It’s been a volatile decade for the United States biofuels industry, to put it lightly. In 2007 the federal government, as part of an effort to reduce U.S. dependence on foreign oil, passed a new potion of the U.S. Renewable Fuel Standard that mandated ethanol blending across the domestic oil industry in quantities scheduled to increase each year. Oil companies can either blend the required amount of biofuel or, alternatively, buy credits known as Renewable Identification Numbers (RINs). As such, investment in ethanol production boomed and Big Corn rejoiced. This is no longer the case.

The ethanol industry has seen major ups and downs over the past couple of years, with many predicting its demise in the face of shuttering plants in 2017, and then the very next year the sector ramped up production to unprecedented levels despite a major glut. Complicating the matter, the Trump administration has taken a dramatically different approach to biofuel blending standards than the Obama administration, who added the biofuel blending mandate to the U.S. Renewable Fuel Standard in 2007.

Under an administration far less supportive of biofuel-blending mandates, the EPA has been fast and loose with the granting of biofuel waivers to even major industry players, as well as allowing a complex system buying and selling biofuel credits to develop and flourish. The once strict Renewable Fuel Standard is now mushy at best, and despite more than a year of reporting on the ever-greater prevalence of biofuel waivers and speculation about whether the Trump administration was gearing up to ease the standards entirely, the industry remains mired in uncertainty. Related: Wall Street Loses Faith In Shale

Now new reporting has revealed another major influence on the ebb and flow of the biofuels industry--a major campaign on the part of billionaire investor and one-time special regulatory adviser to Trump Carl Icahn. The oil industry maverick and majority owner of independent oil refiner CVR Energy Inc. pushed hard to lower compliance costs for the U.S. biofuels mandate, and in doing so saved his company a whopping $189 million last year.

Last year CVR Energy Inc. spent just $60 million on biofuel credits, which they used to meet the quota imposed by the U.S. Renewable Fuel Standard, a far, far cry (a 76 percent decrease, to be exact) from the $249 million on credits just one year before in 2017. According to the numbers presented in regulatory filings with the U.S. Securities and Exchange Commission, CVR Energy is not the only oil refiner to enjoy a major drop in spending on the necessary credits to meet the mandate.

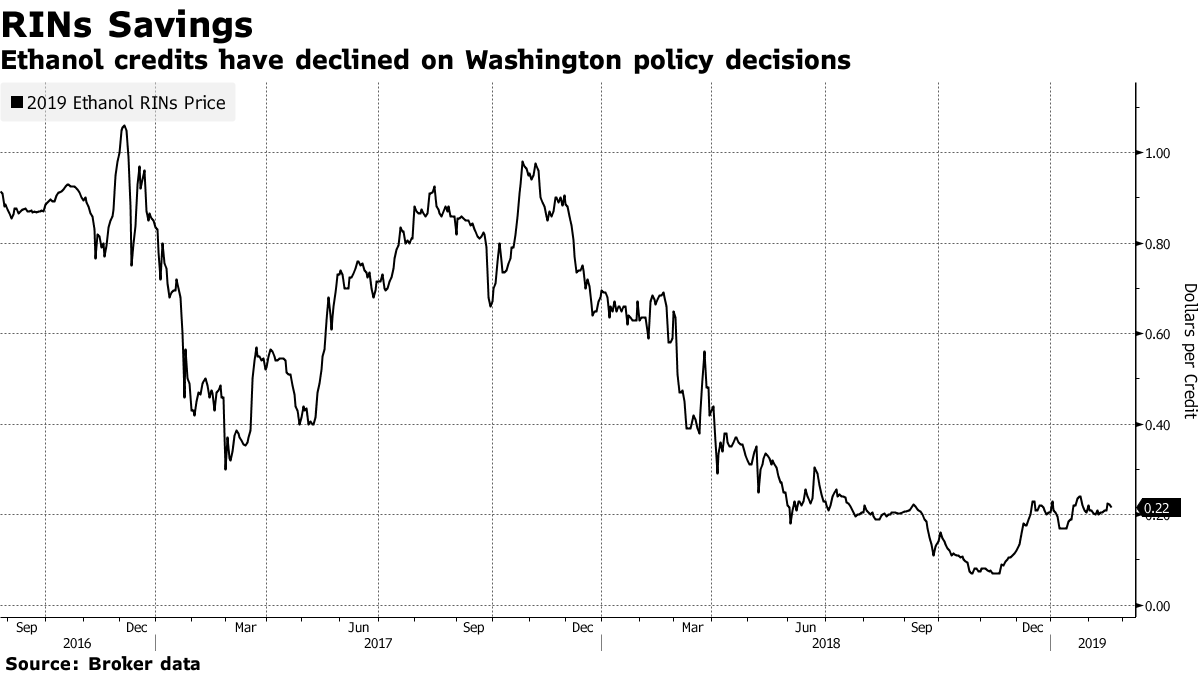

It’s no secret that Icahn was pushing for an overhaul of the 2007 Renewable Fuel Standard--he was very public in his campaign. The revelation lies in the extent to which he was successful. Icahn’s frustration with the state of Renewable Fuel Standard was not necessarily misguided--the system for buying and selling RINs--or biofuel credits--had become wildly volatile and subject to shady backroom dealings and artificially inflated prices. The price of the RINs reached record levels in 2016, which is when Icahn began to protest in earnest, sending a letter to the EPA denouncing the system which he said was “rigged” and “the mother of all short squeezes.” Related: Saudi Arabia Aims To Become Large Natural Gas Exporter

(Click to enlarge)

In response to widespread criticism, especially from industry leaders with great influence and deep pockets like Icahn, the EPA has been looking for ways to improve the program and is due to present various options for a systematic overhaul in the coming weeks. One of the quick fixes that they implemented in the interim was the issuance of waivers to some “small” refineries who were struggling to meet the biofuel quotas. The waivers didn’t just help the smaller refineries, however. They drove down the prices of the RINs considerably, saving a bundle for people independent refiners such as CVR Energy and therefore Icahn Enterprises LP.

Icahn is currently under federal investigation for the legality of his efforts to influence biofuel policy while he was serving as a special regulatory adviser to Trump, a role he left in August 2017. CVR energy disclosed that they had been issued subpoenas concerning this investigation in November 2017.

By Haley Zaremba for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Slides After Trump Calls On OPEC To “Take It Easy”

- Can Any Country Dethrone Qatar As Top LNG Exporter?

- One EV Maker Is Offering A Unique Solution To Blackouts