Oil prices rose slightly on Monday, but the oil markets are still in full-blown panic mode as the number of American states in complete lockdown grows, threatening demand for crude oil.

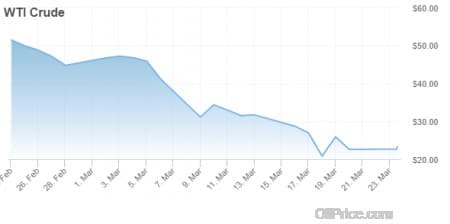

WTI crude may be trading up 2.96% up on the day, but it’s still only $23.30 per barrel—well below the breakeven point for US shale and down more than 50% month over month. The Senate stimulus package that the United States was foolishly hoping would be done on Sunday still isn’t. This contributed to the price slide for oil, but the reality is, the United States is shutting down to slow the spread of COVID-19—and shutdowns mean less transportation, and less transportation means less demand for crude.

The narrative in the United States has switched over the last two weeks from containing the virus—now a pipe dream—to slowing its spread to keep hospitals from being overwhelmed. To do this, various states have issued stay-at-home or shelter-in-place orders.

These shelter-in-place orders are unlikely to affect the oil industry directly because most oil companies have received—or are likely to receive--a “critical infrastructure” exemption that will allow them to operate. But oil demand in the US is faltering and posing a grave threat to the oil industry.

As of Monday, California, Connecticut, Delaware, Illinois, Indiana, Louisiana, Michigan, New Jersey, New York, Ohio, and West Virginia have all issued extensive state-wide stay-at-home orders that either are already in effect or will go into effect Monday or Tuesday. The shelter in place orders have only just begun—the US will soon see the drop off that we knew was right around the corner.

But it might be even worse than expected.

Already refineries in the US are starting to scale back. On Saturday, Exxon’s refinery in Baton Rouge cut back production by about 100,000 bpd. Last week, Marathon Petroleum cut back production at California’s largest refinery, and Phillips 66 cut back its production at its Los Angeles refinery.

Demand for crude oil will fall in concert with refineries.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- How Chevron Could Win Big On “The Worst Oil Deal Ever”

- The Inevitable Outcome Of The Oil Price War

- Oil Prices Retreat After Massive Rally

The USA will recover but it will take time.

Years not weeks or Months.