A crucial pipeline in the North Sea has been shut down due to a crack, causing Brent crude prices to spike on Monday afternoon.

In fact, Ineos, the operator of the key Forties Pipeline System, said that the 450,000-bpd pipeline could be shut down for “weeks” as the company pursues repairs. A hairline crack was discovered last week, which forced Ineos to reduce pressure in the pipeline. But the company announced Monday that it would carry out a controlled shut down after it appeared the crack had widened.

“It is a supply concern not only because the pipeline transports a significant portion of North Sea crude oil output, but also because it may take weeks before the issue is resolved,” Abhishek Kumar, Senior Energy Analyst at Interfax Energy’s Global Gas Analytics, told Reuters.

A shutdown for that length of time and of that magnitude of capacity would be a problem for any pipeline system, but a closure of this particular pipeline has global implications.

The Forties system is the main carrier of the oil that underpins the Brent crude oil benchmark, a fact reflected in the nearly 2 percent spike in Brent prices on Monday, rising above $64.50 per barrel and breaking a new two-year high.

The outage could disrupt North Sea oil supply – North Sea operators could be forced to throttle back production because of the bottleneck. According to the FT, the Forties system carries nearly 40 percent of the UK’s North Sea oil production, and it connects 85 offshore oil fields to the mainland. The BBC reported that more than 80 oil platforms would need to shut down because of the disruption at the Forties system. Related: OilCoin: The World’s First Compliant Cryptocurrency

As of Monday, some reports of announced shut downs started to trickle in.

The outage has echoes of the spill at the Keystone pipeline from just a few weeks ago, a crucial artery that carries nearly 600,000 bpd from Canada to the U.S. The shutdown of the pipeline caused WTI prices to surge and pushed WTI futures into a state of backwardation, in which near-term prices trade at a premium to longer-dated futures. It was the first time in three years that the WTI futures curve was downward sloping, which is a sign of tightness in the market.

But the ramifications for the outage at the Forties could be even more significant, given the much greater influence of the Brent benchmark on global prices. Assuming the 450,000-bpd pipeline remains shut for three weeks, a rough calculation would mean that up to 10 million barrels could be disrupted. That is important because OECD crude inventories stood only 140 million barrels above the five-year average, according to the latest data from the IEA for September.

The UK will need to purchase crude from elsewhere to make up for the shortfall. That could tighten the oil market in the Atlantic Basin, an area that already was feeling more pressure as the global market continued towards rebalancing. The market for Brent will be pretty jittery for the next few weeks, and an unexpected outage from Nigeria, for example, could really send things through the roof.

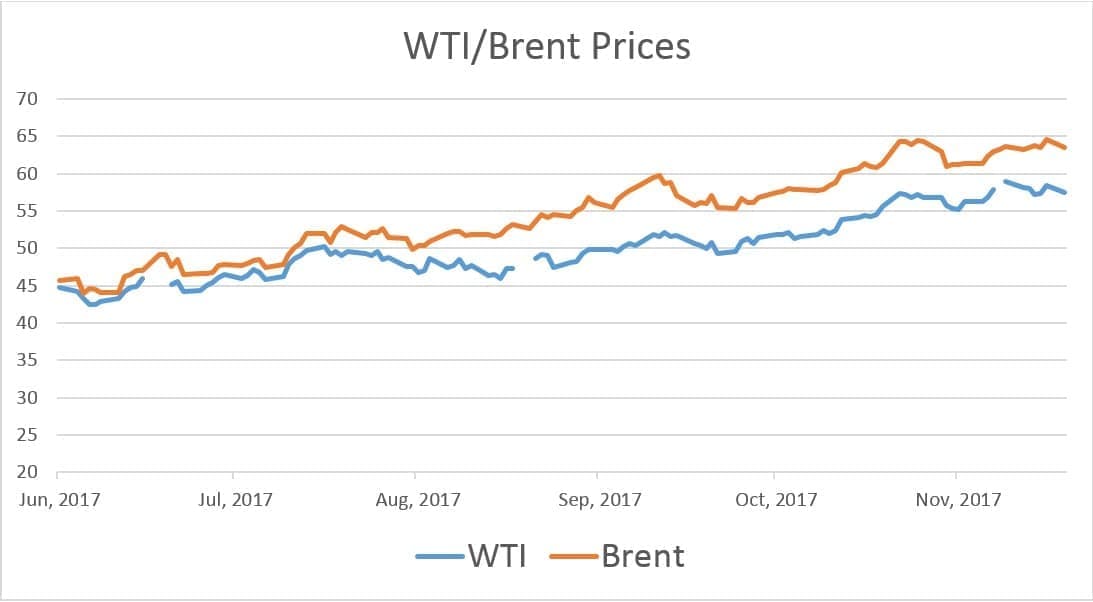

The outage will also widen the Brent-WTI disparity again, which had narrowed a bit after several weeks of hovering at multi-year highs. As of midday trading on Monday, Brent jumped to a nearly $7-per-barrel premium over WTI, a differential that is up nearly $1/barrel from last week. Related: Will Libya Be First To Ditch The OPEC Production Deal?

(Click to enlarge)

A wider price disparity, in turn, will lead to even sharper demand for U.S. crude, which becomes more attractive to buyers as Brent gets more expensive. As a knock-on effect from the outage of the Forties system, the U.S. could see higher oil exports in the next few weeks, which will help drain inventories at a faster clip.

In short, the crack in the Forties pipeline will have ripple effects throughout the oil market, and it will be felt across the globe until it is repaired.

By Nick Cunningham of Oilprice.com

More Top Reads From Oilprice.com:

- U.S. Shale Cautious As Oil Majors Invade Texas

- Why Oil Prices Bounced Back

- Blockchain And The $3.6 Trillion Infrastructure Crisis

Sounds like Brent price manipulation to me.

But the true is:

the Forties system carries nearly 40 percent of the UK’s North Sea oil and gas production

From ineos web site

https://www.ineos.com/sites/grangemouth/news/ineos-completes-the-acquisition-of-the-north-sea-forties-pipeline-system-and-kinneil-terminal-from-bp/

So welcome fakenews to oilprice.