Despite various bullish geopolitical and fundamental factors, bearish sentiment appears to have reentered the market after a particularly long rally.

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

(Click to enlarge)

Friday, May 3rd, 2019

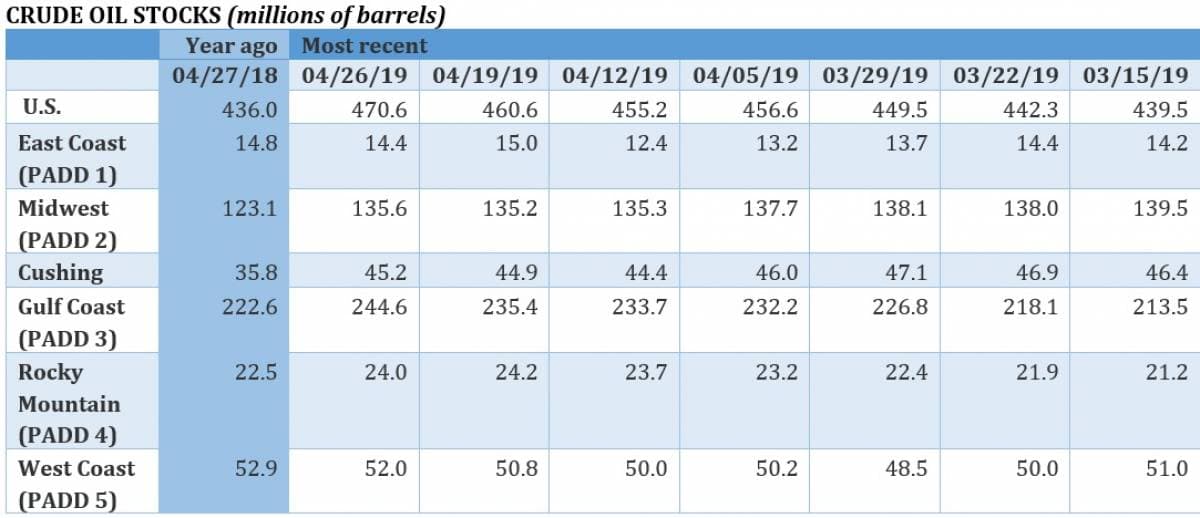

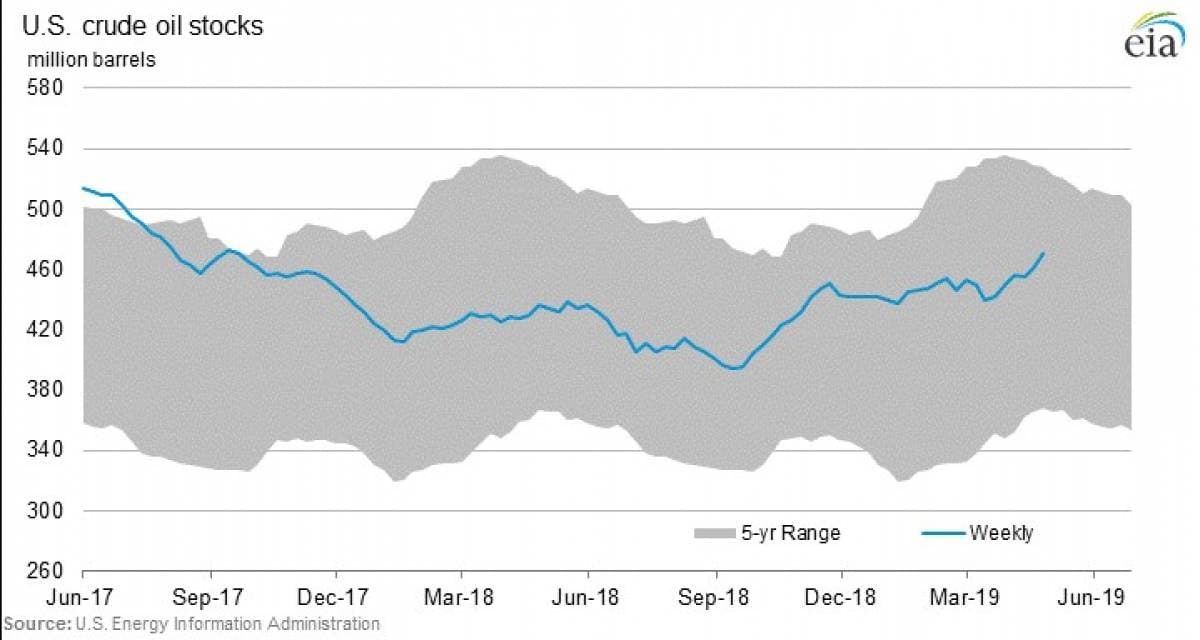

