There is no question that as the oil price dropped in the first quarter of 2020, producers reacted strongly curtailing new drilling, and actually shutting in existing production. Markets have taken encouragement from this withdrawal of supply and helped prices for WTI (the key U.S. benchmark) to a rally of historic proportions.

As the price of WTI crested $30/bbl concerns began to mount that this would embolden drillers to put a bunch of rigs in the field and resume their ‘merry’ ways, drilling to soak up as much market share as they can.

Drilling and fracking will of course begin to pick up as prices approach $40, but concerns about a new ‘Black-gold rush’ are over-wrought. The capacity to put hundreds of rigs back to work simply no longer exists.

In this article we will take a look at the fundamentals of providing services related to fracking, and why capacity has been permanently withdrawn from the market.

What happened?

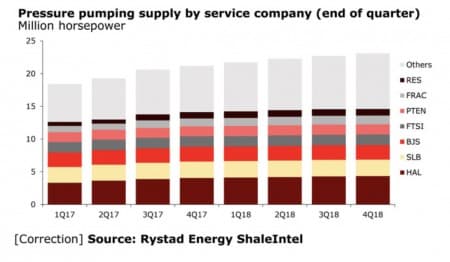

In late-2017 as drilling and fracking in the U.S. was reaching its peak, the major service suppliers-pressure pumpers, sand suppliers, and water management companies more than doubled their capacity to meet expected demand. Demand that never materialized as energy prices began to top out in early 2018, and ‘capital restraint’ began to enter the quarterly call lexicon.

For example, Schlumberger, (NYSE:SLB) bought the pressure pumping assets of Weatherford International, (NYSE:WFT), bringing is U.S. domestic capacity to ~2-mm HHP in fracking power. Halliburton began pouring capex in building new frack spreads until by mid-2018 it also had about 4-mm HHP of fracking equipment ready to send to the field.

Related: How Long Until Hydrogen Is Competitive At The Pump?

It wasn’t only the frackers that fell into this rabbit hole. The sand industry opened new mines, the water management business grew its capacity as well.

In short, the service industry responded to the promise of increased work by fronting the huge amount of capex required to support the levels of activity that was being forecast by the operators.

And, then it all began to fall apart.

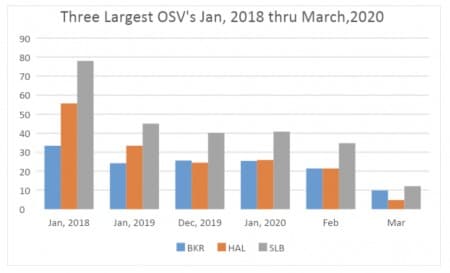

As this article was not intended to be a history lesson, but rather a forecast of things to come (Something I expect you are much more eager to read!), I will summarize the next two years for you as experienced by the write-downs of Goodwill, and business valuations for the big three.

Schlumberger- $12.1 billion charge in Q-3 of 2019.

Halliburton- takes $2.2 bn charge.

Baker Hughes-takes $15.1 charge.

When you add these to the personnel reductions and plant/office closures, you find these companies are a mere shadow of their former selves. Their stock prices are grim testimony to the carnage big bets on shale wrought.

Company filings

Shale status update

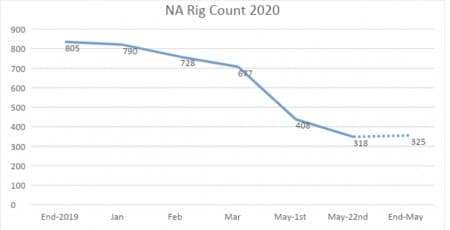

The rig count fell once again by 21 rigs last week. I was a little surprised as I thought we might see an uptick. I am sticking to my guns and predicting an incremental rise for this week. I am being pretty conservative here, it will probably be more than a paltry 7-rig increase.

Baker Hughes

What makes me think drilling will pick up after its relentless decline since the first of the year?

