Friday April 12, 2019

1. Oil prices moving higher, but volatility lower

- Oil prices hit fresh highs for 2019 this week, pushed up by a tightening market and concerns over Libya.

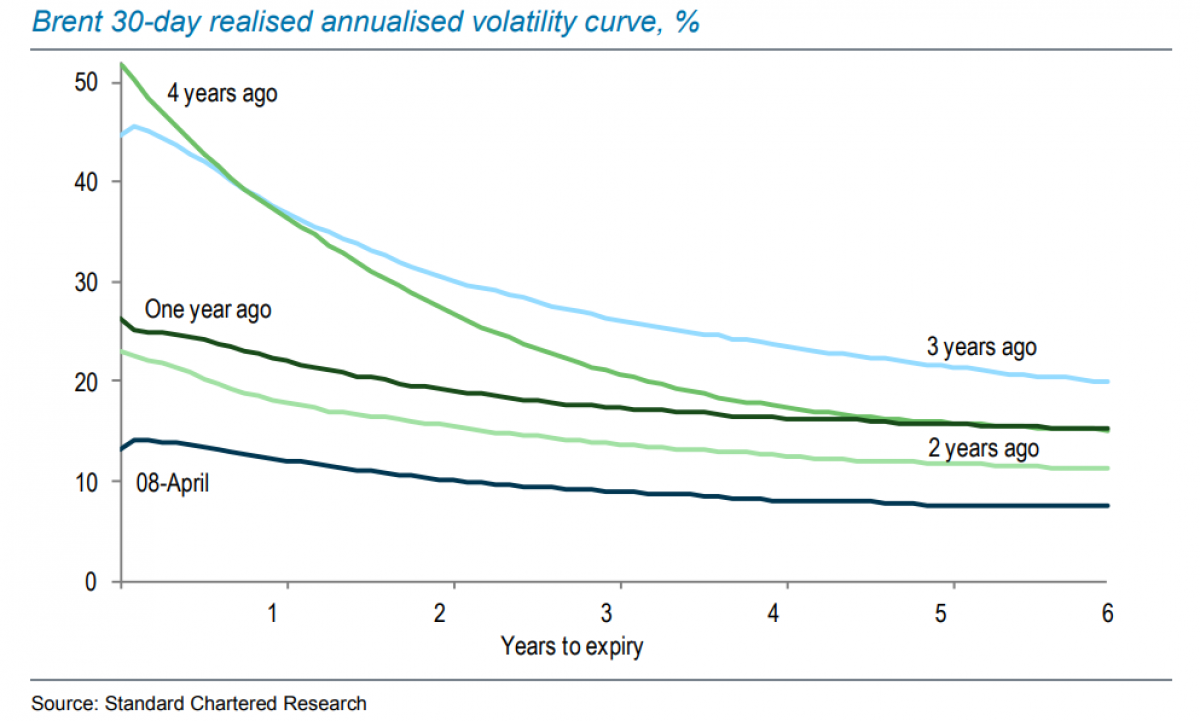

- However, price volatility has been declining, “a pattern consistent with a tightening in physical markets following the OPEC+ output cuts, rather than (as in H2-2018) an expected, but unrealized, future tightening,” Standard Chartered wrote in a note.

- “Front-month Brent volatility began the year above 50%, but now stands at just 13%. The volatility curve is lower than in previous years, with the back below 8%,” the bank said.

- History suggests that when OPEC abandons market management, prices are more volatile. The market was highly volatile following the 2014 OPEC decision to produce at a maximum levels and not intervene, while volatility dropped significantly when the OPEC+ group initiated the first round of cuts in 2017.

- Once again, volatility has fallen this year as the cuts were phased in, even though prices are rising.

2. Copper up, but investment lacking

- Copper prices have rebounded from last year’s lows on supply concerns, but new investment is lacking.

