November 2018 will not go down in the history of oil trading as a successful month, in fact it was so bad that the last time we witnessed such a steep decline was in 2008. The upcoming G20 meeting in Buenos Aires and OPEC+ Summit in Vienna on December 06 are mired in a haze – Russia seems disinclined to cut production (especially in the frost-bitten winter period), whilst Saudi Arabia prefers to keep a low profile about its plans, unsure whether the threat of US Congress sanctions is as formidable as it seems.

(Click to enlarge)

WTI declined more than 20 percent this week, with Friday trading oscillating in the 50-51 USD per barrel interval, whilst the global benchmark Brent fell to 58.5-59 USD per barrel. The „oil” ball is in the court of Russia and Saudi Arabia, whose top-ranking officials will meet this weekend to iron out a mutually acceptable course for the next couple of months.

1. US Commercial Stocks Unstoppable for 10th Consecutive Week

(Click to enlarge)

- Contrary to all expectations, US commercial crude stocks continued to rise for the 10th week in a row, increasing 3.6 MMbbl week-on-week to reach 450.5 MMBbl.

- A large part of the stock buildup is due to the Strategic Petroleum Reserve drawing down 2 MMbbl.

- Refinery runs have reached their highest level since September, increasing 698kbpd week-on-week to reach 17.553 Mbpd.

- The export arbitrage has allowed US producers to export 2.44mbpd of crude,…

November 2018 will not go down in the history of oil trading as a successful month, in fact it was so bad that the last time we witnessed such a steep decline was in 2008. The upcoming G20 meeting in Buenos Aires and OPEC+ Summit in Vienna on December 06 are mired in a haze – Russia seems disinclined to cut production (especially in the frost-bitten winter period), whilst Saudi Arabia prefers to keep a low profile about its plans, unsure whether the threat of US Congress sanctions is as formidable as it seems.

(Click to enlarge)

WTI declined more than 20 percent this week, with Friday trading oscillating in the 50-51 USD per barrel interval, whilst the global benchmark Brent fell to 58.5-59 USD per barrel. The „oil” ball is in the court of Russia and Saudi Arabia, whose top-ranking officials will meet this weekend to iron out a mutually acceptable course for the next couple of months.

1. US Commercial Stocks Unstoppable for 10th Consecutive Week

(Click to enlarge)

- Contrary to all expectations, US commercial crude stocks continued to rise for the 10th week in a row, increasing 3.6 MMbbl week-on-week to reach 450.5 MMBbl.

- A large part of the stock buildup is due to the Strategic Petroleum Reserve drawing down 2 MMbbl.

- Refinery runs have reached their highest level since September, increasing 698kbpd week-on-week to reach 17.553 Mbpd.

- The export arbitrage has allowed US producers to export 2.44mbpd of crude, after the previous two weeks’ somewhat weak average of 2mbpd.

- The extent of the refinery throughput and export volumes increase was offset by a substantial hike in imports, rising 0.6mbpd w-o-w to 8.1mbpd.

- Gasoline stocks have decreased for the third week in a row, reaching 224.5MMbbl, with strong exports (averaging now 1.1mbpd) pointing to the likelihood of further draws.

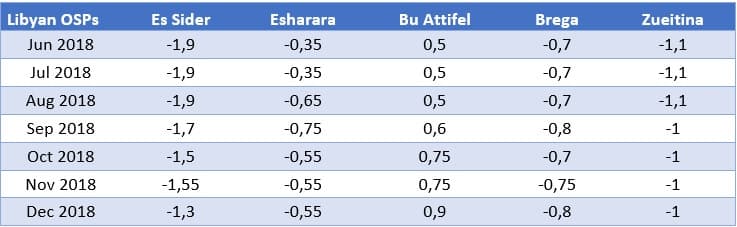

2. Libyan NOC Hikes December OSP Prices

(Click to enlarge)

- The Libyan NOC has raised most of its official selling prices for December-loading crudes by 5-25 cents.

- Es Sider prices experienced the sharpest hike, with discount to Brent Dated moving from -1.55 USD per barrel in November to -1.3 in December 2018.

- After no cargoes were loaded from mid-June to mid-July, Es Sider is back on track to its usual 2 Suezmax cargoes per week routine.

- The only grade to see its premium cut was Brega, a rare cargo on the seas anyway with a mere one Aframax loading in November (in H1 2018 there were usually 3 cargoes per month).

- Abu Attifel prices were raised to +0.9 USD per barrel against Dated Brent, attaining a two-year high.

- Both offshore Libyan grades, El Jurf and El Bouri, set vs the Urals Mediterranean, saw price increases of 10 cents and 20 cents, respectively, for December loadings.

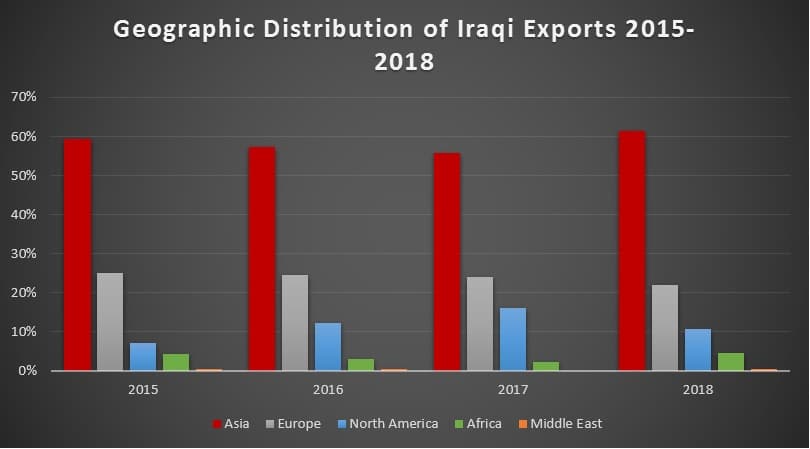

3. Iraq 2019 crude oil term deals

(Click to enlarge)

Source: Oilprice data.

- Iraq’s short-to-medium bet is on Asia as it wants to increase the share of its exports there from the current 61.5 percent to 67 percent in 2019.

- Europe, representing 22 percent of Iraqi exports this year, is expected to account for 20 percent of Iraqi exports, according to SOMO’s 2019 term contract commitments.

- 2019 volumes to the United States are expected to bounce back to 13 percent from the current 10.5 percent, whilst exports to Africa seem to be evaporating altogether.

- The 2019 term contract allocation comprises Basrah Light, Basrah Heavy and Kirkuk, too, which SOMO started marketing late November, albeit at a partial volume of 100kbpd available.

- This geographic allocation comes amid SOMO pressurizing its customers to curtail third-party sales and comply with destination clauses, which are generally expected to become stricter next year.

- SOMO’s drive to disallow term lifters from reselling allocated cargoes is widely seen as an element in the state oil marketer’s strategy to reserve this right to itself and its joint ventures.

4. Wintershall Joins UAE Sour Gas Game

(Click to enlarge)

- The German Wintershall became the 2nd foreign oil company to be awarded a share in the ultra-sour Ghasha Concession, after ENI received 25 percent two weeks ago.

- With recoverable reserves of around 1.7 TCf of gas and more than 200 MMbbls of oil, Ghasha is expected to ease UAE’s gas shortage.

- Despite having significant gas reserves, the UAE imports natural gas from Qatar via the Dolphin pipeline, whilst 25-30 percent of domesticall produced gas is reinjected into producing oil fields.

- The plateau production, to be reached several years after the project is commissioned in 2024-2025, is expected to be around 1.5 BCf per day for gas and 120kbpd for condensate.

- Both ENI and Wintershall have signed up for 40 years into the concession, following in the footsteps of French Total that joined the Ruwais sour gas project.

- Being an offshore project located in a UNESCO-protected biosphere reserve, European partners are expected to provide financing support and know-how on how to construct the required infrastructure (artifical islands) in line with environmental standards.

5. Russia Poised to Ramp up Supplies to India

Source: OilPrice data.

- U.S. sanctions vis-à-vis Iran have so far failed to materialize in any substantial hike in Russian crude exports to India, a long-coveted target for Moscow.

- Following last year’s record-breaking level of 100kbpd of Russian exports to India, this year’s YTD average accounts for a „mere” 65bkbpd.

- Rosneft bought Essar Oil’s 20mtpa Vadinar refinery last year, inking a 10-year deal, under which it would supply 100 million tons of crude to it.

- Yet so far Russia is only 11th on the list of Vadinar suppliers, Iraq, Iran and Nigeria combined taking up half of the supplies.

- Rosneft itself prefers to supply Vadinar with the Venezuelan Merey it gets from PDVSA after the hefty advance payments of the previous years.

- Thus, in order for its Russian volumes to be supplied, Rosneft will have to cherish hopes the waivers will not be extended for India.

6. China Steps In to Replace Total in South Pars

(Click to enlarge)

- The Chinese state-owned CNPC has replaced the French Total in Phase 11 of the South Pars gas project, the largest gas field in the world.

- This marks the abrupt end of the first deal ever concluded under the newly designed Iran Petroleum Contract.

- Thus, CNPC has brought its stake in the project to 80.1 percent, since it already owned 30 percent of the project.

- It remains to be seen what the Chinese intend to with the gas (production capacity of 2BCf per day of gas and 80kbpd of condensate for Phase 11 alone), initially Phase 11 volumes were expected to feed into the Iranian gas network.

- Iran’s gas production has suffered significantly smalle damage from US sanctions than crude, moreover, in case of a potential escalation South Pars volumes might be marketed by CNPC as equity volumes.

7. North Sea Crude Trading Moves to Blockchain Territory

- Vakt, the Blockchain-based trading platform created last year, went live this week, although no trades have been realized so far.

- Vakt is backed by all the main majors that have an interest in North sea trading – BP, Royal Dutch Shell, Equinor, Mercuria, Gunvor and Kock Supply and Trading.

- Access to the platform for other interested parties will be opened in January 2019.

- Vakt shareholders want to connect it with komgo, a similarly Blockchain-based platform that focuses predominantly on the financial documentation (e.g.: letters of credit).

- It is expected that in the first stages Vakt will be used for BFOET trades and then expand to US pipeline crude and product deals in Northwest Europe.