As oil continues to pair Monday gains on soaring U.S. crude inventory, Barclays is calling a $51-per-barrel price on WTI by the third and fourth quarters of this year, and expects Brent to fall to $57 by the end of the year.

The bank forecast that West Texas Intermediate prices will fall to $58 in the second quarter, before continuing their decline.

Recently, the oil market has been supported by supply disruption concerns, emanating most prominently from the Middle East.

However, while demand is being pushed up thanks to global economic growth, coupled with geopolitical risk that threatens to remove more supply from the market, that short-term deficit will head into surplus again by the second half of the year, according to Barclays.

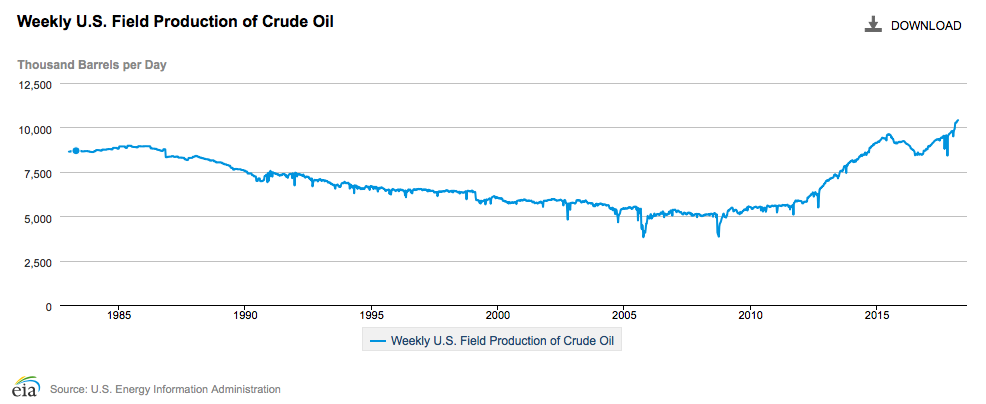

U.S. crude oil production has risen by nearly 25 percent in less than two years, hitting above 10 million barrels per day. For the week ending March 16, U.S. production had increased from 10.381 million to 10.407 million bpd.

(Click to enlarge)

Also weighing on prices is an unexpected build in U.S. crude oil inventories of 1.6 million barrels, according to the EIA.

Oil prices had already dropped on Tuesday with data from the American Petroleum Institute (API) showing a 5.3-million-barrel build.

While the official EIA data shaved 4 million barrels off of this, the market response was flat to negative as the expectations had been for a draw, not a build. Related: Oil Prices Fall As EIA Confirms Inventory Build

Fitch is predicting that U.S. oil production will grow by 1.7 million barrels per day this year and is expecting prices to stay between $50 and $60.

At this rate, supply is growing at a faster pace that could outpace upticks in demand, even with Venezuelan oil production on the steep decline and indications that heightened trouble is brewing between the U.S. and Iran.

Tuesday was the reckoning with this situation, and the bulls have been downsized.

By Damir Kaletovic for Oilprice.com

More Top Reads From Oilprice.com:

- Will Lithium-Air Batteries Ever Become Viable?

- The Invisible Sweet Spot For Big Oil

- Why Natural Gas Prices Will Rise This Summer