Oil prices dipped over the week, but the next few days will be volatile due to escalating geopolitical concerns and trade war tensions

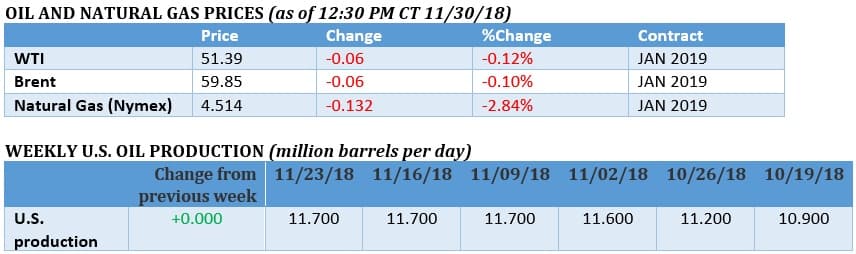

(Click to enlarge)

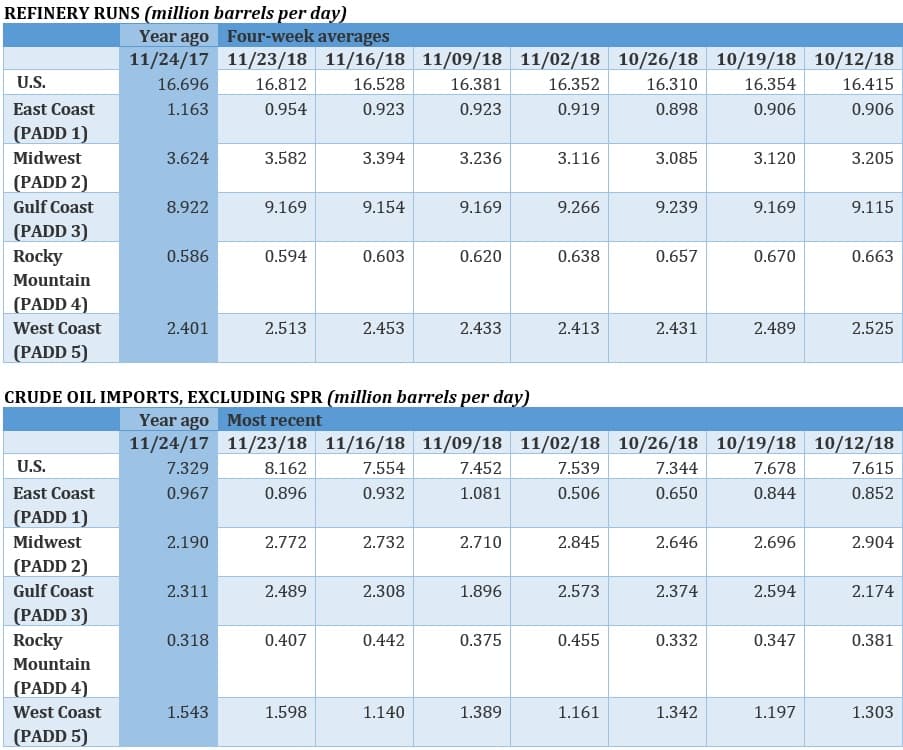

(Click to enlarge)

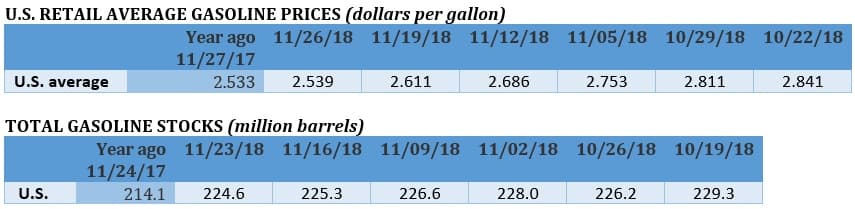

(Click to enlarge)

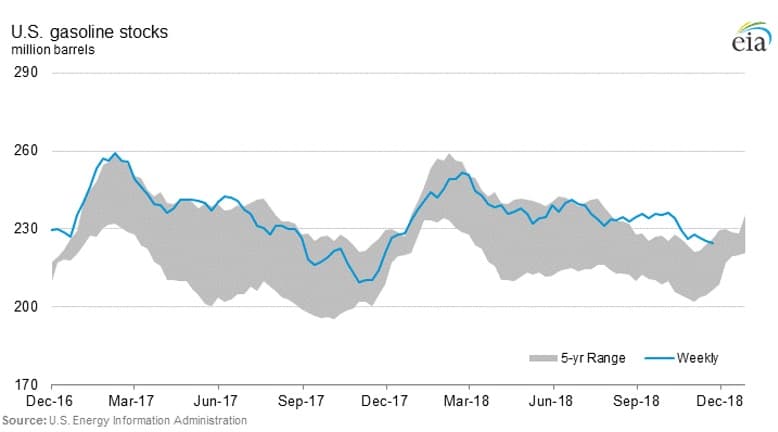

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, November 30, 2018

Oil prices dipped in early trading, but the next few days will be volatile. First, any news from the G20 summit on the Trump-Xi meeting regarding the trade war could have ramifications for the global economy and oil demand heading into 2019. But much of next week will be characterized by whatever jawboning or rumors come out of upcoming OPEC meeting. For now, oil is downbeat but awaiting direction.

