Tensions in the Middle East escalated just as oil prices declined into potentially dangerous territory for major OPEC+ players such as Saudi Arabia. Before October 7, Dubai was as low as $85 per barrel, borderline fiscal breakeven for Riyadh and it felt as if the bond sell-off earlier in the month could scupper the voluntary production cuts of Saudi Arabia and Russia. Throughout the second half of October, oil prices have shrugged off the scrapping of sanctions on Venezuela, rising US crude inventories and gradually weakening refining margins and that resilience has permeated the Middle East’s pricing strategy which has seen a consistent penchant for gradual increases over the course of 2023.

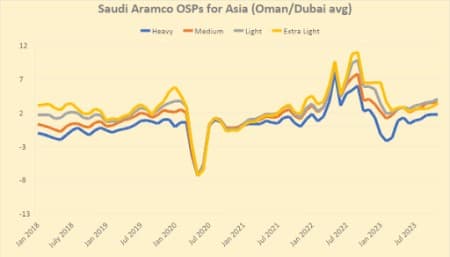

Chart 1. Saudi Aramco’s Official Selling Prices for Asian Cargoes (vs Oman/Dubai average).

Source: Saudi Aramco.

Due to strong refinery margins in September and steeper backwardation that added another $0.55 per barrel vs the August monthly average and came in at $2.40 per barrel, Saudi Aramco had the privilege of increasing formula prices across the board. In Asia, Aramco’s key market for exports, the Saudi national oil company only hiked the OSPs of Arab Light – the main grade exported – and Arab Extra Light, by $0.40 and $0.50 per barrel, respectively. Every other grade was simply rolled over from August quotes, including Arab Medium which should have seen an increase given the overall strength in middle distillate cracks. It is very likely that the pricing caution was driven by concerns about Asia’s buying patterns. China has just started to buy hefty volumes of Saudi again, and an aggressive OSP hike could have frightened Chinese refiners. Saudi Aramco will also need to watch out for soaring freight prices. The spike in VLCC freight costs has run out of steam and the price of a Saudi-to-China delivery is back below the $2 per barrel threshold, there was no similar easing in the Suezmax market where costs are still up 25% compared to a month ago, as high as $4.90 per barrel.

Related: Oil Price Rally Reverses Despite Tightening Market Fundamentals

Chart 2. Formula prices of cargoes bound for Northwest Europe by selected grades (vs ICE Bwave).

Source: Saudi Aramco.

Asia seems to have an increasingly important spot in Aramco’s strategy as the Saudi NOC has been reportedly talking to another Chinese refiner, Shandong Yulong Petrochemical, about a potential 10% stake purchase. Considering the Saudi NOC did not change its formula prices for the United States and rolled over October pricing into November, the biggest month-on-month change came from the European front. Buoyed by regional medium sour grades reaching all-time highs (most notably Johan Sverdrup) and steep backwardation in Brent futures, Aramco hiked all prices for Northwest Europe by $1.20-1.50 per barrel, lifting heavier grades more than the light ones. Regrettably for buyers in Spain, France or Greece, the pricing hike was even larger for the Mediterranean as Arab Light and Arab Medium both witnessed a $2 per barrel month-on-month increase. Such hefty increases, bringing the price of Arab Light in Europe to the highest level ever on record, might very well sap demand in Saudi crudes, especially as Europe’s own medium sour grades have started to weaken recently.

Chart 3. ADNOC Official Selling Prices for 2017-2023 (set outright, here vs Oman/Dubai average).

Source: ADNOC.

The UAE’s ADNOC has been one of the tacit winners of the ongoing OPEC+ production cuts. Pledging to cut only 144,000 b/d until the end of 2023, it keeps on ratcheting up production capacity with ADNOC’s most recent output assessment putting it around 4.65 million b/d. The pricing of the UAE’s flagship light sour grade Murban set by trading at the ICE Futures Abu Dhabi exchange, the November OSP clocked in at $93.92 per barrel, up almost $7 per barrel compared to October and accounting to a $0.73 per barrel premium to cash Dubai’s monthly average in September. The manually set formula prices of Das, Umm Lulu and Upper Zakum saw only marginal changes. Medium sour Das was rolled over from October with the same $0.6 per barrel discount to Murban, whilst Upper Zakum was hiked by 10 cents to a $0.50 per barrel discount. Umm Lulu, a slightly sourer and lighter version of Murban usually bought by Thailand and adding up to a 200,000 b/d export stream, saw its premium to Murban increase from $0.20 to $0.25 per barrel.

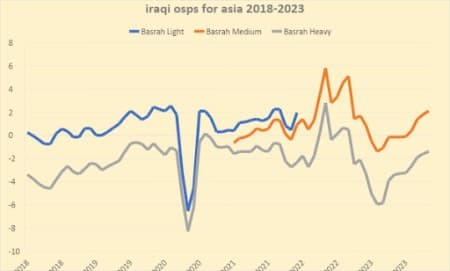

Chart 4. Iraqi Official Selling Prices for Asia-bound cargoes (vs Oman/Dubai).

