For more than a week now, oil prices have consolidated around the psychologically important $40/barrel level as the worst of the recent oil price crash appears to be in the rearview mirror. So far, OPEC+ production cuts appear to be going well with recalcitrant producers such as Iraq, Kazakhstan, Azerbaijan, Nigeria, and Angola toeing the line and raising hopes that the markets have been effectively rebalanced. Still, some oil punters believe that this is just the beginning and that oil prices are set to soar into rarefied territory.

Specifically, JPMorgan has doubled-down on an earlier prediction of a "bullish supercycle" that could take oil prices well past $100/barrel due to a dramatic supply deficit.

Christyan Malek, JPMorgan's head of Europe, Middle East and Africa oil and gas research, has reiterated an earlier bullish note where he had predicted that oil prices could soar to $190/barrel due to dramatic capex cuts by producers, among other factors.

Global oil hasn't seen $100-a-barrel prices since 2014, with $145/barrel serving as the high watermark for two decades.

Survival Mode

Source: Offshore Technology

Malek has been bearish since 2013 but has now turned bullish due to what he sees as a looming 'very large supply-demand deficit' that could emerge in 2022 and possibly hit 6.8 million bpd by 2025 if the markets maintain their current trajectory.

Malek has not offered a price target for his bull case, but has told CNN Business that his firm's $190 bullish call from March still stands.

Malek says oil firms need to spend heavily just to maintain production - something that is clearly not happening with global upstream investments expected to fall to a 15-year low of $383 billion in the current year.

Interestingly, we had mirrored similar concerns in a recent piece. Related: The Real Reason Russia Joined OPEC+

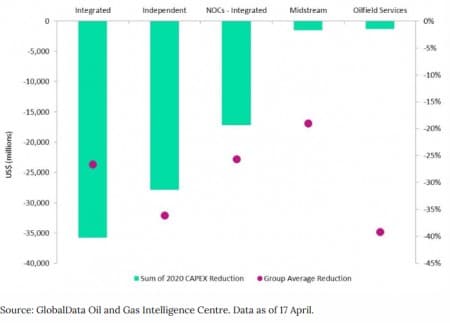

We had highlighted how the current level of capital spending is likely to negatively impact production - especially if oil prices remain at these levels for a couple more years. With oil prices recently sinking to multi-year lows and demand severely suppressed by the Covid-19 crisis, U.S. shale producers have entered survival mode and cut 2020 capex by ~$85 billion in a bid to protect balance sheets, maintain shareholder pay-outs, and preserve liquidity. According to the EIA, oil supply would drop by over 45 million bpd if no capital investment into existing or new fields was made between 2017-2025. Even continued investments into existing fields but with no new fields being brought online - aka the "observed decline" - would still lead to a decline of close to 27.5 million bpd over the forecast period. Assuming global oil demand falls by 10 million bpd in the post-COVID-19 era , it would still leave a huge 17.5 million bpd supply-demand gap.

This suggests that production could be materially affected if Capex remains at the current levels for another 2-3 years.

Nimble Shale

Whereas we believe that production is likely to suffer materially if capex levels don't rise and thus support oil prices, we do not foresee a situation where oil prices could go well past $100/barrel as JPMorgan and Malek have suggested.

About two years ago, the Harvard Business Review predicted that we had seen the last of those huge oil boom-and-busts due to the rise of U.S. shale. According to HBR, smaller U.S. shale companies are much more nimble than traditional NOCs (national oil companies), leaving them well-placed to quickly respond to any temporary oil supply spikes or dips:

"...with oil producers in North America expanding output, prices are likely to remain volatile. Unlike national oil companies and oil majors that typically take five to 10 years to develop conventional oil reserves, these independent and 'unconventional' players have improved their drilling and fracturing technology to the point where they can respond within months to temporary spikes or dips in the market.

The recent price swings highlight a new era of uncertainty gripping the world's energy markets. As global oil producers work at cross-purposes, the industry's traditional boom-bust cycle is being replaced by faster, shallower price rotations based on changes in production. It makes price movements less extreme but also more difficult to predict. The constantly fluctuating number of barrels of crude available from nimble shale operations is a primary driver, but so are the long-term impacts of increased fuel efficiency and the fits and starts of the global transition away from fossil fuels on world demand. The news is all good for customers, but it makes planning for the industry players much more difficult."

The million-dollar question is whether U.S. shale will be able to bounce back from the ongoing crisis with the same resilience it has displayed in the past.

Related: Bullish Sentiment Is Fueling A Wave Of Oil Trades

After the 2015-16 oil bust, shale producers were able to outlast an earlier Saudi price war by lowering their costs by about 50 percent and roping in investors, a move that triggered a spectacular new growth phase. As OPEC began cutting production again, U.S. shale production jumped by almost 4 million bpd in the space of about 3.5 years.

Unfortunately, it's quite a different ballgame this time around.

U.S. shale companies are already in survival mode, having cut capex by ~30 percent in the current year.