How about the movement in Nabors Industries, (NYSE:NBR) over the past month. When’s the last time you saw a land driller triple in a single month?

Yahoo Financials: Nabors Industries, (NYSE:NBR)

Somebody thinks things will get better soon for this contract driller.

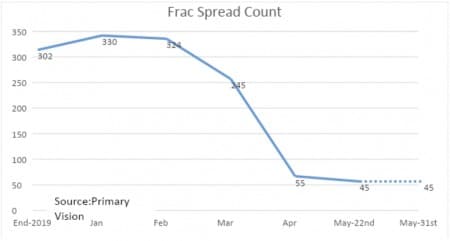

On to the Frac spread count. This is a lagging indicator and I am not looking for a bump this week. I think we will exit May, right where we are now.

When I say lagging indicator, I mean some wells have to be drilled in order to need fracking. I think we are looking at least another couple of weeks before we see a significant spike in fracking. Have a look at the share prices for Liberty Oilfield Service, (NYSE: LBRT), a big independent fracker.

Related: Saudi Arabia Wants Record Oil Output Cuts To Last Till End 2020

Yahoo Financials: Liberty Oilfield Service, (NYSE: LBRT)

While you can see an obvious upward trend, it’s a bit short of the level hit by Nabors, although it should be said, doubling in a month is no mean feat!

The signs are pretty consistent here, shale drilling and completions will pick up. The key is they aren’t going to go crazy.

Where do we go from here?

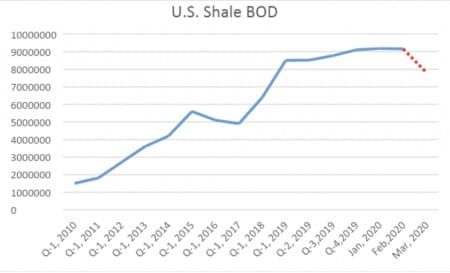

In the chart below I track production as reported by the EIA-914, the edition with the March data hasn’t been released yet so I have put an imputed decline of what I expect in these figures based on my own work. This denoted by the dotted red line in the graph. I have discussed this in some detail in a prior OilPrice article.

I expect an initial decline of about 1.5 mm BOPD when the report is released on March, 29th. From there, I anticipate increasingly smaller declines of 250-500K monthly as drilling and fracking pick up and shut-in wells are opened back up.

Here is the key though, in no way will the increase in drilling overcome the decline rate of shale at these levels. That means, that although incremental production will increase as we go through the next couple of quarters, total production from shale will continue to decline for the rest of the year.

We are currently standing by our previous 2020 exit production rate for shale of 4.5-5.0 mm BOPD, about half of where it began the year.

Your takeaway

In my view, concerns about the inventory overhang will quickly dissipate as the economy rebounds. We are seeing this happen before our eyes. Driving is up 80% month over month. Not only are we taking more trips, but we’re also taking longer trips, the average hitting 250 miles as reported recently by the Arrivalist. Matt Clement, Arrivalist’s vice president of marketing comments in the linked article.

“The majority of road trips measured since COVID-19 began impacting travel in mid-March were 50 to 100 miles, with some of 100 to 250 miles,” he explained. “But over Memorial Day weekend trips of 250-plus miles reached a level not seen since the spring break season in late February and early March.”

There are other indicators as well that match the driving data. Hotel bookings are up. Airline bookings are up. People are beginning to move about the country again.

Buoyed by good news on the Covid-19 front, as respects new infection rates, and the promise of vaccines just over the horizon, local economies are coming back to life.

That bodes well for oil prices as increased activities draws down inventories. We are projecting a demand-driven price for WTI by year-end near $50/bbl, exacerbated by tightness in supply from the curtailments we’ve seen domestically, and globally.

Finally, some good news for the oil patch!

By David Messler for Oilprice.com

More Top Reads Fromm Oilprice.com:

- The Oil Bulls Are Back

- Oil Prices Fall On Bearish EIA Data

- OPEC+ Deal Could Collapse As Oil Prices Shoot Up