The first week of 2019 has brought back some of the bullish sentiment that market watchers had given up on after three consecutive (and quite painful) weeks of losses. The reason for the recent oil rally lies in Saudi Arabia making good on its OPEC/OPEC+ promise to cut production. Total OPEC production has witnessed its steepest month-on-month decline in the last two years, dropping by more than 0.5mbpd to 32.6mbpd.

(Click to enlarge)

As more countries fulfill their production cut commitments, the market tension should ease somewhat, even though the bullish factors will be partially counteracted by growing US crude stockpiles. Dated Brent rose by almost 10 percent week-on-week to reach 57.5 USD per barrel on Friday afternoon, whilst WTI finished the week trading at 48-48.5 USD per barrel, gaining some 7 percent from last Friday’s 45.3 USD per barrel.

1. Saudi Arabia Cuts February 2019 OSPs

- Saudi Aramco, the Saudi state oil company, has raised the prices for most of its February-loading cargoes, most notably hiking Asia-bound prices.

- Arab Super Light witnessed the biggest increase (down by 0.6 USD month-on-month), whilst Extra Light was raised by 40 cents due to recovering light distillate margins in Asia Pacific.

- Arab Light and Medium saw only modest increases by 10 cents, whilst Arab Heavy was cut by 30 cents.

- Arab Heavy was the only grade that saw price relief (similarly 30 cents per barrel) in NW Europe-bound…

The first week of 2019 has brought back some of the bullish sentiment that market watchers had given up on after three consecutive (and quite painful) weeks of losses. The reason for the recent oil rally lies in Saudi Arabia making good on its OPEC/OPEC+ promise to cut production. Total OPEC production has witnessed its steepest month-on-month decline in the last two years, dropping by more than 0.5mbpd to 32.6mbpd.

(Click to enlarge)

As more countries fulfill their production cut commitments, the market tension should ease somewhat, even though the bullish factors will be partially counteracted by growing US crude stockpiles. Dated Brent rose by almost 10 percent week-on-week to reach 57.5 USD per barrel on Friday afternoon, whilst WTI finished the week trading at 48-48.5 USD per barrel, gaining some 7 percent from last Friday’s 45.3 USD per barrel.

1. Saudi Arabia Cuts February 2019 OSPs

- Saudi Aramco, the Saudi state oil company, has raised the prices for most of its February-loading cargoes, most notably hiking Asia-bound prices.

- Arab Super Light witnessed the biggest increase (down by 0.6 USD month-on-month), whilst Extra Light was raised by 40 cents due to recovering light distillate margins in Asia Pacific.

- Arab Light and Medium saw only modest increases by 10 cents, whilst Arab Heavy was cut by 30 cents.

- Arab Heavy was the only grade that saw price relief (similarly 30 cents per barrel) in NW Europe-bound cargoes, too, as Extra Light was hiked by 50 cents and the others were rolled over from last month.

- Interestingly, Saudi Aramco seems to be tightening the screws vis-a-vis the United States, as prices for all grades were raised for February 2019 by 15-30 US cents per barrel.

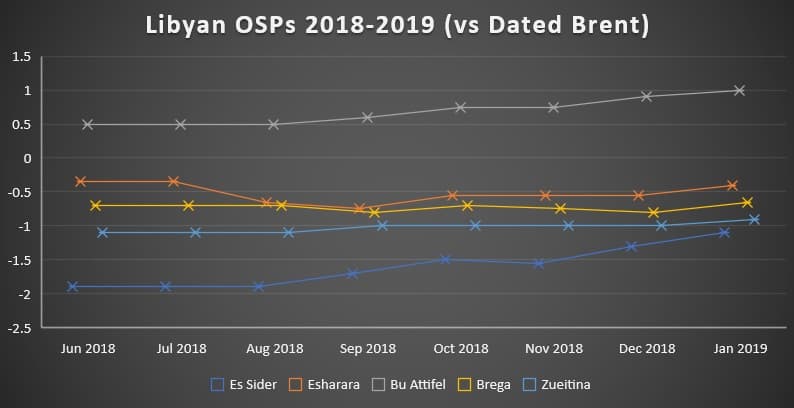

2. Libya hikes oil prices for January 2019

(Click to enlarge)

- Libya’s National Oil Company has hiked official selling prices on all its grades loading in January 2019 by some 10-20 US cents per barrel.

- This comes on the back of Mustafa Sanalla cutting a deal with the Petroleum Facilities Guards that took over the 350kbpd El Sharara field in early December.

- The force majeure will most likely be lifted in the upcoming days, bringing the total discontinuation period to a month.

- Libya’s usual reference grade, Mediterranean Urals, started off 2019 quite robustly, trading at +0.2-0.3 USD per barrel premium over Brent Dated.

