It’s not just oil getting crushed right now--commodities across the board are nose-diving, including precious metals. Not even gold can maintain its safe-haven status. The only shelter right now for sentiment is in the US dollar.

Everything’s plunging to new lows. Even bitcoin, whose digital existentialism should theoretically protect it from a biological virus. Even palladium, which had recently been soaring to historical heights and had become everyone’s new favorite metal.

And if you thought gold was the only safe-haven investment that affords real staying power--think again. Everything’s being sold for cold, hard cash.

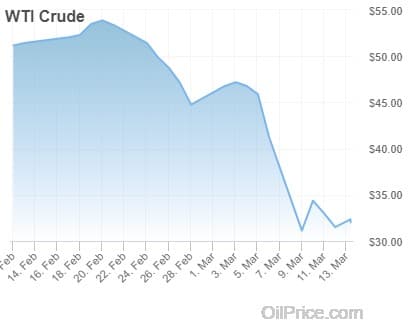

Oil: A Crude Awakening

If oil was being held at gunpoint before, now it’s staring down a double-barrel shotgun: it is not only battling depressed oil demand growth stemming from the coronavirus, but it is also the victim of Saudi-Russian move to flood the market with cheap oil. While production from the two friends-turned-foes has not yet ramped up, it’s supposed to happen as of April 1, and the oil market sees doom on the horizon. Indeed, Saudi Arabia is already booking additional VLCCs to carry this extra--and unnecessary--oil to market.

As a result of this Saudi-Russian oil price war, both Brent and WTI are having one of their worst months in history.

And the prevailing market sentiment seems to be that an oil price recovery isn’t right around the corner.

One would think this situation would be a perfect set-up for precious metals--particularly for gold … but the rules are changing.

Gold Loses Its Shine

Suddenly, amid a pandemic that now has the U.S. scrambling (belatedly) for containment, everyone has realized that gold actually has no use aside from being alluring.

It’s a bad day and a sign of the times when gold no longer feels like a safe-haven commodity.

Just a week ago, gold bugs were certain that we were just seeing the beginning of a gold rally, thanks to the coronavirus. Even moderate gold lovers were fairly sure that the world’s favorite safe haven would be a major beneficiary of the pandemic. Indeed, the precious metal hit a seven-year high earlier this week.

But then something went wrong. Gold suddenly lost its shine.

Kitco quoted veteran gold trader Kevin Grady, of Phoenix Futures and Options LLC, as saying that everyone was running for the exit with any profits they could find. Related: Analysts See Oil Prices Staying In The $30s For Months

“Everything is just getting crushed,” he told Kitco. “They’re selling all of their profitable positions to meet the margin calls in equities. It’s literally throwing the baby out with the bathwater to raise any capital they can to cover the margins and losses they’re receiving in equities.”

Source: goldline.com

Palladium: A Short-Lived High

The coronavirus is eating into car sales due to the virus, and car sales and palladium go hand in hand. China’s February car sales fell by 82% year over year, according to the China Association of Automobile Manufacturers, which issued the depressing news on Thursday. The depressing figures couldn’t have come at a worse time for palladium.

Along with the across the board commodity crash on Thursday, palladium sank 30%, and as of early Friday was on track to finish its worst week--ever. The commodity sank from roughly $2500 ozt at the beginning of the week to $1800 ozt on Friday.

Source: infomine.com

Similar to other commodities, traders are heading for the door with palladium, opting instead for something more illiquid and something not tied so specifically to the automotive industry, which relies on travel to spur sales--something that has been scaled back significantly in recent months. Related: Rig Count Inches Lower In Dramatic Week For Oil

Bitcoin: No Digital Immunity

One would think that a 100% virtual currency would be immune to the effects of a physical virus. But bitcoin investors panicked this week, dumping it in a move that sent the virtual currency falling more than 50% in just two days.

And it’s not just bitcoin. Cryptocurrencies across the board are getting killed. The total market capitalization for the entire crypto market lost some $93.5 billion in just 24 hours.

But here’s the rub: No one really has a handle on what really makes bitcoin move because the whales wield too much control over price. Still, there could potentially be a silver lining for bitcoin: Everything’s closing down as the U.S. scrambles to get a handle on after-the-fact containment, and Trump is gearing up to declare a national emergency. With deliveries already soaring, some bitcoin bugs are holding out hope that the digital coin will become suddenly more popular for a huge uptick in online shopping.

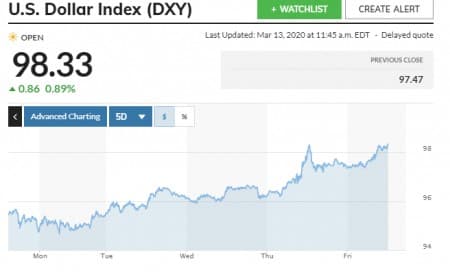

The Dirtiest of Currencies Soars Amid Pandemic

Meanwhile, the dollar’s gains have been breathtaking. Typically a no-risk, no-reward investment, the dollar shrugged off that unfavorable reputation as traders pulled their investments from basically everything else and flocked to the most liquid and safest thing around.

Last week, things weren’t looking so good for the dollar, seeing a 3 percent decline. But this week, the Dollar Index made up for the loss with this week’s increase of nearly 3 percent. Thursday, which saw the index increase by 1.75 percent, was the index’s best day on record.

Source: TD Ameritrade

While this trading week will mercifully be over soon, the volatility and chaos in the markets will not. With every new headline on the death toll and school and event closures in the US, traders will continue to gravitate toward the Dollar.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Saudi Arabia To Flood Oil Markets With An Extra 2.6 Million Bpd

- The First Casualty Of Tanking Oil Prices

- Saudi Arabia's Archenemy Is Taking Advantage Of The Oil War