Oil prices have been a rollercoaster over the past couple of months as negative catalysts frequently outshine the positive ones and vice-versa. In recent times, fears of a spillover in the conflict between Israel and Hamas, which could embroil Iran and its allies in the region, have offered considerable support to oil prices.

Unfortunately for the bulls, the oil price momentum has fizzled out with the risk premium that jumped in recent days following Israel’s ground incursion into Gaza proving to be less extensive than some investors expected. Investors also focused on Wednesday's Federal Reserve meeting,

The latest spate of bad results by energy companies has also soured sentiment. The sector has once again emerged as the worst performer with Q3 202 earnings decline clocking in at -38.1%, a far cry from the 2.7% average growth by the broad market. Big Oil has also come under scrutiny after Exxon Mobil Corp. (NYSE:XOM) and Chevron Corp. (NYSE:CVX) both failed to meet Wall Street’s expectations.

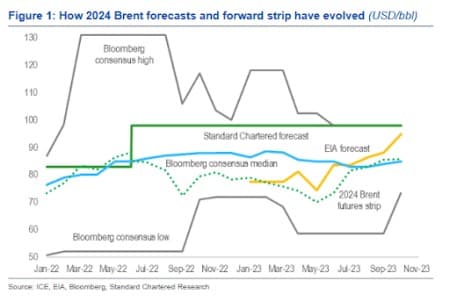

With only two months remaining in the year, Wall Street prognosticators and investors alike are increasingly turning to their crystal balls to try and predict what 2024 holds in store for the oil markets. Looking at the 2024 oil price forecast by leading energy agencies, you find that predictions have narrowed considerably in recent months amid ongoing supply deficits (The evolution of these predictions is shown below). Commodity analysts at Standard Chartered have noted that whereas their forecast (the unbroken green line) is the highest in the Bloomberg sample, it seems less of an outlier than it was before increases in some other key indicators. To wit, StanChart’s May forecast was over $23 per barrel (bbl) higher than the EIA’s and nearly $28/bbl above the futures strip; however, those gaps have now narrowed to $3/bbl and $14/bbl, respectively. The banker also notes that the gap above the Bloomberg median has only narrowed slightly, remaining between $12-15/bbl in recent months despite the narrowing of the high-to-low range. Related: U.S. Gasoline Refining Profits Tumble As Demand Weakens

StanChart says its 2024 Brent forecast of $98/bbl is well supported by supply and demand fundamentals, saying it expects global demand to grow 1.5 million barrels per day (mb/d) in 2024, with non-OPEC supply adding 0.88mb/d led by the US, Canada, Guyana and Brazil. They have also predicted supply deficits in Q1 and Q2 that will eventually give way to a mild surplus in H2. Meanwhile, StanChart has predicted that OPEC’s aim of stabilizing prices in an acceptable range is likely to continue, and could lead to a further tightening of fundamentals in 2025.

Source: Standard Chartered Research

Standard Chartered has predicted a further 120 mb reduction in global inventories in Q4, on top of the 172 mb reduction in Q3. The experts expect the rate of inventory draw to accelerate from 0.52 mb/d in October to 1.38 mb/d in November and 1.99 mb/d in December. StanChart says it’s possible that the current dominance of Middle East headline trading has led to lower prices by distracting the market from both falling inventories and from producer policies aimed at achieving a soft landing for the market at higher price levels. In other words, the recent tendency towards higher prices with lower volatility has been replaced by a downwards drift with higher volatility.

That’s a remarkable trend considering surging U.S. production. Data by the U.S. Energy Information Administration (EIA) shows that U.S. crude production grew 0.7% to 12.99 million barrels per day (bpd) in July, its highest since November 2019, when production hit a peak of 13 million bpd. Texas production grew 1.3% to 5.6 million bpd in July, its highest on record; North Dakota's output increased 1.2% to 1.2 million bpd while production from New Mexico's climbed 0.6% to 1.8 million bpd.

The demand side of the equation is equally encouraging. According toStanChart, global oil demand has already exceeded the pre-Covid oil demand set in August 2019, averaging 102.33 million barrels per day (mb/d), good for a m/m increase of 1.2 mb/d and a y/y increase of 2.3 mb/d. The analysts have refuted arguments by some Wall Street analysts that high oil prices have already triggered demand destruction.

Meanwhile, U.S. gas prices have continued their descent in recent weeks, with a gallon of regular gasoline now selling at a national average of $3.462, down from $3.815 a month ago and $3.758 a year ago.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

- Researchers Unveil Catalyst To Convert CO2 Into Methane

- Europe’s Renewables Landscape Transforms With Rooftop Solar Adoption

- American October LNG Exports Highest Since April

Therefore prices are projected to continue to surge with or without a risk premium with Brent crude price ranging from $90-$100 a barrel in 2023. Brent could get an additional boost if Iran and its allies get involved in the Hamas-Israel conflict thus widening the conflict and leading to an oil and gas disruption from the Gulf region.

And with OPEC projecting a demand growth of 2.2 million barrels a day (mbd) in 2024 and a continued tightening of the market, prices could even go higher than in 2023 even without a risk premium. I don’t bank much on a non-OPEC oil supplies because they are always a moving target.

It is also very possible that the Saudi production cut could continue into 2024 and could even become a permanent fixture of the market because of Saudi declining production.

Dr Mamdouh G Salameh

International Oil Economist

Global Energy Expert