For much of 2018, investors probably thought they had a strong bet in the energy complex. But that bet badly turned sour in the final 60 days of the year.

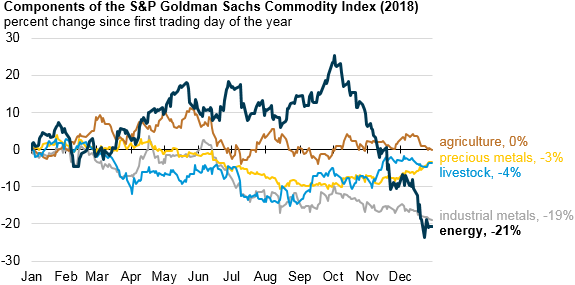

The spot energy index in the S&P Goldman Sachs Commodity Index (GSCI) gained 25 percent between January and October. But with the books closed on 2018, the index ended the year down 21 percent. The S&P GSCI “is a weighted average of commodity prices intended to reflect global commodity production quantities and futures contracts’ trading volumes,” according to the EIA. Energy was not the only commodities sub-sector in the GSCI index posting losses in 2018, just the worst-performing one.

(Click to enlarge)

Of course, that is largely just a reflection of the sharp decline in oil prices. But the share prices of most oil and gas companies are also largely based on oil price movements. So, the steep slide in oil prices in the final two months of 2018 led to disaster for investors in energy stocks.

“The stock market went to hell in December. And when it got there, it found that the energy sector had already moved in, signed a lease and decorated the place,” Tom Sanzillo, Director of Finance at the Institute for Energy Economics and Financial Analysis (IEEFA), wrote in a commentary.

The energy sector was at or near the bottom of the S&P 500 for the second year in a row, Sanzillo pointed out. And that was true even within segments of the oil and gas industry. For instance, companies specializing in hydraulic fracturing fell by 30 percent, while oil and gas supply companies lost 40 percent. “The fracking boom has produced a lot of oil and gas, but not much profit,” Sanzillo argued. Related: Moody’s: The Shale Band Is Back, And Here To Stay

Looking forward, there are even larger hurdles, especially in the medium- to long-term. Oil demand growth is flat in developed countries and slowing beginning to slow in China and elsewhere. The EV revolution is just getting started.

The last great hope for the oil industry is to pile into petrochemicals, as oil demand for transportation is headed for a peak. But profits in that sector could also prove elusive. “The industry’s rush to invest in petrochemicals to maintain demand for oil and gas is likely to continue, but the profit potential in this sector is more limited than oil and gas exploration, and is likely to keep the energy sector at or near the bottom of the S&P 500,” Sanzillo concluded.

In the meantime, the strategy for oil and gas executives to appease investors is to focus on “quick cash, quarterly payouts and fast talk,” Sanzillo says. “Either way the stocks lack a long-term value rationale.”

Meanwhile, the Wall Street Journal reports that the U.S. shale industry has been over-hyping the production potential from their wells. The WSJ compared well-productivity estimates from shale companies to those from third parties. After looking at the production data at thousands of wells and how much oil and gas those wells were on track to produce over the course of their lifespans, the WSJ found that company forecasts seemed to be misleading. Related: 2019 Could Make Or Break OPEC

“Two-thirds of projections made by the fracking companies between 2014 and 2017 in America’s four hottest drilling regions appear to have been overly optimistic, according to the analysis of some 16,000 wells operated by 29 of the biggest producers in oil basins in Texas and North Dakota,” reporters for the WSJ wrote. “Collectively, the companies that made projections are on track to pump nearly 10% less oil and gas than they forecast for those areas, according to the analysis of data from Rystad Energy AS, an energy consulting firm.”

Schlumberger, for instance, has reported that secondary shale wells near older wells in West Texas have been 30 percent less productive than the initial wells, the WSJ found. Also, many shale companies used data from their best wells and extrapolated forward, projecting enormous growth numbers that have not panned out.

The upshot is that shale companies will have to step up spending in order to hit the promised production targets. However, so many of them have struggled to turn a profit, and the recent downturn in oil prices has put even more pressure on them to rein in costs.

That raises questions about the production potential not just from individual shale companies, but also from the U.S. as a whole.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Gasoline Prices Could Be About To Skyrocket

- Oil Buyers’ Market In Asia Set To Continue

- $70 Oil Could Be Right Around The Corner

Aloha to the return of big trucks and SUV's and cheap airline tickets on long vacations, for a season anyways.

Wishful thinking, the share price declines are the opportunity of a lifetime as peak demand is still a couple of decades out.

Nice try EV guy.