With the millions of tons in new liquefied natural gas capacity coming on stream these days, many have begun worrying about an oversupply that would pressure prices to uncomfortably low levels. Energy analysts at Wood Mackenzie, however, don’t share the concern.

In a recent report, Wood Mac said over 60 million tons in annual production capacity was due a final investment decision this year—a record number and a hefty increase on the 21 million tons in capacity sanctioned last year. This could tip the market into oversupply, but not this year: LNG projects take years to build.

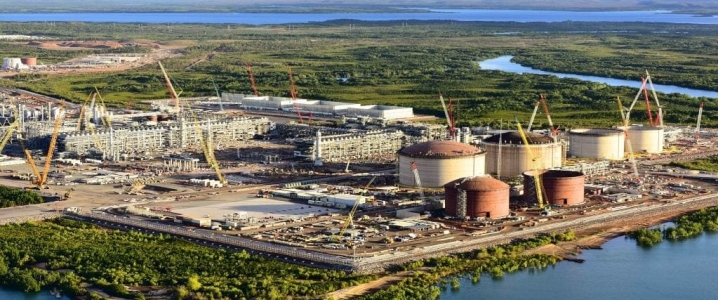

Yet last year saw some large-scale additions to production capacity such as Shell’s Prelude and Inpex’ Ichthys, both offshore Australia, and Novatek expanded its Yamal LNG facility. U.S. LNG production is also at a record high, with S&P Global Platts reporting LNG plant feeds hit 5.12 billion cu ft daily in the last week of 2018.

This greater global production will combine with stable but slowing down demand in Asia, the biggest LNG market in the world, Wood Mac said, to pressure prices to an average of US$6.90 per mmBtu on a title transfer facility basis. That’s down from an average of US$8 per mmBtu last year. LNG prices on the spot market in Asia will average US$8.50 per mmBtu, Wood Mac’s analysts estimated, down from US$10.30 per mmBtu in 2018. Related: Nord Stream 2 Is Losing Support In Germany

As Asia cannot absorb all the additional production, Europe will need to step in and will likely do it gladly: the European Union has been seeking ways to diversify its gas supply sources not just for geopolitical reasons but because pipeline capacity is currently full and even the addition of the Nord Stream 2 won’t do much about its increase because the gas flow through the new pipe would end up at a distribution hub in Austria whose capacity will not be expanded.

Another reason most of Europe will be happy to take in surplus LNG from around the world is that Gazprom’s contract for gas transit via Ukraine is expiring at the end of this year, Wood Mac’ analysts note. While the chances of having the contract renewed are good enough, a surprise is always possible when it comes to Russia and Ukraine and Europe would be smart to prepare for any eventuality by stocking up LNG.

Wood Mac notes growing worry about a global economic downturn in its report but says a 2019 recession would be the lesser evil: “A recession would bring gas/LNG demand and oil prices down, delay FIDs and push the global LNG market back a few years. But there could be a worse scenario for the gas market: a major economic downturn happening in 2020 or 2021, just after 60-100 mmtpa of LNG has taken FID. That would wipe out our forecast price recovery post-2020 and make our forecast that prices soften a little around 2025 look a lot worse.”

Not everyone agrees there will be a recession, but some believe economic data and stock market trends point in that direction, as per a recent Bloomberg report. There is even talk about a recession in Germany, the biggest economy and biggest energy consumer in Europe. If the most pessimistic predictions materialize, this would indeed pressure LNG prices further and delay final investment decisions, disturbing the whole gas market.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

- Darkening Outlook For Global Economy Threatens Crude

- Colombia’s Oil Rebound Off To A Rough Start In 2019

- Oil Enters Bull Market As Shorts Are Wiped Out