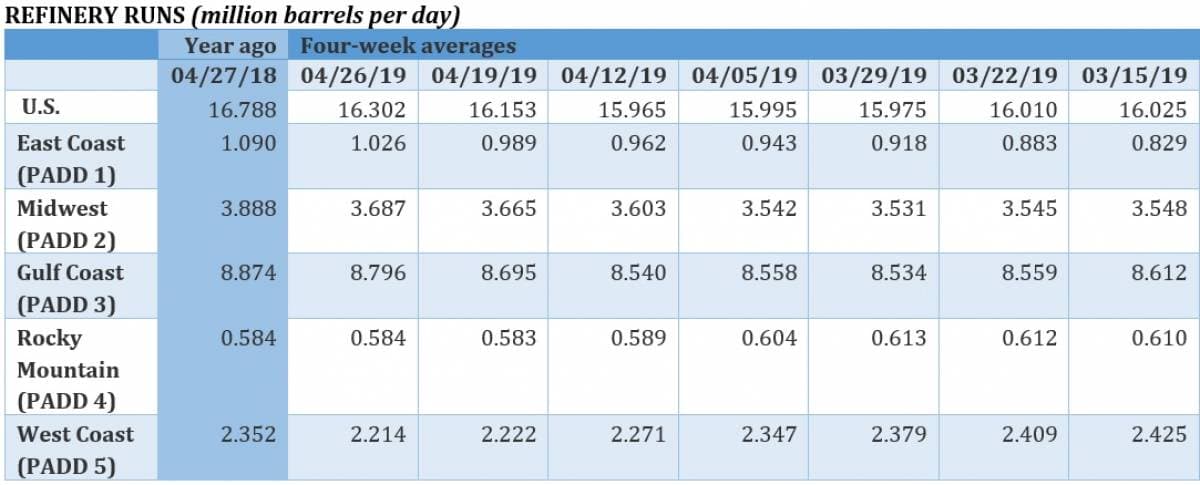

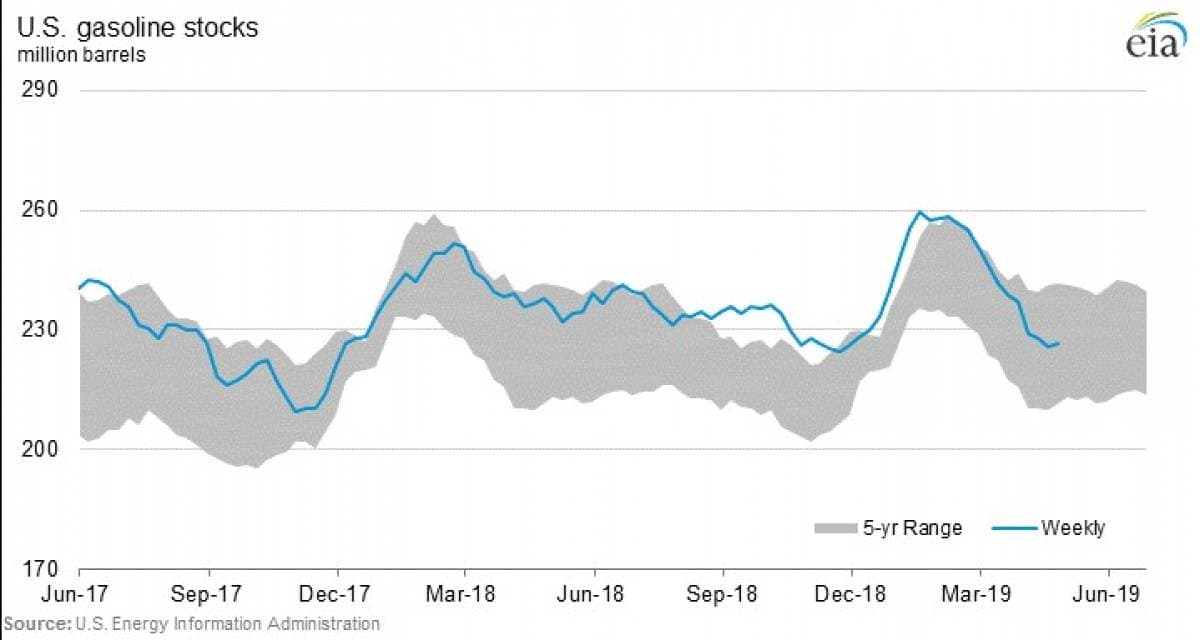

The oil price rally ended this week, with rising U.S. inventories and production scaring away the bulls. Crude stocks soared by 10 million barrels and U.S. production rose to 12.3 mb/d in the last week of April.

Iran warns OPEC is about to collapse. Iran’s oil minister said that OPEC may fall apart. “Iran is a member of OPEC for its interests and any threat from member states won’t go unanswered,” Bijan Namdar Zanganeh said, referring to Saudi Arabia’s apparent coordination with the U.S. on Iran sanctions. “I told [OPEC Secretary-General Mohammad] Barkindo that OPEC is in danger by the unilateralism of some members and the organization faces the risk of collapse.” Last year, Qatar quit OPEC, but it would be a much more significant development of Iran were to exit.

ExxonMobil to invest $2 billion in Baytown chemical plant. ExxonMobil (NYSE: XOM) said that it would move forward on a $2 billion expansion of its Baytown, TX chemical facility. The investment is the latest in the company’s “Growing the Gulf” campaign, a $20 billion 10-year spending spree on chemical and petrochemical projects on the Gulf Coast. Related: Oil Market Is Set To Become Very Tight Later This Year

Oil prices fall on U.S. inventory increase. The increase in crude inventories by 10 million barrels last week helped spark an oil price selloff on Thursday. “Amid this host of bullish catalysts is one deepening pocket of weakness - U.S. oil stocks are swelling due to an upswing in crude inventories,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London, according to Bloomberg. “Glut alarm bells are ringing louder in the U.S.”

Phillips 66 sees earnings fall. Phillips 66 (NYSE: PSX) saw its profits fall to just $204 million in the first quarter, less than half of the $524 million it earned in the same quarter a year earlier. The company said that outages and low refining margins ate into the bottom line.

Shell outperforms rivals on LNG. Royal Dutch Shell (NYSE: RDS.A) reported a minor decline in first-quarter earnings to $5.4 billion, exceeding forecasts. Its trading and LNG unit helped mitigate the poor market conditions and allowed Shell to outperform its peers.

Vermont utility to use Tesla batteries. Vermont utility Green Mountain Power aims to use 100 percent renewable energy by 2030, and will use home batteries from Tesla (NASDAQ: TSLA) to achieve that goal.

OPEC production hits a four-year low. OPEC production fell to a four-year low in April, according to Reuters. Declines in Venezuela and Iran were largely to blame. The cartel’s collective output stood at 30.23 mb/d, down 90,000 bpd from March and the lowest since 2015. “The Iran sanctions come on top of already fragile supplies and raise concerns about tightening markets,” Norbert Ruecker of Swiss bank Julius Baer said.

Small businesses prepare for recession. A Bank of America survey found that roughly two-thirds of small businesses in the U.S. are preparing for an economic recession by setting aside cash or cutting expenses.

Saudi Arabia could boost output in June. Saudi Arabia said it may increase oil production in June, but any increase would likely be consumed domestically for electricity generation, leaving little extra left over for exports.

France to delay nuclear cutbacks by 10 years. France pushed off a nuclear power reduction date by 10 years as part of a plan to reduce carbon emissions. Instead of slashing nuclear power by 50 percent by 2025, France will do so by 2035. Related: Iraqi Oil Industry Takes A Critical Turn

Saudi Arabia aims to produce shale gas. Saudi Aramco is hoping to achieve a 15-fold increase in natural gas production from unconventional sources over the next decade. “We are looking to take our unconventional gas within the next 10 years to 3 billion standard cubic feet a day of sales gas,” chief Executive Officer Amin Nasser told reporters.

GM announces plan for electric pickup truck. GM (NYSE: GM) confirmed its plan to launch an all-electric pickup truck. “We intend to create an all-electric future that includes a complete range of EVs, including full-size pickups,” GM CEO Mary Barra said during an earnings call, declining to offer further details.

Trump to slash offshore oil regulations. The Trump administration is set to loosen regulations on monitoring and third party certifications of emergency equipment for the offshore oil sector. The regulations were put into place in response to the 2010 BP (NYSE: BP) Deepwater Horizon disaster.

UK can cut emissions to zero by 2050. The Committee on Climate Change, an independent adviser to the British government, said that the UK can eliminate greenhouse gas emissions by 2050, and that if other countries follow suit, there is a 50-50 chance that the world can stay below 1.5C warming by 2100.

Tesla to raise shares. Tesla (NASDAQ: TSLA) said it would raise $2 billion in fresh capital, with $1.35 billion in convertible notes and $650 in fresh equity. The move comes after Tesla reported a major loss in the first quarter.

Tesla sees shortages of key metals and minerals. Tesla (NASDAQ: TSLA) said that it sees future shortages in copper, lithium, nickel and other key components used in electric vehicles. The top global supply manager for battery metals at Tesla said that underinvestment in mining could result in a shortage in the years ahead. U.S. lawmakers are proposing legislation to streamline permitting for new mines to help stimulate domestic mining of critical metals.

Amsterdam to ban fossil fuel cars by 2030. Gasoline and diesel vehicles and motorcycles will be prohibited from entering Amsterdam beginning in 2030 in an effort to improve air quality.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com: