Fundamentals rule. The U.S. conflict with Iran and the widespread instability across the Middle East are only registering as blips on the oil market radar. Not even the seizure of an Iranian oil shipment to Syria could move the needle.

Oil prices continue to fall on a series of critical fundamentals:

- US crude production fell for the third week in a row, but the US crude oil inventory draw was uneventful at best.

- Wednesday US govt data shows new orders for factory goods plummeting for the second consecutive month in yet another sign the US economy is weakening.

- On the sanctions front, Venezuela’s exports are actually recovering as it continues to export oil to Asia (mostly China).

- The extension of the OPEC production cut deal earlier in the week had a subdued effect because the market had priced it in ahead of time.

The elephant in this room is definitively the US economy and signs of slowing global demand growth. The EIA, IEA, and OPEC have all revised their own demand growth projections downward, ranging from 1.14-1.2 million bpd for 2019, and 1.4 million bpd in 2020. It’s a big elephant.

Iranian Oil Flows Freely To China. Now It’s Time To Save Face

Sanctions on Iran aren’t working. That much is clear. Chinese ships importing Iranian crude have been monitored by Israeli intelligence (which is keen to keep this conflict brewing) and commercial ship trackers. The trick is to remove radar from the grid by going dark to…

Fundamentals rule. The U.S. conflict with Iran and the widespread instability across the Middle East are only registering as blips on the oil market radar. Not even the seizure of an Iranian oil shipment to Syria could move the needle.

Oil prices continue to fall on a series of critical fundamentals:

- US crude production fell for the third week in a row, but the US crude oil inventory draw was uneventful at best.

- Wednesday US govt data shows new orders for factory goods plummeting for the second consecutive month in yet another sign the US economy is weakening.

- On the sanctions front, Venezuela’s exports are actually recovering as it continues to export oil to Asia (mostly China).

- The extension of the OPEC production cut deal earlier in the week had a subdued effect because the market had priced it in ahead of time.

The elephant in this room is definitively the US economy and signs of slowing global demand growth. The EIA, IEA, and OPEC have all revised their own demand growth projections downward, ranging from 1.14-1.2 million bpd for 2019, and 1.4 million bpd in 2020. It’s a big elephant.

Iranian Oil Flows Freely To China. Now It’s Time To Save Face

Sanctions on Iran aren’t working. That much is clear. Chinese ships importing Iranian crude have been monitored by Israeli intelligence (which is keen to keep this conflict brewing) and commercial ship trackers. The trick is to remove radar from the grid by going dark to load up on Iranian crude and pop back up on the radar in the right place, heavier. The larger oil tankers generally can’t get away with this, but the smaller ones can easily go off the grid when they need to.

The point is that Iranian oil is still flowing a decent clip, and it’s getting to market by being offered at a discount due to sanctions.

Washington knows it’s not working, too. Hence very quiet reports that the State Department is considering allowing China to import oil from Iran as a form of payment for Sinopec investment in an Iranian oilfield. Chinese ships might not have to go dark much longer.

Somehow, the administration has to save face on Iran without starting a war, and that is a difficult ask during an election campaign. Saving face right now, for the immediacy of it, would potentially mean giving China a waiver on Iranian oil imports. But the cat is already out of the bag now that the New York Times is plastering the “vanishing ships” story everywhere.

In the meantime, Iran managed to load 573,000 tons of LPG last month. That’s a 31% increase over May and a 46% increase over the same time last year. Almost all of it went to China--another big shift because China represented only two-thirds of Iran’s gas exports in 2018. Basically, China’s getting a great deal out of sanctions and doesn’t even need a waiver. If it gets a waiver, it won’t get a discount.

Getting Iranian oil to Syria has proven more difficult, though. An Iranian supertanker trying to get oil to Syria (a double sanctions violation) has been detained in Gibraltar, sparking a diplomatic row with the UK. The tanker was said to have been too big for the Suez Canal and was forced to sail around Africa to the Mediterranean, presumably on its way to the Banyas refinery. The ship was flying a Panamanian flag and managed by a company in Singapore, but it is Iranian - hence the diplomatic tensions, and Iranian defiance that this was an illegal seizure. Iran has now threatened to respond in kind by seizing a British oil tanker.

In the Big Oil Existential Dilemma, It’s Perovskite We Need to Watch

Nothing better illustrates the existential dilemma facing Big Oil than an Oxford Institute for Energy Studies (OIES) report released this week. The biggest oil story of our time is definitively centered on Big Oil companies and their attempt to navigate two very disparate worlds: fossil fuels and renewables. This is made even more poignant by OIES’ prediction that fossil fuels will be required in significant amounts even well beyond 2050.

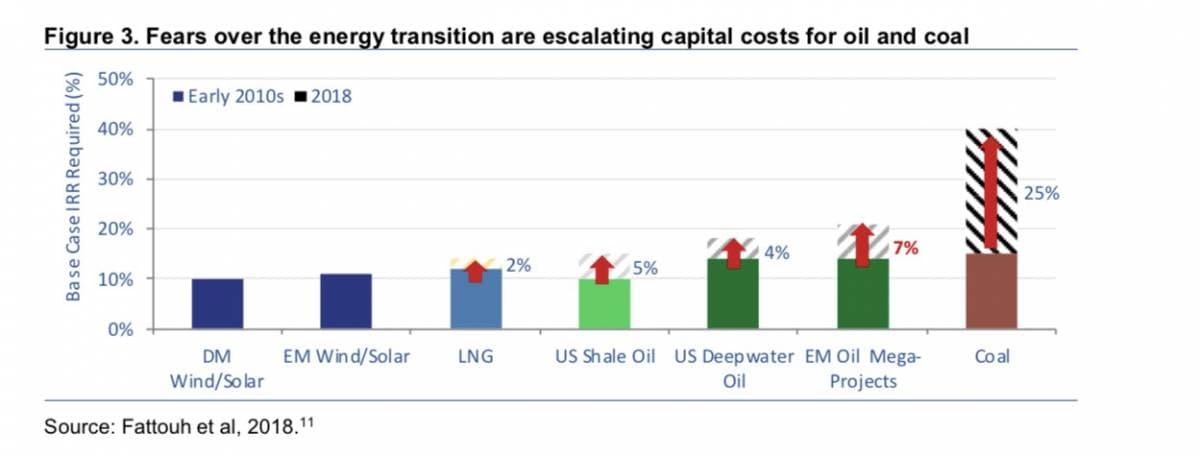

Big Oil is under immense pressure to deal with climate change. And that is resulting in a fair amount of fear, which in turn is pushing up capital costs for fossil fuels.

To that end, they are dipping their toes into renewables, but at some point their business models may explode when these two models collide. Right now, Big Oil is primarily using its Venture Capital arms to invest in new energy, while the core companies are focusing on more efficient production of fossil fuels. For now, that’s how they are keeping the business model from self-destructing. From an investment perspective, the most exciting takeaway from this comes from the Perovskite corner:

On the solar scene, Perovskite promises to be the game-changer, and this month it is being tested for real-life applications. It is cheap and has proven to be more efficient than silicon for absorbing light. On the big oil scene, it’s Equinor you need to keep an eye on when it comes to Perovskite development.