U.S. Senate vote hamstrings Saudi Arabia. Saudi Arabia is aiming to cut oil production in order to boost prices, but the recent vote by the U.S. Senate to end the war in Yemen, even if it doesn’t become law, heightens the pressure on Riyadh to assuage American concerns. That gives President Trump more leverage as he demands lower oil prices from Saudi officials. Riyadh faces a choice between accepting painfully low oil prices or defying Washington by cutting production. Reports suggest they are going to try to thread the needle, opting for modest cuts that at least put a floor beneath crude prices. “President Trump has effectively put a ceiling on oil prices -- arguably this ceiling is about $70 a barrel Brent, maximum $75,” Thibaut Remoundos, founder of Commodities Trading Corporation Ltd., told Bloomberg. “It will be interesting to see if Saudi-Russia can keep the floor in place.” Related: Oil Prices Set To Book Worst Month In A Decade

Saudi Arabia struggling to convince others to cut. Many members of the OPEC+ coalition want Saudi Arabia to do all of the heavy lifting when it comes to production cuts. After all, they argue, Saudi Arabia was the one that added 1 million barrels per day of fresh supply since May. The Saudis “made this mess. They need to clean it up,” a Middle Eastern oil official told the Wall Street Journal. On Wednesday, Saudi oil minister Khalid al-Falih indicated that Saudi Arabia would not cut alone.

Trump administration to advance seismic drilling in Atlantic. The Trump administration is taking an early but critical step that could pave the way to oil exploration in the Atlantic Ocean. According to Bloomberg, the National Marine Fisheries Service could allow seismic surveying by five companies in the Atlantic, a precursor to exploration. Seismic testing is essential to exploration, but is highly controversial because of its effect on marine animals such as whales and dolphins.

Russia shows signs of support for OPEC+ cuts. Russia indicated that it could support an OPEC+ production cut next week in Vienna. Russia’s deputy foreign minister said that Russia wants more predictability and “smooth price dynamics.” However, Russia, and its oil firms, are not scared of lower prices. “Russian crude producers will feel comfortable in the $50 to $60 per barrel band,” said Dmitry Marinchenko, oil and gas director at Fitch Ratings.

Canadian oil discounts leading to layoffs. Oil prices for Western Canada Select (WCS) are trading below $15 per barrel, inflicting pain on the entire sector. Oilfield services companies in Alberta are issuing layoffs as activity slows down. Investment broker Peters & Co. said in a note that drilling activity has fallen by 10 per cent in recent weeks and could “weaken further over the course of December, a function of budget exhaustion and the curtailment of capital spending.”

Permian natural gas prices fall below zero. Natural gas prices at the Waha hub in the Permian fell into negative territory this week amid a worsening glut. A lack of pipelines to ferry away natural gas has some producers essentially paying other companies to take the product.

Shale industry could cut spending. The U.S. shale industry could cut budgets for the first time since the last downturn years ago. Shale companies are formulating their 2019 budgets right now, and the latest crash in prices could force a more cautious approach. “Something has to give,” Andy McConn, an analyst at Wood Mackenzie, told Bloomberg. “We expected some minor increases in budgets going into next year but now we see risk to the downside, with budgets flat or down year on year.”

China buying oil while it’s cheap. Bloomberg reports that China may be stepping up its purchases of oil as prices hit one-year lows, although data is spotty.

Related: Natural Gas Drives Saudi Geopolitical Pivot

EPA to send ethanol blending requirements. The Trump administration’s EPA is set to announce ethanol blending requirements for 2019, which will include an increase in advanced biofuels by 15 percent while conventional corn ethanol levels will be kept flat. The implication is that the EPA has decided not boost the corn ethanol requirement to compensate for the rush of waivers it granted to oil refiners over the past two years, which ethanol producers have blamed for sinking the market for ethanol credits.

