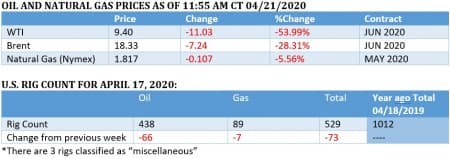

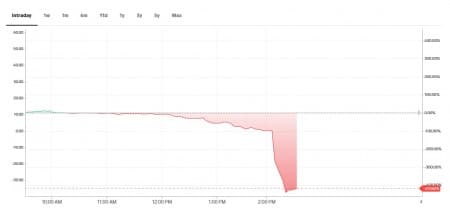

The May '20 WTI contract rebounded on Tuesday morning, but the June '20 WTI contract, the new front month contract is tanking, indicating that producers could be about to face much more pain the coming month.

Chart of the Week

- WTI closed at -$37 per barrel on Monday, the first time it has ever closed in negative territory.

- The development reflects traders trying not to get stuck with physical delivery for May as the contract expires on Tuesday. But the hot potato chaos also reflects a fundamental lack of storage.

- June WTI contracts are trading at a more reasonable but still catastrophic $9.40 per barrel as of 11:55 AM CT on Tuesday.

Market Movers

- BP (NYSE: BP) refineries are operating well below normal rates. Its Toledo, OH refinery is down nearly 30 percent, and its Whiting, IN refinery is 17 percent below capacity.

- Phillips 66 (NYSE: PSX) was upgraded to Buy by Bank of America while PBF Energy (NYSE: PBF) was downgraded to Neutral.

- Halliburton (NYSE: HAL) cut spending by $1 billion and also posted a $1 billion loss for the first quarter.

Tuesday April 21, 2020

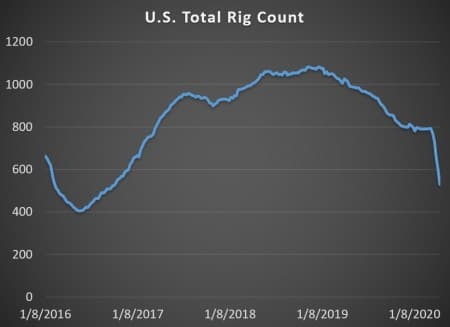

In a historic first, WTI closed in negative territory on Monday, or -$37.63 to be exact. The decline comes as the WTI contract for May expires on Tuesday. Analysts differed over the significance, since the expiring contract becomes increasingly irrelevant. But on Tuesday, the June and July contracts began to collapse as well, deepening the crisis for the oil industry.

Trump calls for bailout. In a tweet on Tuesday, President Trump said: “We will never let the great U.S. Oil & Gas Industry down. I have instructed the Secretary of Energy and Secretary of the Treasury to formulate a plan which will make funds available so that these very important companies and jobs will be secured long into the future!” For now, it is unclear what form such government help will take, although a week ago, Bloomberg reported that the Department of Energy was considering a plan to pay shale drillers not to produce.

Saudi Arabia considers cuts sooner. Saudi Arabia may cut as soon as possible, rather than waiting for May, according to the Wall Street Journal. “Something has to be done about this bloodbath,” said a Saudi official familiar with the matter. “But it might be a little bit too late.”

Trump considers halting Saudi imports. The U.S. celebrated the OPEC+ deal a week ago, but with oil prices collapsing once again, the Trump administration may consider limits on imports. “We certainly have plenty of oil, so I’ll take a look at it,” he said.

Trump wants to fill SPR. On Monday, Trump once again pushed for filling up the SPR. “This is a great time to buy oil...Nobody's ever heard of negative oil before.”

Oil industry lobbying for Fed help. The U.S. oil and gas industry “has asked the Federal Reserve to change the terms of a $600 billion lending facility so that oil and gas companies can use the funds to repay their ballooning debts,” Reuters reported.

Premium: Oil Storage Nears Its Limit

Alberta calls for help. The Canadian government announced a C$2.45 billion aid package for Canada’s energy sector last week. Alberta Premier Jason Kenney said the province needs more. “More support is needed to deal with the crisis in Canada’s energy sector, but this is a great first step,” Kenney said. “Our energy sector is facing its biggest challenge ever, and we need to be sure that industry can access the capital it needs to survive and thrive in future years.”

Saudi oil stored at sea. At least one in 10 supertankers is storing oil at sea, and some of those cargoes originated from Saudi Arabia, according to the Wall Street Journal. “The kingdom is now facing a situation where they may have to shut parts in their production, likely from Ghawar and others because they don’t have buyers,” a senior Aramco executive told the WSJ. “The fact is buyers don’t have storage so regardless of whatever level of output you want, there won’t be storage for it.”

Canada cuts steam-driven oil projects. Steam-assisted gravity drainage (SAGD) oil projects in Canada are facing shut ins and the curtailment could cause permanent damage. ConocoPhillips (NYSE: COP) cut output by 100,000 bpd, while Husky Energy (TSE: HSE) and Cenovus Energy (NYSE: CVE) cut production by 15,000 bpd and 45,000 bpd, respectively. Total Canadian shut ins could total 1.5 mb/d, according to TD Bank.

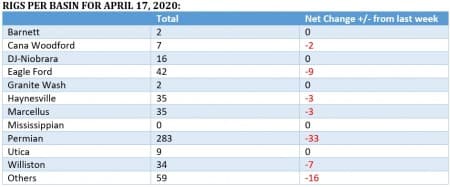

Halliburton cuts $1 billion. Halliburton is cutting jobs, cutting capex by $1 billion and warning of a steep downturn. “We expect activity in North America land to sharply decline during [Q2] and remain depressed through year-end, impacting all basins,” CEO Jeff Miller said. “Activity is in free fall in North America.”

Premium: The Oil Sector That Will Suffer The Most

Oil industry loses 51,000 jobs. An estimated 51,000 jobs were lost in the oil industry in March, a 9 percent reduction that will surely grow much more severe in the weeks ahead. “We’re looking at anywhere between five and seven years of job growth wiped out in a month,” Philip Jordan, VP at BW Research Partnership, a research consultancy, told Bloomberg. “What makes it sort of scary is this really is just the beginning. April is not looking good for oil and gas.”

WoodMac: Non-OPEC supply to fall by 4 mb/d by end-2021. Wood Mackenzie updated its forecast for supply declines, noting that cut backs are happening faster than the firm thought just a few weeks ago.

India’s fuel demand plummets by 50%. India’s demand for all fuels fell by 50 percent in April.

Russia orders companies to cut 20 percent. Russia’s energy ministry told domestic oil producers to cut oil production by 20 percent from February levels, a sign that Moscow intends to follow through on the OPEC+ deal.

China doubles stockpiling. China doubled the fill rate at its strategic and commercial inventories in Q1 2020, with some 2 mb/d of oil not processed by refiners in the first quarter.

Whiting Petroleum gets delisting warning. Whiting Petroleum (NYSE: WLL) was given a delisting notice from the NYSE because its share price is in danger of trading below $1 per share for a 30-day period. Whiting filed for bankruptcy on April 1.

By Tom Kool of Oilprice.com

More Top Reads From Oilprice.com:

- Goldman: Don’t Expect U.S. Oil Prices To Recover Soon

- What’s Next For Oil As Prices Go Negative?

- A Massive Wave Of Shut-Ins Fails To Halt Oil Price Crash