- “[B]ecause prices have been relatively low since mid-last year and the trade tensions initiated by the US are generating uncertainty, virtually no investment is being made at present in major new copper projects,” Commerzbank wrote in a report.

- Copper prices are up to $6,500…

Friday April 12, 2019

1. Oil prices moving higher, but volatility lower

- Oil prices hit fresh highs for 2019 this week, pushed up by a tightening market and concerns over Libya.

- However, price volatility has been declining, “a pattern consistent with a tightening in physical markets following the OPEC+ output cuts, rather than (as in H2-2018) an expected, but unrealized, future tightening,” Standard Chartered wrote in a note.

- “Front-month Brent volatility began the year above 50%, but now stands at just 13%. The volatility curve is lower than in previous years, with the back below 8%,” the bank said.

- History suggests that when OPEC abandons market management, prices are more volatile. The market was highly volatile following the 2014 OPEC decision to produce at a maximum levels and not intervene, while volatility dropped significantly when the OPEC+ group initiated the first round of cuts in 2017.

- Once again, volatility has fallen this year as the cuts were phased in, even though prices are rising.

2. Copper up, but investment lacking

- Copper prices have rebounded from last year’s lows on supply concerns, but new investment is lacking.

- “[B]ecause prices have been relatively low since mid-last year and the trade tensions initiated by the US are generating uncertainty, virtually no investment is being made at present in major new copper projects,” Commerzbank wrote in a report.

- Copper prices are up to $6,500 per ton, but that is not high enough for new projects.

- An estimated 1 million tons of copper capacity is expected to come online through 2023, according to Bloomberg, but that may not be enough to close an emerging supply gap.

- “We are looking at a classic resource cycle,” Colin Hamilton, managing editor for commodities at BMO Capital Markets, told Bloomberg. “No one has copper coming now, when it is needed, but everyone has projects coming 2022-2023 –- potentially after we’ve had to drive some substitution.”

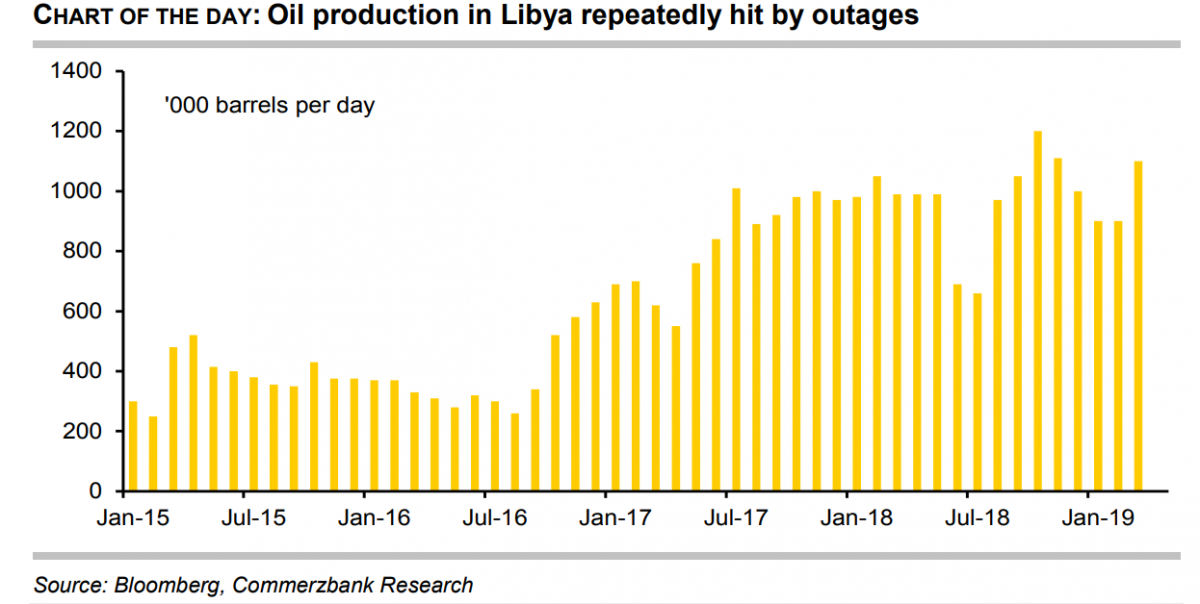

3. Libya faces potential supply outage

- The attack on Tripoli by the Libyan National Army threatens to disrupt the country’s oil supply.