Source: SOMO.

Iraq has maintained an independent pricing policy over the past years, occasionally contradicting Saudi Aramco’s moves. For November 2023, too, the Iraqi state oil marketing company Somo decided to lift formula prices in Asia, lifting Basrah Medium and Basrah Heavy by $0.30 and $0.20 per barrel, respectively. The Basrah Medium hike is lower than Aramco’s Arab Light upwards correction by $0.40 per barrel, at the same time Basrah Heavy assessed at a -$1.40 per barrel to Oman/Dubai will be shrinking the spread between Iraq’s heaviest grade and Arab Heavy, the heaviest grade on offer from Saudi Aramco. Iraq’s seaborne exports have been relatively stable over the past months, averaging around 3.45 million b/d excluding the still-shuttered Kurdish areas. However, Iraqi exports going to Europe or the United States have been declining as Asian buyers scoop up Somo’s barrels – US-bound departures last month were the lowest since July 2021 and that is even without the Trans Mountain Pipeline impact hitting the US West Coast.

Chart 5. Iraqi selling prices for US-bound cargoes (vs Dated Brent).

Source: SOMO.

Still relying on PADD 5 to import Basrah Medium cargoes, Iraq is facing an uphill battle with the TMX commissioning being just around the corner and would need to prepare itself for a tough fight for market share. Cognizant of this challenge, Somo’s pricing for the US has been cautious, with the November formula prices seeing two roll-overs for Basrah Heavy and Kirkuk and the most coveted Basrah Medium getting only a slight $0.10 per barrel hike to a -$0.25 per barrel discount vs the Argus Sour Crude index. Generally speaking, Iraq could be exporting more even without Kurdish production resuming and it has been using the bumper profits of the past two years to achieve just that. The federal Iraqi government allocated $950 million for the construction of two subsea trunk pipelines within the Sealine-3 project as well as rehabilitation work at the mostly idled 600,000 b/d capacity Khor al-Amaya oil terminal.

Chart 6. Iranian Official Selling Prices for Asia-bound cargoes (vs Oman/Dubai average).

Source: NIOC.

Iran’s national oil company NIOC lifted the official selling price of its flagship Iran Light grade for Asian buyers by $0.35 per barrel, 5 cents less than Saudi Aramco’s change for Arab Light, putting it at a $3.85 per barrel premium to Oman/Dubai. None of Iran’s exports trade that high as NIOC routinely needs to discount its crude to incentivize Chinese buyers to maintain high rates of buying. With the ongoing escalation in Gaza prompting US authorities to take a more hawkish stance vis-à-vis Tehran, as could be seen from recent sanctions against Asian companies allegedly facilitating Iran’s drone and missile programs, the question whether NIOC can maintain the current high pace of exports is central to the Middle Eastern country’s outlook. For the time being, there has been no impact on outflows, the overwhelmingly China-bound flows are still around 1.4-1.5 million b/d, however Tehran has scaled back its ambitious plans to ramp up crude output above the 3.2 million b/d last reported by the country’s oil ministry.

Chart 7. Kuwait Export Blend official selling prices into Asia, compared with Arab Medium and Iranian Heavy (vs Oman/Dubai average).

Source: KPC.

Kuwait’s national oil company KPC straightforwardly mirrored Saudi Aramco’s rollover of the Asia-bound formula price for Arab Medium and kept the November OSP of Kuwait Export Crude unchanged at a $3.05 per barrel premium to Oman/Dubai. In that same vein, the other Kuwaiti grade coveted in the wider market, the light sweet Kuwait Super Light (48 API and sulfur content of 0.4%) was hiked by $0.5 per barrel, the exact same amount as Arab Extra Light was a couple of days before that, bringing KSLC to a $2.95 per barrel premium to Oman/Dubai. Seeing its product exports go up 50% year-on-year to almost 750,000 b/d, largely a consequence of Al Zour being finally fired up with all three CDUs working, Kuwait has been mostly in the news due to its oil products and not crude. The recent shift to use more low-sulfur fuel oil (LSFO) in the Middle Eastern country’s power generation instead of HSFO is yet another example of this trend, marking probably the last step in Al Zour’s normal operations.

By Gerald Jansen for Oilprice.com

More Top Reads From Oilprice.com:

- Guyana's Oil Boom Challenges OPEC+ Dominance

- Exxon Misses Profit Forecast Despite Strong Refining Business

- Big Oil’s Mega Acquisitions Raise Questions About Peak Oil Demand

Accordingly, Middle East producers act with discretion when deciding to lift the prices of their crudes so as not to harm the global economy or their customers.

It is natural for Asia to have an increasingly important spot in Aramco’s strategy since a big chunk of Saudi crude exports go to China and the bulk of Saudi oil refinery investments also find home in China.

UAE’s ADNOC can’t have a production capacity of 4.65 million barrels a day (mbd) because if it did it would have been able to raise its production to 4.0 mbd but it has never been able to even raise its production to 3.3 mbd on average.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert