Concho Resources has struck a deal to acquire natural gas peer RSP Permian for US$9.5 billion in an all-stock deal that is the biggest acquisition in the sector since 2012.

The price per share came in at a 29-percent premium to RSP’s latest stock close, giving the target company a market cap of over US$8 billion. The deal also includes RSP’s debt, hence the total price tag.

Following the announcement, Concho’s chief executive expressed what many must have thought: The tie-up is a sign of further consolidation in the U.S. shale oil and gas industry. It will create the biggest player in the Permian.

“I see the Permian getting more efficient, not less efficient, as we do these full-scale developments. The attraction in our industry to the Permian will just continue to grow," Tim Leach said.

Concho’s shareholders, however, don’t seem to have the same upbeat sentiment.

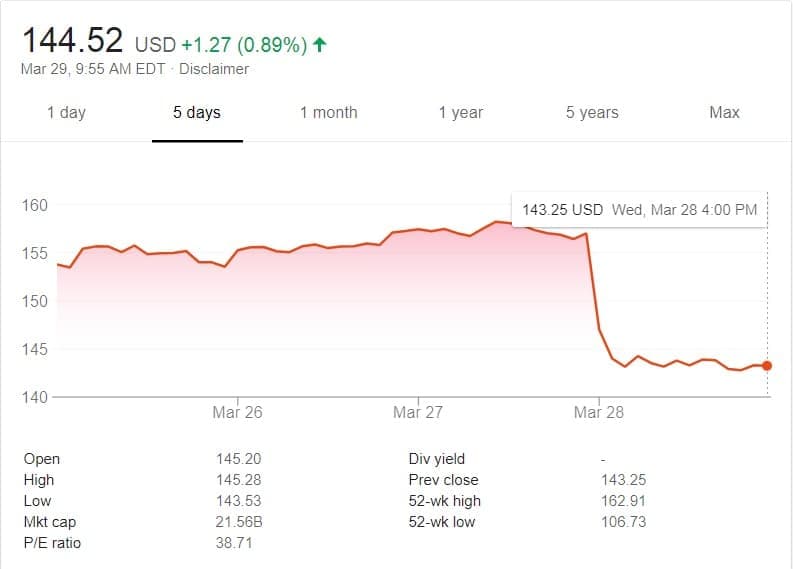

The FT reports that immediately after the deal was announced a selloff began, resulting in a 9-percent drop of the company’s shares. RSP’s stock, however, benefited from the news, adding 16 percent to almost US$45.

(Click to enlarge)

The shareholder skepticism is understandable at a time when shareholders in the shale business as a whole insist that they start seeing more returns on their investments, and not more production or, apparently, acquisitions. Related: Barclays: Expect $51 Oil This Year

Yet Concho believes that the deal would be beneficial for both parties.

It expects benefits of up to US$2 billion from combining the two companies’ assets.

In some parts of the Permian, Concho’s assets are adjacent to RSP’s, so the merger will allow the companies to drill more horizontal wells from a single pad and make these wells longer, which is fast turning into the new industry standard. Besides, Leach said, the tie-up will help the companies focus on the highest-return assets in the combined portfolio.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- Building The World’s Largest Solar Project

- Why Natural Gas Prices Will Rise This Summer

- The End Of The Status Quo In LNG Markets