2019 is young indeed but we’re already starting to see some signs of what will shape oil prices this year. On the downside, it’s clear that macro-economic concerns will continue to keep a lid on prices. On the upside, OPEC+ seems to mean business on their 1.2m bpd production cut offering, the key source of bullish risk in the market. These themes should sound familiar as bearish economic concerns and bullish tight supply concerns governed oil prices in 2018.

Away from oil, markets continue to signal that something is amiss with the 10-year old global economic recovery. Stock markets were hit hard this week after Apple lowered its 2019 revenue guidance based on slowing China sales- the company credited the Trump/Xi trade war in doing so- and S&Ps traded about 16% below their all-time high print just three short months ago. Equity market waves even created a mini ‘flash crash’ in several currency pairs. In China the carnage was even more severe with the Shanghai Composite lower by about 31% in the last twelve months following the release of China’s first contraction-territory PMI reading in 19 months. Even more interestingly, bond markets have begun to price in higher expectations of dovish central banking activity in 2019 allowing the yield curve to steepen slightly while rates have moved drastically lower. Not to be left out, commodities continue to show worsening deflation risks with the Bloomberg Commodity Index falling to its lowest mark in more than 2.5 years…

2019 is young indeed but we’re already starting to see some signs of what will shape oil prices this year. On the downside, it’s clear that macro-economic concerns will continue to keep a lid on prices. On the upside, OPEC+ seems to mean business on their 1.2m bpd production cut offering, the key source of bullish risk in the market. These themes should sound familiar as bearish economic concerns and bullish tight supply concerns governed oil prices in 2018.

Away from oil, markets continue to signal that something is amiss with the 10-year old global economic recovery. Stock markets were hit hard this week after Apple lowered its 2019 revenue guidance based on slowing China sales- the company credited the Trump/Xi trade war in doing so- and S&Ps traded about 16% below their all-time high print just three short months ago. Equity market waves even created a mini ‘flash crash’ in several currency pairs. In China the carnage was even more severe with the Shanghai Composite lower by about 31% in the last twelve months following the release of China’s first contraction-territory PMI reading in 19 months. Even more interestingly, bond markets have begun to price in higher expectations of dovish central banking activity in 2019 allowing the yield curve to steepen slightly while rates have moved drastically lower. Not to be left out, commodities continue to show worsening deflation risks with the Bloomberg Commodity Index falling to its lowest mark in more than 2.5 years on Wednesday.

As for upside risk OPEC+ production cuts officially started this week. We got an early look into the urgency felt by the group on Wednesday when the cartel’s December production estimates began to roll in. Bloomberg analysis saw production falling 530k bpd m/m to 32.6m bpd for its largest m/m decline in two years. Saudi Arabia lead the effort to tighten supplies by reducing output by 420k bpd to 10.65m bpd. Libyan production dropped by 110k bpd due to political turmoil causing outages at its largest field and Iran’s output fell by 120k bpd as U.S. sanctions began in earnest. In the near term it seems highly possible that reduced output from Saudi Arabia, Libya and Iran will help prevent further decimation of oil prices. Spread markets suggest as much as the prompt 1-month brent spread has treaded water with a modest contango of 25 cents which may find support as supply cuts- and the impact of Iranian sanctions- continue to deepen. Early estimates show that OPEC shipments to the U.S. fell to a 5yr low this (via Reuters) which will certainly lead to meaningful gains in inventory draws and put upward pressure on prices.

As we head into the new year, it seems likely to us that prices will maintain a largely sideways trend for the short term as news flow focuses on reduced OPEC supplies and global growth concerns. New risks will inevitably pop up, however, and we think that traders would be wise to continue to think about the mounting geopolitical and currency risks in the market which seem to be largely ignored. On the geopolitical side, Venezuelan crude exports quietly fell to a 28 year low in December at 1.25m bpd. Meanwhile Iranian sanctions are finally showing teeth, Libya’s largest field continues to struggle and Saudi Arabia seems dead serious in their will to prevent another market collapse. As for currencies, gold and bond markets are screaming that the Fed will turn more dovish in 2019 but the US Dollar Index continues to hold its 2018 gains. It seems highly possible to us that the market is underpricing the bullish potential of more geopolitical risk and a lower US Dollar, at which point the only weight left to keep the market sideways would be a serious decline in the health of the global economy. All scenarios are possible, leaving us plenty to worry about for the next twelve months!

