Breaking News:

Solar Surplus: California's Renewable Energy Dilemma

California's excess solar power production,…

Porsche Shares Slide as Sportscar Maker Slashes Revenue Forecast

Shares of the German sportscar…

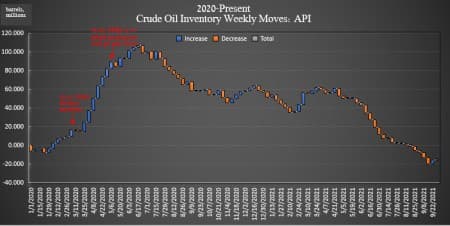

Second Surprise Crude Build Caps Oil Price Gains

The American Petroleum Institute (API) on Tuesday reported another surprise build in crude oil inventories of 951,000 barrels for the week ending October 1.

This compares to analyst expectations for a loss of 300,000 barrels for the week. It is the second week in a row that estimates were on the wrong side of zero.

In the previous week, the API reported a surprise build in oil inventories of 4.127 million barrels—a market shock considering the 2.333 million barrel draw that analysts had predicted for that week.

Oil prices rose on Tuesday leading up to the data release, with the gas crisis raging on and OPEC+'s Monday decision to keep production plans unchanged instead of increasing production by even more than the 400,000 bpd it had planned for November.

WTI rose 2% on Tuesday afternoon leading up to the data release.

At 3:49 p.m. EST, WTI was trading at $79.17—a more than $4 gain on the week, and a $1.55 gain on the day. Brent crude was trading up 1.87% for the day at $82.78.

Oil inventories in the United States have drawn down nearly 72 million barrels so far this year, according to API data—well below pre-pandemic levels. The EIA's latest data suggests that crude oil inventories in the United States are now 7% under the five-year average for this time of year, at 418.5 million barrels.

U.S. oil production has slowly recovered from the wrath of Hurricane Ida, increasing three of the last three weeks. For week ending September 24, U.S. oil production rose 500,000 bpd to 11.1 million bpd—recovering all by 400,000 bpd of what had been lost in the storm.

The API reported a build in gasoline inventories also—again for the second week in a row--of 3.682 million barrels for the week ending October 1—on top of the previous week's 3.555-million-barrel build.

Distillate stocks saw an increase in inventories of 345,000 barrels for the week, compared to last week's 2.483-million-barrel increase.

Cushing inventories saw another build as well this week, adding 1.999 million barrels to the total inventory, after last week's 0.359-million-barrel increase.

By Julianne Geiger for Oilprice.com

More Top Reads from Oilprice.com:

- WTI Crude Oil Price Hits 7-Year High

- The Real Reason OPEC+ Refused To Boost Production Further

- Natural Gas Stocks To Watch As The Energy Crisis Goes Global

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B

Anyhow trying to manipulate a market this massive to include the entirety of the energy complex (oil, natural gas, coal, uranium, bio-fuels, etc) just seems impossible to be have had happen especially now with Big Blackout Asia well underway and "palladium nutters" annihilated.

*ANYHOW* great news for US based refineries and for anyone smart enough to get their hands on old 2 stroke diesel engines.

The USA made a lot of great buses back in the day.

Tractors and mining equipment as well.

Long $hfc Holly Frontier

Strong buy