Breaking News:

NIMBY: The Battle for Britain’s Clean Energy Future

The UK government faces growing…

Iranian Oil Exports Have Risen Sharply, Facilitated By Malaysia

Whether or not the U.S.…

Oil Falls After API Reports Major Surprise Crude Inventory Build

The American Petroleum Institute (API) has reported a major surprise build of 5.321 million barrels of U.S. crude oil inventories for the week ending March 23, with the market expected to respond by erasing last week’s gains.

Analysts had been expecting little change after last week saw a surprise draw.

This week’s API data also show a 1.655-million crude inventory build at Cushing, but gasoline and distillates saw a big draw.

The API reported a gasoline draw of 5,799 million barrels, and a distillate draw of 2.23 million barrels.

Last week, the API reported a surprise draw of 2.739 million barrels of United States crude oil inventories for the week ending March 16, defying analyst expectations of a build of the same amount.

Oil prices, which had enjoyed a boost to a two-month last week on geopolitical risk levels, were already refocusing on crude inventory data by Tuesday morning, losing some gains as commodities sector weaknesses trumped potential supply disruptions.

The general consensus, though, was that prices were slipping on profit-taking, as traders collected on last week’s upward momentum ahead of API data.

Both benchmarks had lost some of last week’s gains by afternoon trading on Tuesday, ahead of the API, with the WTI benchmark down by $0.87 (-1.33%) to $64.68, and Brent trading down $0.61 (-0.88%) at $68.91 at 4:04 pm EST.

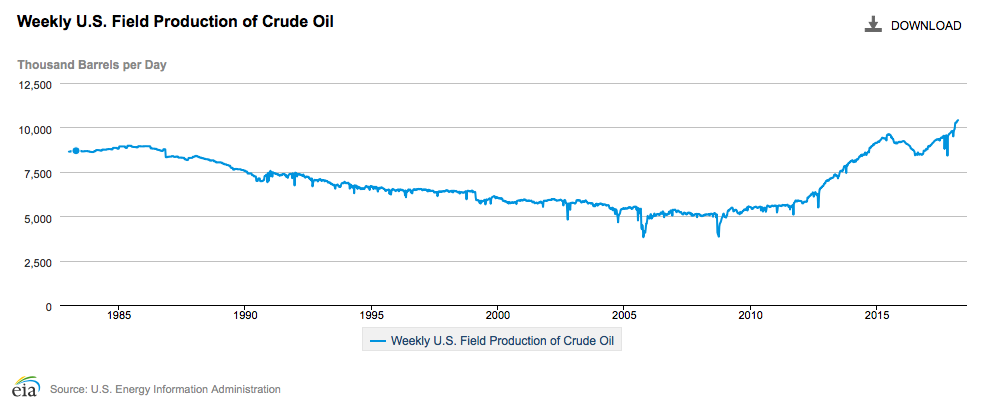

Meanwhile, US crude oil production, which for the week ending March 16 increased to 10.407 million bpd, up from 10.381 million bpd the week prior.

(Click to enlarge)

The U.S. Energy Information Administration report on oil inventories is due to be released on Wednesday at 10:30a.m. EST.

This week’s inventory data comes amid increasingly bullish talk from key analysts who view Big Oil as entering its “Golden Age”: a ‘restraint’ phase of backwardation, cost deflation and consolidation. They point to impressive EPS earnings for oil and gas companies who have been generating higher profits at depressed oil prices than they were when oil was at $100 per barrel.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com:

- Europe Cracks Down On Diesel Vehicles

- Oil Rig Competition Flares Up Amid Permian Boom

- Oil Prices Slip On Profit Taking

Julianne Geiger

Julianne Geiger is a veteran editor, writer and researcher for Oilprice.com, and a member of the Creative Professionals Networking Group.

-

"traders"??? they are the damn speculators who only drive the prices. it is all a big game with them drive the price up and the consumer pays and then sell it off for their profit without ever actually having to handle the product. what a scam!!!

-

Big product draws and not close to high demand season.

-

The financial markets for the oil industry are really a joke. In the last week WTI jumped from almost $60 to over $65 a barrel based on a bigger than expected draw down in supply. Now, 7 little days later theirs a huge surprise build in inventory. What that tells me is that either the available data is so bad that its silly to see that kind of price volatility, especially increase, or its intentionally manipulated to manipulate the price. It does seem that every time the price of oil starts to edge or drop below an even temporary benchmark like $60 WTI there is suddenly some news, very frequently and unexpected draw down, that sparks a jump in price. Of course, I'm not an expert, but I do deal with a lot of numbers in my business, and very rapid changes in trend data up and down usually mean a issue with data reliability, or manipulation of the data. Millions of barrels of oil don't suddenly draw down, and then jump up in 7 days. Of course, again...I'm not an expert. Maybe someone out there who is would write an article about why this happens so frequently? And whether its a data issue, manipulation, and I'm open to the possibility that all those millions of barrels really do disappear, and the appear within a 7 day period?

Open57.81

Trading Vol.6.96M

Previous Vol.241.7B