- Libya once produced 1.6 mb/d, before the fall of Dictator Muammar Qaddafi in 2011. But in the years following his ouster, Libya struggled with civil war and flagging production. It took until 2017 before the country’s output began to rebound.

- The restoration of the Sharara oil field – the country’s largest with a capacity of 300,000 bpd – in February helped push Libyan output back above 1 mb/d.

- That is now under threat. The LNA has protected Libya’s oil fields and kept them open, but it does so by paying off local militias. It may be unable to do that if it becomes stretched thin by its assault on Tripoli.

4. Oil discoveries on the rise

- After years of wallowing in the doldrums, new oil discoveries are on the rise. Global discoveries of conventional oil reserves hit 3.2 billion barrels of oil equivalent (boe) in the first quarter of this year, according to Rystad Energy.

- In February, the industry found 2.2 billion boe, the best month for new discoveries since August 2015 when Eni (NYSE: E) found the Zohr gas field off the coast of Egypt.

- “If the rest of 2019 continues at a similar pace, this year will be on track to exceed last year’s discovered resources by 30%,” Taiyab Zain Shariff, Upstream Analyst at Rystad Energy, said in a statement.

- So far, ExxonMobil (NYSE: XOM) has been the most successful, announcing three discoveries this year, which combined accounts for nearly 40 percent of the global total.

- “From a global perspective, the push for substantial new discoveries shows no signs of slowing down, with another 35 high impact exploration wells expected to be drilled this year, both onshore and offshore,” Rystad Energy wrote in its report.

5. Natural gas crashes coal prices

- Coal prices have crashed from $120 per metric ton last June at its peak, to just $78 in Newcastle recently.

- “The decline comes from a combination of US and Indonesian production rising strongly on high prices, and seaborne demand softening on trade wars and a general slowdown in manufacturing across US, EU and China,” according to Bank of America Merrill Lynch.

- The investment bank expects prices to remain at these low levels, with risk on the downside.

- The more that natural gas becomes available, via a proliferation of LNG export terminals, the more pressure on coal there will be.

- In fact, LNG itself is facing a short- and medium-term glut.

- “A global oversupply of gas and resulting coal to gas switching in Europe has put downward pressure on European coal prices especially, and we expect this to persist as more US liquefaction capacity starts up in 2H19,” Bank of America Merrill Lynch concluded.

6. Bitcoin rally could be stalled by China ban

- Bitcoin has staged a remarkable rally this month, moving back above $5,000.

- But the cryptocurrency market faces a severe challenge as China announced plans to ban crypto mining.

- China’s powerful National Development Reform Commission targeted cryptocurrency mining for elimination because it “seriously wasted resources.”

- About 70 percent of Bitcoin mining and 90 percent of trades occurs in China, according to Bloomberg.

- The Chinese government wants to run them out of business.

7. Battery costs continue to fall

- Lithium-ion battery prices have declined by 85 percent since 2010. A wave of new battery factories are set to come online in China, Thailand and the United States, which could drive down battery prices further, according to Bloomberg.

- Lithium-ion batteries cost $1,160 per kilowatt hour in 2010, according to Bloomberg NEF. That fell to just $176/kWh in 2018, and could decline further to below $100/kWh by 2020.

- Many industry analysts have said that a different battery – one that is not based on lithium – will be necessary to accelerate the energy transition. Lithium is costly and the batteries lack the energy density of other promising technologies.

- But falling prices and the proliferation of factories likely means that lithium-ion batteries will entrench their position in the market.