the curve are higher.

- Hedge funds continue to aggressively sell ICE Brent and NYMEX WTI futures and options. Last week speculators were net sellers of 35k contracts between the two grades bring their combined net length to 334k- down by 10% w/w and down by 63% in just the last two months. Selling from speculators is clearly still a significant source of bearish risk in the market and OPEC+ will have to put some fear into the hearts of traders next week in order to raise the market. Until then, gross shorts positions held by funds have nearly quadrupled in the last two months for both of the two main contracts.

- US Fed chief Jerome Powell gave a boost to commodities, equities and bonds on Wednesday remarking that he believed interest rates are approaching a neutral level. The comment eased concerns that the Fed will continue its course of tightening rates next year and helped drive more buying of short-term bonds and a selloff in the US Dollar.

DOE WRAP UP

- US crude stocks increased for a tenth straight week jumping 3.5m bbls to 350m bbls. Overall inventories are now flat y/y further illustrating that OPEC’s previous round of production cuts have been almost completely undone by the most recent production flood coming from OPEC, Russia and the US.

- US producers pumped 11.7m bpd last week for an increase of 2m bpd in just the last twelve months. US crude production has averaged 10.7m bpd in 2018, up from 9.4m bpd in 2017.

- US crude exports printed 2.4m bpd and have averaged 1.9m bpd so far in 2018 after averaging 1m bpd in 2017. US crude exports to China continue to run at 0 bpd (and have since August) after averaging 350k bpd last year.

- US crude imports printed 8m bpd last week and are averaging 7.9m bpd in 2018 after averaging 8m bpd in 2017.

- Inventories in the Cushing, OK WTI delivery hub jumped more than 1m bbls w/w to 36.5m bbls and are higher by more than 14m bbls in just the last ten weeks.

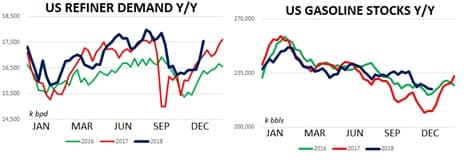

- On a more bullish note, US refiner demand printed 17.6m bpd and is within spitting distance of its all-time high.

- US gasoline demand + exports are showing decent y/y growth at 10.25m bpd. US distillate demand exports are better y/y by about 6% at 5.3m bpd. Exports of refined products have been particularly strong in recent weeks recently jumping to an all-time high over 8.7m bpd.

- Refined product supplies are still a mixed bag in the US. Gasoline stocks are higher y/y by 7% at 224m bbls and are particularly bloated on the east coast. US distillate stocks are lower y/y by 3% continuing to provide one of the few sources of support for the market.