Capex was yet to return to earlier levels recorded before the last oil bust, meaning they just don't have much leeway to make any more cuts without substantially hurting production. To make matters worse, the sector is already heavily indebted and deeply out of favor. Executives may blame the Covid-19 pandemic and the Saudi Arabia/Russia price war for their ongoing distress, but the truth of the matter is that Wall Street and the investing universe had begun to sour on an industry that has for years prioritized growth over profitability.

Growth at the Right Price

Wall Street will likely remain unmoved until the oil price rally reaches a critical level.

Both Saudi Arabia and Russia will be keenly watching shale's struggles, hoping to capture a bigger slice of the market. But this strategy is not without risks for either party - especially for Riyadh.

Both countries are highly reliant on oil revenues, with Moscow needing an oil price of ~$40/barrel to balance its budget while Riyadh needs over $80/barrel to balance its books as per the IMF.

U.S. policymakers mostly blame Saudi Arabia, not Trump, for the latest oil collapse.

Recently, oil-state senators threatened to withdraw military aid for Saudi Arabia, and are likely to continue playing low-key hardball with the Kingdom as long as low oil prices persist. Moscow, on its part, is already under U.S. energy sanctions, and low oil prices will make Washington's restrictions even more painful.

Wall Street is unlikely to become interested in the nascent oil price rally, but will probably throw its weight behind the sector once prices start approaching the $80/barrel that Riyadh needs to balance its budget.

In other words, shale is likely to bounce back - but only at the right price - at which point we could see a deluge of the black commodity which will likely limit further advances in oil prices.

Lastly, the rapid rise of renewables is likely to cap the long-term gains by the oil sector because it would make oil too uneconomical. Indeed, last year, BNP Paribas told CNBC that oil prices need to remain in the $10-20/barrel to remain competitive in the pivotal mobility sector:

"What we're saying is if you're comparing investing money in renewable energy in tandem with electric vehicles, you can get six to seven times the energy yield at the wheels – useful energy, mobility – for the same capital outlay as you can spending on oil at the current market price of $60 a barrel, and then refining it into gasoline and using it in an internal combustion engine, which loses 80% of the energy as heat."

With EV penetration still low, this is more of a long-term concern than a mid-term one. However, it's important to bear in mind that analysts have repeatedly underestimated the growth of renewables over the past decade. Renewables are quickly replacing coal in the global energy mix and have continued to do so during the Covid-19 crisis thanks to falling costs and the ESG megatrend.

It’s probably safe for you to ignore those $190 oil price predictions.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Oilfield Services May Not Recover Until 2023

- How Saudi Arabia Caused The Worst Oil Price Crash In History

- Pirates Threaten Oil Operations In Gulf Of Mexico

At a time when the global economy is trying to disentangle itself from the destructive COVID-19 pandemic and the global economy trying to recoup an estimated 30% demand loss against a huge oil glut estimated to exceed 1.4 billion barrels, it may sound far-fetched indeed for anybody to be giving any thought to a potential oil supply shock in 2-3 years. And yet, this is exactly what market fundamentals are already telling us. The market could swing into a deficit sometime in 2022 causing oil prices to climb to $100 or more.

Many factors could contribute to this shock prominent among them the virtual collapse of the US shale oil production, China’s unquenchable thirst for oil and a huge decline in global investments in oil exploration and production.

The first factor is the collapse of the US shale oil industry. Few industries have been hit harder by the COVID-19 Pandemic than the US shale oil industry. It will emerge from the pandemic emaciated and will find it extremely difficult even to produce 7 mbd this year and the next three years.

The second factor is China’s unquenchable thirst for oil. Its own demand and its imports are already back to 2019 levels. Furthermore, China is on the way to full economic recovery by the end of the year. This is the more impressive given that many analysts estimated that China’s crude oil demand lost 20% and its economy shrank by more than 6.0% in the first quarter of the year during the pandemic. China’s economy is projected by the International Monetary Fund (IMF) to grow at 6.8% in 2021 compared with 6.1% in 2019.

The third factor is the huge decline in global investments in oil exploration and production. The International Energy Agency (IEA) expects global energy investments to drop by an “unparalleled” 20% this year. The pandemic has also forced the global oil industry to defer as much as $131 billion worth of oil and gas projects slated for approval in 2020.

Moreover, the industry is set to see its total annual revenues plunge by $1 trillion this year from $2.47 trillion in 2019 to $1.47 trillion this year. The projection for 2021 is $1.79 trillion. As a result there could be a supply shortage of 7-9 mbd in the next 2-3 years sending oil prices rocketing above $100. This couldn’t be a bad prospect as it will invigorate the global economy by attracting global investment into the oil industry and enabling both the oil industry and the oil producers to invest in exploration and production of new oil.

Dr Mamdouh G Salameh

International Oil Economist

Visiting Professor of Energy Economics at ESCP Europe Business School, London