Iran’s nuclear chief warns that time is running out on nuclear deal. Iran’s top nuclear official warned the European Union that it could exit the 2015 nuclear deal if it does not begin to see some of the benefits from European efforts to rescue the accord. “If we cannot sell our oil and we don’t enjoy financial transactions, then I don’t think keeping the deal will benefit us anymore,” Ali Akbar Salehi, head of the Atomic Energy Organisation of Iran, told Reuters. “I think the period of patience for our people is getting more limited and limited. We are running out of the assumed timeline, which was in terms of months.” Meanwhile, the U.S. State Department said that Iran’s oil exports would fall further “very soon.”

Refining margins sink to five-year lows. Flat U.S. gasoline demand and high refinery output have combined to push refining margins down to five-year lows, according to the EIA.

Pemex triples estimated reserves for oil field. Pemex more than tripled the estimate reserve figure for its Ixachi field, saying the field in Veracruz could now hold 1.3 billion barrels of oil equivalent in proven, probable and possible (3P) reserves. “Without doubt this news will allow Pemex to contribute with more production in the future and stabilize the production platform,” outgoing Pemex CEO Carlos Trevino said.

LNG from Africa set to surge. New LNG capacity from Mauritania and Senegal in West Africa, operated by Kosmos Energy (NYSE: KOS), is set to come online in December. Other projects will come online in Cameroon, as well as Mozambique in East Africa, in the coming years. Many projects are using floating LNG, cutting costs and lead times relative to conventional onshore fixed facilities. “Africa is the hot spot for floating LNG,’’ said Lucas Schmitt, a senior gas analyst at consultants Wood Mackenzie Ltd., according to Bloomberg. “Confidence in floating facilities is firming up.’’

Volkswagen plans EV plant in U.S. Volkswagen is considering a plant in North America to manufacture electric vehicles. “We are 100 percent deep in the process of ‘We will need an electric car plant in North America,’ and we’re holding those conversations now,” Scott Keogh, the newly appointed CEO of Volkswagen Group of America, told journalists at the Los Angeles auto show. Earlier this month, VW said it would spend $50 billion by 2023 to remake itself, with a focus on EVs.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com:

- Qatar Looks To Revitalize Trade Amid Embargo

- Natural Gas Prices Fall Below Zero In Texas

- The Biggest Winners Of The Oil Price Slump

The other direction is that its economy needs an oil price above $80 a barrel to be able to balance the budget. Therefore, it has no alternative but to try to persuade OPEC in their meeting in December to cut production. If Saudi Arabia’s oil minister Khalid al-Falih is now saying that his country will not cut production without a collective decision from the OPEC+ members, then he should have consulted them before he succumbed to President Trump’s pressure on his country and raised oil production in collaboration with Russia against the wishes of the overwhelming majority of OPEC members in their meeting in June. The Saudis sacrificed then their national interests and those of the OPEC members to please President Trump.

Still, OPEC need not cut any production. The overwhelming OPEC members could be against any new cuts. Instead, they will demand that Saudi Arabia and Russia withdraw the 650,000 barrels a day (b/d) they jointly added to the market in June and return them to the original 1.8 mbd cut under the OPEC/non-OPEC agreement. In so doing, the glut in the market will ease.

Having made a grave mistake in June by adding 650,000 b/d to the market, Saudi Arabia and Russia are not in a position to ask OPEC members for new cuts.

There is no doubt that the escalating trade war between the US and China has created uncertainty in the global economy impacting on the growth of the global demand for oil. That is why the forthcoming meeting between President Trump and the Chinese leader Xi Jingping on Saturday on the fringes of the G20 summit in Buenos Aires is awaited with great anticipation.

President Trump did not really anticipate China’s response when he imposed tariffs on its exports to the United States. He thought that China will bend the knee to him. This not only didn’t happen but China retaliated blow by blow to his imposition of tariffs. Moreover, it stopped completely buying US crude oil and curtailed very significantly purchases of US LNG.

It is now dawning on President Trump that he can’t win a trade war with China. Moreover, he is very ill-advised to threaten China with more tariffs on the remaining $267 bn of its exports to the US on the eve of his meeting with his Chinese counterpart.

Despite President Trump’s tough talk, his position vis-à-vis China has been weakened in recent time. The trade war is already starting to take a toll on the US economy. American farmers have been hit hard by retaliatory tariffs from China, which have tanked prices for corn and soybeans. More recently, the stock market has seen a spike in volatility, and all of the gains US stocks have seen in 2018 have been wiped out in the last few weeks. Perhaps more painful was the recent announcement from General Motors that the company was closing down five factories and laying off 14,000 people. Automakers warned that steel and aluminium tariffs would cost the industry billions of dollars.

That is why I believe that President Trump may be more inclined to strike a deal with the Chinese President ending the trade war. Still, in typical Trump’s pattern, he will declare victory exactly as he did with North Korea. However, the global economy will give a huge sigh of relief.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London