Oil prices plummeted by 4 percent on Thursday morning, as a rising U.S. dollar, rising U.S. crude inventories, and fresh setbacks in vaccination programs in Europe weighed on the market.

As of 11:45 a.m. EDT, WTI Crude prices were dropping by 4.20 percent at $61.89, and Brent Crude was plunging by 3.91 percent at $65.34.

Oil prices were down for a fifth consecutive trading day, as the recent rally began to unwind with a continued increase in U.S. commercial inventories, a stronger U.S. dollar, and renewed concerns about demand this quarter and early next quarter amid setbacks in vaccination rollouts in the biggest economies in Europe.

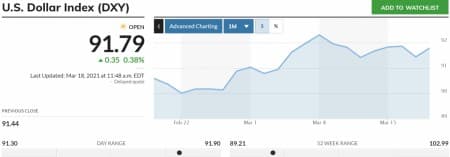

The higher dollar has weighed on the oil market this week as a stronger greenback makes crude oil more expensive for holders of other currencies.

Adding to the bearish sentiment, the Energy Information Administration reported on Wednesday a crude oil inventory build of 2.4 million barrels for the week to March 12.

The EIA inventory report showed that U.S. commercial crude oil inventories rose above 500 million barrels for the first time this year, ING analysts commented.

On another bearish note for demand, more than a dozen countries in Europe are still suspending the AstraZeneca shot over concerns about blood clots, even though the World Health Organization (WHO) said on Wednesday, “At this time, WHO considers that the benefits of the AstraZeneca vaccine outweigh its risks and recommends that vaccinations continue.”

One of the best performers in vaccinations in Europe so far, the UK, warned today of a “significant reduction in the weekly supply” of vaccines in England from April. According to the BBC, some supply of AstraZeneca vaccines – which the UK continues to use – could be delayed because of issues related to a manufacturer in India. More disruptions to vaccination schedules and slower vaccination rates could mean a slower return to some sort of normal consumer behavior and travel to other countries.

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com:

- Oil Extends Losses On Renewed Demand Concerns

- Saudi Arabia Must Prepare For More Attacks On Its Oil Industry

- Oil Prices Retreat As Biden Plans Major Federal Tax Hike

Some EU countries are suspending the use of the AstraZeneca vaccine over concerns about blood clots despite the WHO saying that its benefits outweigh its risks.

Soon these concerns will subside with the bullish factors in the market overpowering this bearish factor thus enabling oil prices to resume their surge.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London

i suppose energy.gov is mixing up data about TAP beer supply from Coors light.