As if oil prices needed any more help on their downward spiral towards the teens, The IMF just slashed global growth to the worst since the '30s.

“This crisis is like no other,” Gita Gopinath, the IMF’s chief economist, wrote in a foreword to its semi-annual report.

“Like in a war or a political crisis, there is continued severe uncertainty about the duration and intensity of the shock.”

As Bloomberg notes, The International Monetary Fund predicted the “Great Lockdown” recession would be the steepest in almost a century and warned the world economy’s contraction and recovery would be worse than anticipated if the coronavirus lingers or returns.

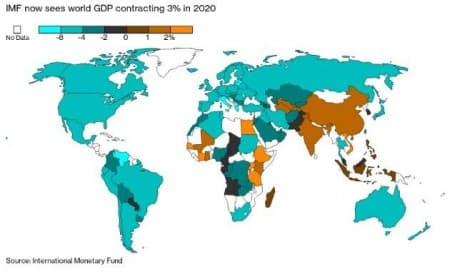

In its first World Economic Outlook report since the spread of the coronavirus and subsequent freezing of major economies, the IMF estimated on Tuesday that global gross domestic product will shrink 3% this year.

That compares to a January projection of 3.3% expansion and would likely mark the deepest dive since the Great Depression. It would also dwarf the 0.1% contraction of 2009 amid the financial crisis.

Of course, there is the hockey-stick recovery with IMF anticipating growth of 5.8% next year, which would be the strongest in records dating back to 1980, it cautioned risks lay to the downside.

The grim projections are a stark reversal from the IMF’s outlook less than two months ago (on Feb. 19, the fund told Group of 20 finance chiefs that “global growth appears to be bottoming out.”)... and now...

“Many countries face a multi-layered crisis comprising a health shock, domestic economic disruptions, plummeting external demand, capital-flow reversals and a collapse in commodity prices,” the IMF said.

“Risks of a worse outcome predominate.”

And the impact on the most economically-sensitive commodity is clear...

The IMF’s baseline scenario assumes that the pandemic fades in the second half of this year and that containment measures can be gradually wound down.

We suspect that is optimistic and that we're gonna need more production cuts and more bailouts!

By Zerohedge.com

More Top Reads From Oilprice.com:

- Saudi Arabia Claims The U.S. Was Not Their Target In The Oil War

- Gazprom CEO: Oil Could Hit $45 This Year

- The Sad Truth About The OPEC+ Production Cut

The IMF is, however, basing its projection on an assumption that the pandemic fades in the second half of this year and that containment measures can be gradually wound down.

A positive sign is that China is already bouncing back extremely quickly in all sectors, except those relating to the service industries with projections already abound that China could grow at 6.8% in 2021 compared with 6.1% in 2019. Given the speed by which China is bouncing back, it could be projected to grow at 4%-5% in the second half of this year compared with 3%-3.5% in the first half. Moreover, China will be hugely thirsty for crude oil. This development will give a huge impetus to an oil market bereft of good news and may also prevent oil prices from sliding further downward.

Meanwhile, it is of paramount importance that countries of the world should implement the strict measures that enabled China to control the outbreak and open the country to business again. This will certainly shorten the duration of the global lockdown and enable people to resume their normal activities including demand for crude oil rather than wasting their time making oil production cuts which are futile in the current circumstances.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London