Breaking News:

Geomagnetic Storms Could Devastate Washington DC's Power Supply

New research shows Washington DC…

OPEC Oil Reserves in Decline

Rystad Energy disputes OPEC’s claim…

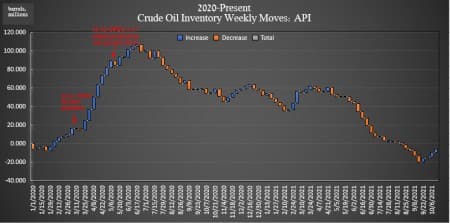

Draws In Product Inventories Offset Rising Crude Stocks

The American Petroleum Institute (API) on Tuesday reported its fourth straight week of crude oil inventory builds. The week, according to the API, the build was 3.294 million barrels-strong.

U.S. crude inventories are still 63 million barrels below where they were at the beginning of the year.

Analyst expectations for the week were for a build of 2.233-million barrels for the week.

In the previous week, the API reported a surprise build in oil inventories of 5.213-million barrels, compared to the 140,000 barrel build that analysts had predicted.

Oil prices were trading up on Tuesday in the runup to the data release, with WTI reaching near $83 and Brent reaching almost $85 per barrel. Both WTI and Brent were up .52% and .76%, respectively, at 3:30 p.m. EST.

At 3:35 p.m. EST, WTI was trading at $82.87—a more than $2 gain on the week. Brent crude was trading at $84.97.

Oil inventories in the United States have drawn down nearly 63 million barrels so far this year, according to API data, and 6 million barrels since the start of 2020.

U.S. oil production for the week ending October 8—the last week for which there is data—rose 100,000 bpd to 11.4 million bpd and is now essentially recovered from the devastating effects of Hurricane Ida.

The API reported a draw in gasoline inventories of 3.5 million barrels for the week ending October 15—compared to the previous week's 4.575-million-barrel draw.

Distillate stocks saw a decrease in inventories of 3.0 barrels for the week, compared to last week's 2.707-barrel decrease.

Cushing inventories also saw a draw this week, of 2.5 million barrels, on top of last week's 2.275-million-barrel decrease.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Refining Billionaire: $100 Oil Is Likely

- OPEC+ Under Produces Quota Despite Calls For More Oil

- Peak Meat, EVs, and Solar: The World in 2030

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B