- The average annual Med Urals-Dated spread amounted to -1.2 USD per barrel, all the significant December Med Urals appreciation notwithstanding.

- Es Sider’s January discount vs Dated was increased by 20 cents to -1.1 USD per barrel, whilst Esharara rose by 15 cents to -0.4 USD per barrel.

3. Iraq Hits New Export Record in December

(Click to enlarge)

- Hitting 4.14mbpd in December 2018, Iraqi oil export numbers have reached new heights, just as Iraq is supposed to start cutting back production following the OPEC/OPEC+ Agreement.

- Not only did export volumes from the Persian Gulf terminals (ABOT, Umm Qasr, Khor al Zubair) rise to 3.66mbpd, SOMO-controlled flows from Ceyhan rose to 0.1mbpd after a year-long hiatus.

- The all-time high, however, will not last for long as Baghdad has promised to curb production as soon as January 2019.

- The 0.15 mbpd production reduction commitment will result in Iraqi oil exports hovering around 3.9-4mbpd in the several months to come, whilst oil production will be capped at 4.51mbpd.

- According to Platts, the Iraqi government estimates average annual export volumes at 3.88mbpd, with oil prices averaging 56 USD per barrel for the upcoming year.

4. China’s Commerce Ministry Cuts Teapot Import Quota

- China’s Ministry of Commerce has awarded independent refiners, also labelled teapots, a H1 2019 import quota of 656 million barrels.

- This is more than a 25 percent less than the import quota for H1 2018, even though the current 1.8mbpd allocation is generally expected to edge higher.

- Teapots will now be tempted to go on a buying spree in the first months of 2019, so as to be legally able to apply for additional volumes.

- The quotas were granted to 58 companies – in most cases the allocated quota does not even meet 50 percent of their operational capacity.

- Interestingly, two new giant refineries belonging to Zhejiang Petroleum and Hengli Petrochemical (both 400kbpd) will be palpably constrained to fully start up their operations. The former is expected to start up in May 2019, the latter has started trial operations in November 2018.

5. India Nudges Iran Towards a ”Crude-for-Investments” Deal

(Click to enlarge)

- The Indian government has allowed Iran to use its crude money deposited in the state-controlled UCO Bank to buy Indian bonds and invest in Indian projects.

- Indian media are hinting in the direction of the Irani state oil company NIOC using its crude export proceeds to invest in Chennai Petroleum’s new endeavors – that is, the Indian refiner in which NIOC already has a 15.4 percent stake since 1965.

- Chennai Petroleum owns two refineries in Tamil Nadu, South India, with a total processing capacity of 11.5mtpa and is seeking to upgrade its 1mtpa Nagapattinam site into a 9mtpa state-of-the-art refinery.

- Indian Oil Corporation, the 51 percent owner of Chennai Petroleum, stated last year that it would tap the market anyway to gather funds for the Nagapattinam expansion.

- India has also allowed Iran to use its crude money to buy government bonds which have suffered greatly throughout 2018 amid the rupee depreciation.

- Iranian crude exports to India have averaged 0.3mbpd in November-December 2018, with state-owned Indian refiners fully availing themselves of the US-waivered volumes.

6. Fourth Zhoushan VLCC Terminal Enters the Crude Game

- The Chinese city of Zhoushan, located in the province of Zhejiang, will soon commission its fourth VLCC terminal with a throughput capacity of 260kbpd.

- The fourth terminal, which has already received its first trial cargo on December 29, will also boast a 3.5 million barrel storage tank farm, connected to ZWOEST’s 18 million barrel capacity tank farm on the adjacent island of Mamu.

- In its turn, the Mamu island storage tank farm will be linked to the first-ever private Zhejiang refinery hub, consisting of two 400kbpd refineries and two 1.4mtpa ethylene plants.

- The first of the 400kbpd Zhejiang refineries is expected to be commissioned in May-June 2019, up until then the terminal would most likely cater for the needs of Sinopec’s refineries in the region.

7. Petrobras to Focus on Deepwater

- In a much-awaited press conference following Jair Bolsonaro’s swearing in as President of Brasil on January 1, new Petrobras CEO Roberto Castello Branco outlined the main tenets of his upcoming tenure.

- In Castello Branco’s view, Petrobras should focus on areas where it is naturally powerful, meaning deepwater production will be prioritized over other segments.

- Asset sales, ranging from the divestment of onshore plays and stakes in four refineries (a plan that the Brazilian Supreme Court blocked last year) would be primarily used to reduce the company’s exorbitant debt, currently standing at some $85 billion. The new energy administration is intent to unblock several measures that hit an impasse in the Brazilian senate, most notably over the possibility to sell majority stakes in the Transfer of Rights (TOR) region in the Santos basin.

- Despite the postulated liberalization, Petrobras will not be privatized according to Castello Branco.