Quick Hits

- Oil prices moved slightly higher this week after December OPEC production data revealed larger than expected declines from Saudi Arabia, Iran and Libya. The three countries combined to remove about 650k bpd from the market versus December.

- Brent traded near $56 at the end of the week for a gain of about $6 from its low point on December 26th. WTI traded near $47 for a $4 jump.

- The Bloomberg Commodity Index printed 76 this week for a 3yr low. The index is lower by 15% from its recent cycle peak in May. Gold prices have notably increased by about 13% since September suggesting that investors see heightened odds of dovish US Fed policy in 2019. Copper prices also suggest turmoil in the global economy and are down 24% since June.

- Hedge funds were net sellers of WTI futures and options last week and net buyers of Brent. Net length in both contracts continues to languish near 3yr lows and is lower by about 70% since September. The recent Brent buying broke a 10-straight week streak of selling.

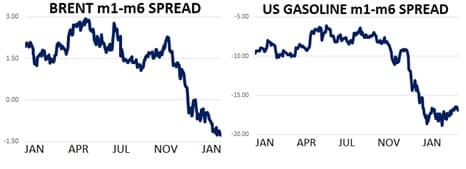

- Time spreads continue to lean bearish on short term market fundamentals. In Brent, the prompt 1-month/6-month spread is offering about 20 cents of contango per month and trending lower. 20 cents is a relatively modest amount of contango, but we’re concerned that the spread hasn’t shown any sort of bounce since the announcement of the OPEC+ production cuts and the recent production losses from the Saudis, Libyans and Iranians.

- US time spreads are looking significantly more bearish and are yielding 40 cents per month of contango through the first six months of the curve. The relative bearish structure for WTI is due to the surge in US production and limited takeaway capacity to move US barrels overseas.

- US refined product markets show a more positive view of the market as the prompt 6-month gasoline spread has flattened and even trended higher since October.

- The IEA and OPEC recently released fresh demand forecasts for the new year. The IEA sees global crude oil demand growth of 1.4m bpd while OPEC predicts 1.3m bpd.

- As for price forecasting, the IEA’s head of markets commented this week that predicting oil market moves will be even more difficult than usual this year as geopolitical and economic concerns mounts opposite a massive surge in US crude production and increased supply management from OPEC.

- Oil’s OIV index (NYMEX’s measure for implied volatility) has declined from 60 in late December towards 54 at the end of this week. Vols and option prices will continue to drop if prices remain stable.

- The skew for options prices remains bearish. This week 25 delta put options traded at a 5-vol premium to 25 delta call options (56% v. 51%.)

- Global refining margins remain low relative to historical levels and continue to fuel demand concerns. In the US, the WTI 321 crack is currently yielding $14/bbl which is $4/bbl below its 10yr average. Globally, the gasoil/brent crack is trading near $13/bbl which is $9 below its 10yr average.

- In currency markets the US Dollar continues to hold on to its recent gains despite continued confidence in bond markets that US Fed policy could turn dovish in 2019 should data remain sour. The DXY is currently trading near 96.3 which is just 0.7 points off of its recent high in November. The EUR/USD traded 1.14 this week which was basically flat over the last month.

- Bond markets continue to enjoy gains as traders forecast a more dovish US central bank. This week the US 10yr yield dropped to 2.55% for its lowest market since January of last year.

- Stock market carnage was widespread this week following Apple’s reduced revenue guidance for 2019. S&Ps traded near 2,450 which was lower by about 12% in the last month. The Shanghai Composite and Eurostoxx 50 Index are both trending low and down by 8% since early December.